A new Bitcoin protocol sent the network's transaction fees skyrocketing for more than an hour, generating $4 million, the highest increase since the halving.

Bitcoin Sees Highest Fees Since Post-Halving Period

Bitcoin is often criticized for its slowness and low scalability, mainly due to its limited block size. Some see this as a barrier to BTC adoption, while others see it as an essential quality that ensures the decentralization and robustness of the network.

While it can be argued that high fees make miners profitable, the main drawback of small block sizes is that transaction fees can add up very quickly.

For example, after the halving in April 2024, the launch of the Runes protocol, a fungible token protocol on Bitcoin, caused such a stir that transaction fees allowed blocks to be recorded generating hundreds of thousands, even millions of dollars in fees for several days.

🪨 Further reading – What is Runes and how to use this Bitcoin protocol?

Since then, transaction fees have dropped to their lowest level in a year, reaching 2 sats/vB. However, Yesterday the network experienced a sharp increase in feeswhich lasted only an hour and a half.

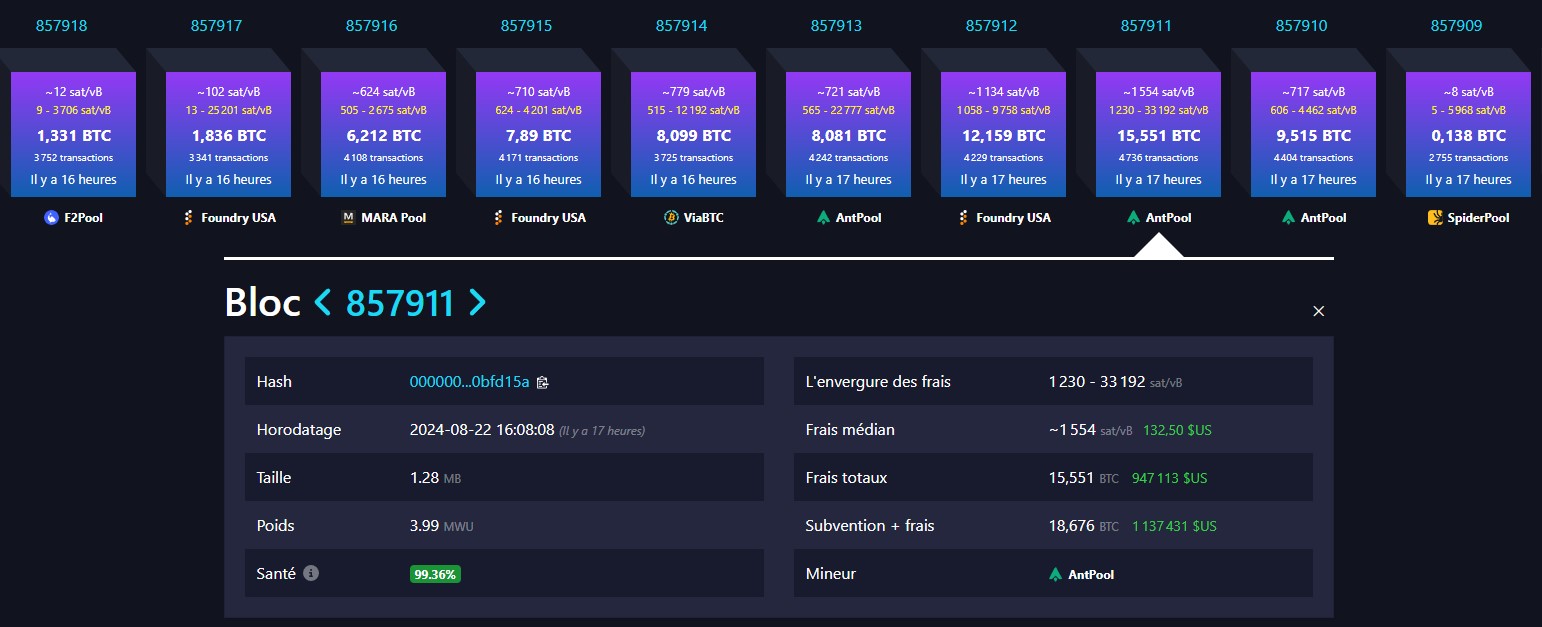

Blockchain Insights at the Time of Sudden Fee Increase

In total, More than 67 Bitcoins were collected by miners in less than 2 hours, or more than 4 million dollars.

Moreover, Antpool particularly distinguished itself by having the chance to mine 3 of the 4 blocks generating the most fees, thus accumulating 33,147 BTC in fees to which is added 9,375 BTC in network subsidy.or more than $2.5 million in less than an hour.

Ledger: the best solution to protect your cryptocurrencies 🔒

New Retaking Protocol Makes Explosive Entrance

Babylon is a staking protocol that aims to integrate Bitcoin into securing Proof-of-Stake (PoS) blockchains.. It allows Bitcoin holders to stake their BTC while retaining full control of their assets, without resorting to a trusted third party.

Retaking on Ethereum, introduced by EigenLayer, allows users to reuse their already staked ETH to secure other services on the blockchain and earn additional yield.

📰 Also read in the news – Salvador: 80,000 civil servants trained in Bitcoin – A visionary initiative or a risky bet?

At its launch, Babylon set a deposit cap of 1,000 BTC, or around $60 million. It was this limit that prompted investors to rush in and pay ever-increasing fees to secure their participation in the protocol, pushing fees up to over 1,500 sats/vB..

However, it is important to note that BTC stakers do not receive any rewards at the moment, only points that will likely be used for an eventual token distribution by the protocol, in a style similar to EigenLayer.

20 € offered when you register on Bitvavo

Source: mempool

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.