After a rather disappointing 2024, investors are fleeing Ethereum to seek gains on other cryptos. However, the dynamic that is building around Ethereum is immense, and when the start is given, the market will have a reminder: if Bitcoin is the king, Ethereum is the prince of cryptos.

Ethereum disappointed investors in 2024

In 2024, Investors Had High Hopes for the Future of Ethereum and its token, Ether (ETH). With the approval of spot ETFs, many hoped to see the 2nd largest cryptocurrency follow in the footsteps of big brother Bitcoin. Unfortunately, the success was not there and even with the start of the bullrun on November 6, Ethereum crypto is struggling to gain bullish momentum.

Several reasons explain this “éfailure ”, according to Sygnum’s annual Crypto Market Outlook 2025 report:

This is partly explained by the surprise and rapid approval of the ETF, and the very short resulting marketing campaign, also the much lower awareness of Ethereum (about half that of Bitcoin according to surveys) and by the fact that ETFs did not benefit from the return on Ethereum staking.

✅ Which countries have the most Bitcoin?

However, all is not lost. Retail investors quickly lost interest in Ethereum and moved to crypto which is taking off, but money is earned with patience in this market. Ether will experience a bullish rally in 2025 according to analysts, and people who sold their crypto will participate in the FOMO which will bring the price towards the $10,000 zone.

Open an account on Binance, the world’s #1 crypto platform

Why would ETH go as far as $10,000 in 2025?

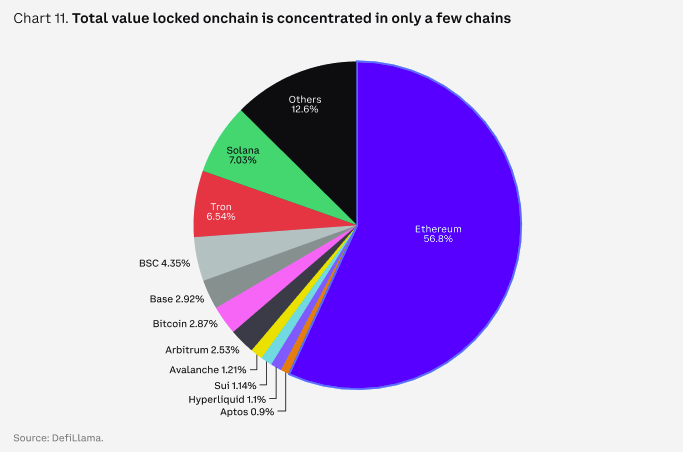

Ethereum remains the 2nd largest crypto in the ecosystem and the leader in finance on-chain (DeFi) as well as apps, not to mention the pharaonic number of protocols and layers 2 that are built on it. The fundamentals are therefore solid.

Distribution of TVL on the different Finance Onchain (DeFi) protocols

The obstacles blocking the growth of Ethereum are:

- ETFs not adapted to the returns of DeFi protocols;

- lack of knowledge/marketing around this ecosystem;

- absence of a clear legal framework in the United States, preventing institutional investors from taking a position on finance onchain.

The legal framework is in the midst of a period of change since the election of Donald Trump. The latter appointed an entrepreneur passionate about cryptocurrencies at the head of the “ presidential council for digital assets », and the anti-crypto Gary Gensler will soon leave the presidency of the Securities and Exchange Commission (SEC).

👮♂️ How the SEC Became the Enemy of Crypto

ETFs should also evolve to adapt to protocols on-chainby allowing “ in-kind redemptions » for Bitcoin ETFs for example, or benefit from protocol yields with Ethereum ETFs. As Coinbase’s 2025 report says:

We are interested in what might happen if the SEC allows staking in ETFs or lifts its mandate for cash creations and redemptions, replacing them with crypto redemptions.

Ledger: the best solution to protect your cryptocurrencies 🔒

Ethereum, the crypto “index” of the market

That's not all. Reports on the 2025 market do not predict a slew of “ single token ETF » which would a priori have no traction and not much interest for investors. On the other hand, index-type ETFs, allowing you to position yourself on a basket of cryptos or on a particular sector, would be interesting. Like what we find with other industries.

As long as such an ETF does not see the light of day, it is probably Ethereum which will play this role by defaultBitcoin really being a crypto “ apart » with its own dynamic. Ethereum, for its part, has an influence on the entire market and is connected to a large number of protocols, which gives it this dimension of “ index value “.

📈 How to buy Ether easily and safely?

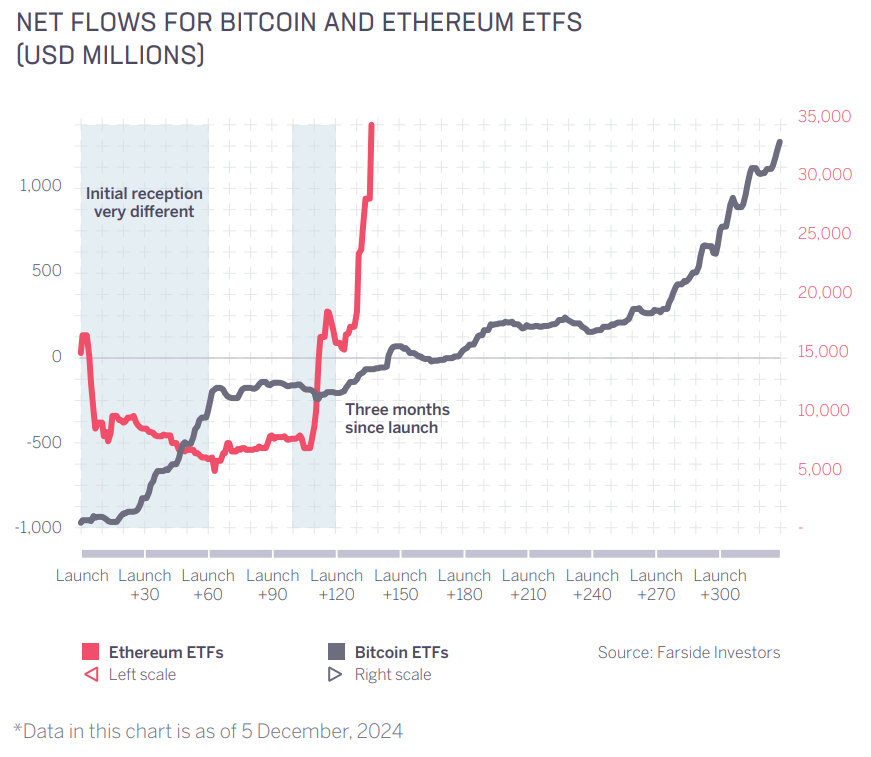

This position will bring a large flow of liquidity to Ethereum. The ETF has also started to gain some traction despite a difficult start, which can be explained according to Sygnum by the policy of market platforms of “ only invest in products with a trading history of at least 90 days “. Recently, volumes on Ethereum ETFs have gone parabolic.

Ethereum and Bitcoin ETF volumes in the first 300 days

These different elements will launch strong growth and a record influx of liquidity on Ethereum. How high will ETH stop? The crypto is currently trading at $3,300, 1,500 below its highest price (ATH).

Once this threshold is crossed, the powerful momentum, liquidity of ETFs and FOMO will drive the price towards the next psychological levels5 and 10,000 dollars. Ethereum is in an interesting period with all indicators in green, it's just waiting for a spark to explode.

Coinbase: register on the most famous crypto exchange in the world

Sources: 2025 report from Sygnum, Farside Investors

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital