The Aave lending protocol is emerging from a period of consolidation and has enjoyed renewed appeal in recent months. How can this be explained and what are the consequences for the AAVE token price?

The AAVE price has exploded in recent weeks

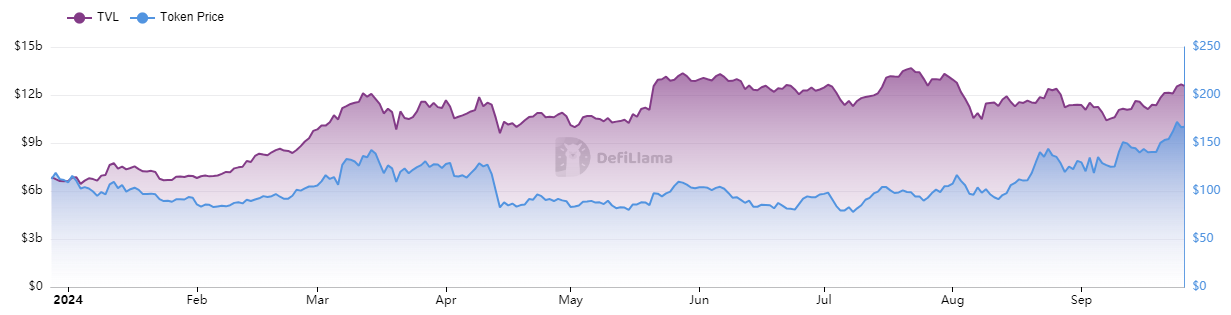

Yesterday, the AAVE price reached $172, a level it had not crossed since 2022. Throughout the summer, the cryptocurrency has been on a rise, gaining 93% in the space of 3 months..

As of today, AAVE has a market capitalization of $2.5 billion. For comparison, it was only $882 million a year ago.

The AAVE price has been exploding since the beginning of summer

💡 Find our presentation of Aave, the cryptocurrency lending and borrowing protocol

On-chain indicators are also looking good. The number of AAVE holders has increased significantlyInvestors holding between 100 and 1,000 AAVE tokens are also increasingly present: 1,000 new arrivals have been noted on the Aave network in recent months through this metric.

Aave driven by the “DeFi renaissance”?

According to the firm Santiment, which analyzed Aave's breakthrough this week, The progression shows that the protocol now occupies a major place in the decentralized finance (DeFi) sector.. The figures speak for themselves: at the time of writing, Aave occupies second place among the protocols with the highest TVL.

In the category of lending protocols, where he officiates, Aave clearly displays its dominance with $12.6 billion in TVL. For comparison, JustLend, the 2nd protocol in this category, currently has $5.6 billion in TVL.

Evolution of Aave's TVL (in purple) and token price (in blue)

Beyond a general resurgence of interest in DeFi, it should also be noted that an Aave competitor, Curve Finance, has tended to lose ground this summer.

👉 Not to be missed among our guides – Leverage DeFi with Aave

Curve has indeed experienced a major attack in recent months, which led to losses amounting to millions. According to Santiment, this naturally led users to an alternative: Aave..

“Its high performance has attracted both individual users and larger investors, who view Aave as a reliable platform in the ever-evolving world of DeFi.”

Ledger: the best solution to protect your cryptocurrencies 🔒

Updates that contributed to this Aave breakthrough

Aave has also been proactive in its developments. It has adapted to the layer 2 sector, which is exploding at the moment, and is now available on Polygon, Base and Optimism. In addition, it plans to launch its own layer 2 when it introduces its V4.

Another innovation: the introduction of GHO, its own decentralized stablecoinThe stablecoin sector is also booming, and the mechanism used is particularly incentivizing for users.

Aave has also mutated some internal mechanisms, with the “Umbrella” update aimed at “correcting the weaknesses of the current Safety Module”. Concretely, Aave is evolving its security protocol in order to mitigate the risks of sudden collapses.

🌐 In the News – Bitcoin DeFi TVL Could Surpass Ethereum in 2 Years, Predicts Core DAO Contributor

Another point highlighted by Santiment: unlike other protocols, which tend to distribute tokens widely, Aave has instead chosen the opposite strategy. It has in fact bought back tokens present on the market, which reduced the supply and increased the scarcity of AAVE.

$AAVE is trading at the highest level since May 2022 and seems to be breaking out of a 2 year consolidation pattern.

Expect ATH reclaim to further solidify DeFi Renaissance. pic.twitter.com/pn29UsBMes

— Arthur (@Arthur_0x) September 22, 2024

In August, Aave introduced an isolated market for Ether.fi, allowing its users to open positions using their cryptocurrencies held on the staking protocol. More recently, Aave v3 Welcomed Coinbase's Wrapped Bitcoin, cbBTC, to Ethereum and BaseIn doing so, Aave users can use cbBTC as collateral or to generate yields.

The lending and borrowing protocol is therefore in great shape and continues to adapt to a changing market. Enough to reach its absolute record again, at more than $660? This is the wish of many.

Cryptoast Academy: Don't ruin this bull run, surround yourself with experts

Sources: Santiment, DefiLlama

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.