On January 3, 2009, Satoshi Nakamoto launched Bitcoin by mining the very first block of the blockchain, initiating a silent revolution. 16 years later, the year 2024 marked an unexpected turning point, with institutional adoption and the creation of private strategic reserves, affirming Bitcoin's ability to preserve value over the long term. And 2025 could be the year states follow suit.

A look back at the genesis of Bitcoin: 16 years of revolution

16 years ago, on January 3, 2009, a mysterious figure known under the pseudonym Satoshi Nakamoto launched a financial revolution by mining the very first block of the Bitcoin blockchain.

This historic block, called “ Genesis Block ” Or ” Block 0 ”, marked the beginning of a new era for finance and technology. This block establishes the fundamental rules of the Bitcoin blockchain, such as mining difficulty and block rewards.

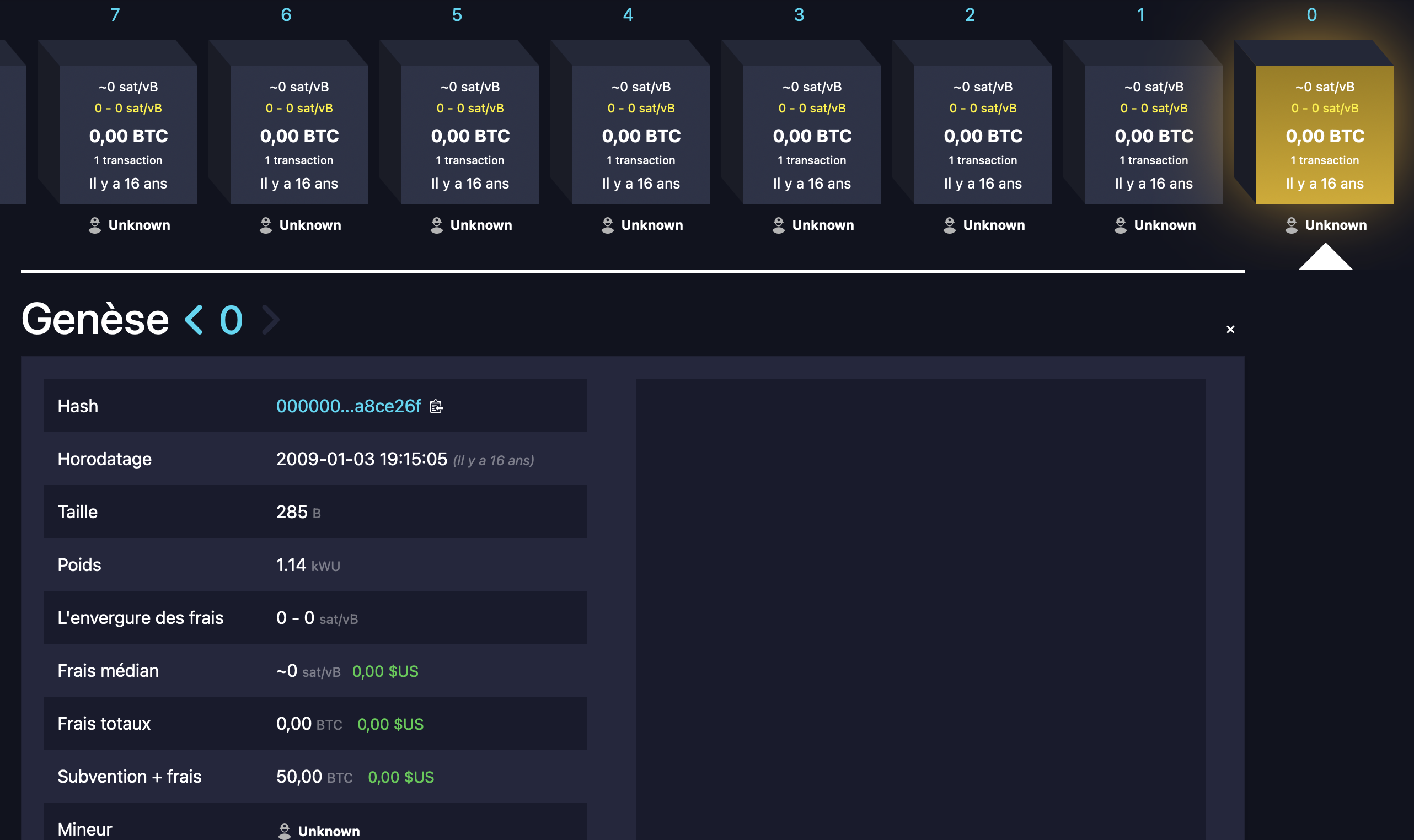

Overview of Bitcoin “Genesis” block via memepool block explorer

As the first element in the chain, the Genesis block is unique: it has no previous block to refer to, unlike all subsequent blocks that rely on the link to their predecessors.

Good to know

Some consider that the Bitcoin network was launched on January 8, with the mining of the first block, since to make a chain you need two blocks: the Genesis block (block 0) and the first block. The 50 BTC issued by block 0 cannot be spent.

It is also interesting to know that the Genesis block contains the first ever transaction of Bitcoin, which awards a reward of 50 bitcoins for its mining. However, these bitcoins are not spendable, due to a technical limitation intrinsic to the Genesis block. These 50 BTC therefore exist only on a symbolic basis and highlight the experimental nature of the beginnings of Bitcoin.

📚 Who are the 10 largest holders of Bitcoin?

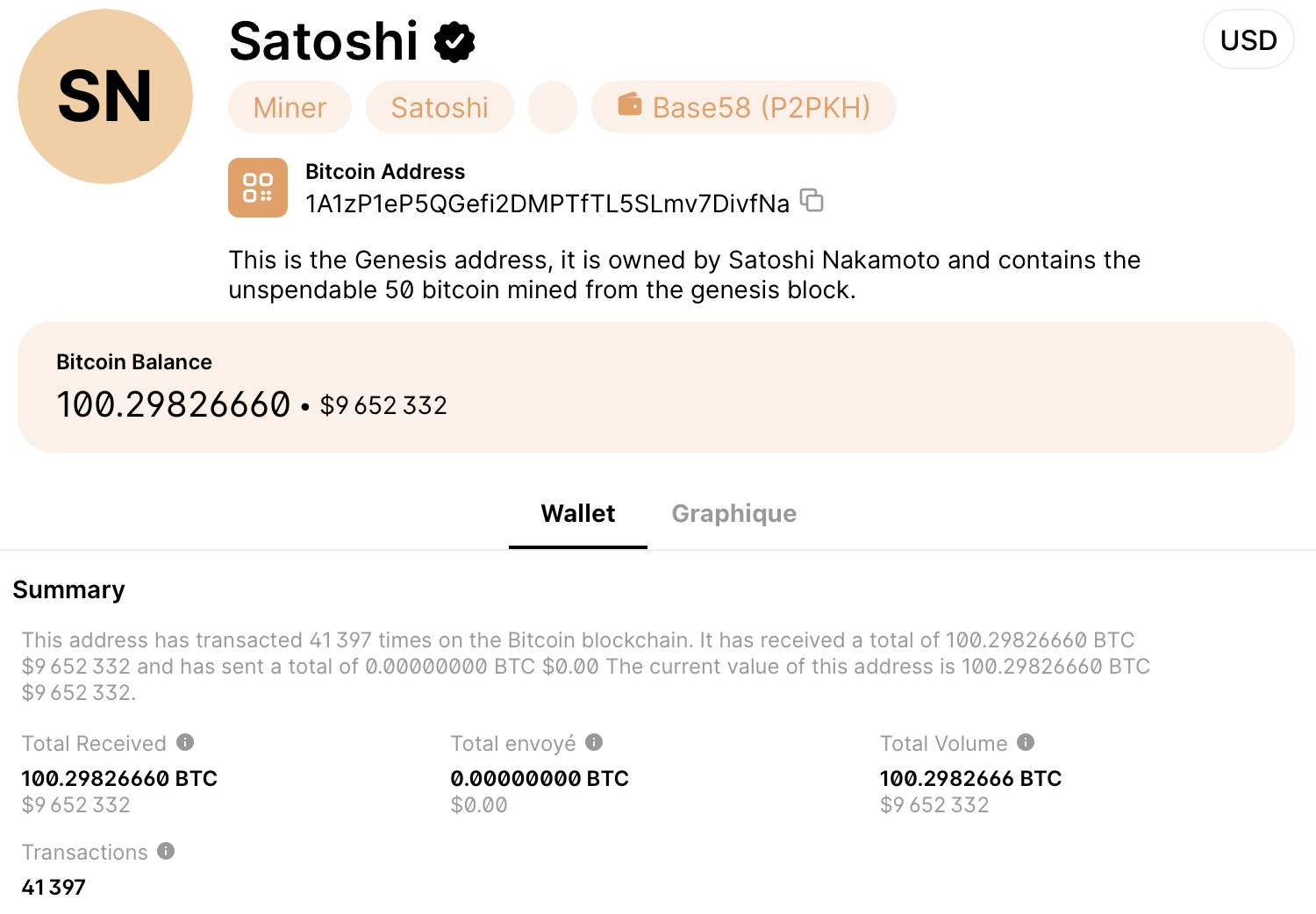

This reward is associated with the address known as “ Genesis address », which belongs to Satoshi Nakamoto. The last trace of life of this anonymous benefactor dates back more than 14 years today.

In addition to these 50 non-spendable BTC, this address has become an object of analysis and fascination in the Bitcoin community. She made 41,397 transactions on the Bitcoin blockchain, received a total of 100,29826660 BTC, or approximately $9.6 million at the time of this writing, and never sent any funds.

Indeed, to this day, the total value of BTC associated with this address is still intact.

Analysis of Satoshi Nakamoto's home address via blockchain.com

Another striking aspect lies in the message integrated by Satoshi Nakamoto in block 0: “ The Times 03/Jan/2009 Chancellor on brink of second bailout for banks “. With this reference, Satoshi Nakamoto addresses a criticism of the traditional financial system, as it emerged weakened by the 2008 crisis and the bank bailouts paid for by taxpayers.

This headline, taken from the front page of the British newspaper The Times of January 3, 2009, symbolizes the perceived injustice of a system favoring institutions to the detriment of citizens. Engraved in the blockchain, this message has become the manifesto for a decentralized and resilient monetary system, embodied by Bitcoin.

€20 offered when you register on Bitvavo

2024, a turning point with mass adoption and the 4th halving

In its early days, Bitcoin was far from being taken seriously. The first known transaction, during which 10,000 BTC were exchanged for 2 pizzas, in May 2010, illustrates the low commercial interest in this new currency.

Yet, in just a few years, Bitcoin has overcome numerous crises and evolved to become a leading asset. The year 2024 marked a new milestone in the history of Bitcoin, with several landmark events that strengthened its status and accelerated its adoption.

After years of discussions and rejections, the United States Securities and Exchange Commission (SEC) has finally given the green light to several spot Bitcoin ETFs. This move paved the way for mass adoption by institutional investors, making Bitcoin more accessible and legitimate than ever. Major players like BlackRock and Fidelity immediately launched their Bitcoin-focused products, leading to a massive influx of capital into the market.

👉 In the news – Bitcoin and Ethereum ETFs arrive in Argentina

In 2024, the Bitcoin network experienced its 4th halving, halving the rewards for miners from 6.25 BTC to 3.125 BTC per block. The combined effect of increasing adoption and decreasing available supply contributed to a significant rise in its price, taking it to cross the $100,000 mark for the first time.

Over the years, the adoption of Bitcoin has taken on an important political dimension, especially starting in 2021, with the adoption of Bitcoin as legal tender by El Salvador.

In 2024, the recognition of Bitcoin by US authorities, combined with a clearer regulatory environment, has strengthened its image as a legitimate reserve asset.

This is why major powers like Russia or the United States are considering following Microstrategy's example by setting up a strategic reserve of BTC. This could change the current narrative of Bitcoin often seen as a currency “ decentralized and apolitical », to reposition it as a geopolitical tool in the digital economic war.

Here's to the year 2025 and its share of surprises for the adoption of Bitcoin!

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: Mempool, Blockchain.com

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital