On Wednesday, Nvidia announced its second-quarter results. At more than $30 billion, that's a 122% increase over the year. However, the stock price has fallen on the stock market. We take stock.

Nvidia posts more than $30 billion in revenue in Q2

Being one of the most popular stocks in recent years, Nvidia's quarterly results were necessarily expected by investorsThe company announced them yesterday, reporting more than $30 billion in revenue for the period from April 1 to June 30.

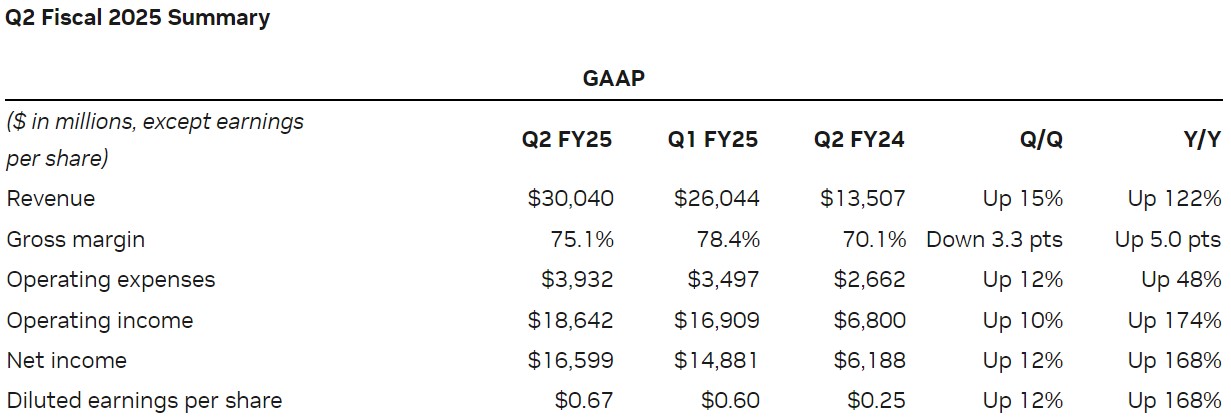

Such a result is not insignificant, as it represents an increase of 122% on a quarter-on-quarter basis, as well as an increase of 15% compared to the previous quarter:

Figure 1 – Nvidia Quarterly Results

Artificial intelligence (AI) would play an important role in these figures, notably thanks to several of the brand's products:

Spectrum-X Ethernet for AI and Nvidia AI Enterprise software are two new product categories that are reaching significant scale, demonstrating that Nvidia is a complete, data center-scale platform. Across the stack and ecosystem, we are helping builders from cutting-edge models to consumer internet services, and now enterprises. Generative AI is going to disrupt every industry.

👉 How to buy Nvidia (NVDA) stock?

In addition to an increase in turnover, an increase in net income should also be highlighted. Indeed, it rose to almost 16.6 billion dollars in the 2nd quarter, marking an increase of 168% compared to last year, and 12% more than in the first quarter.

Trade Republic: Buy Crypto and Stocks in 5 Minutes

A drop in the action despite everything

Despite a more than honorable performance, these figures do not seem to have convinced investors. And the reason is the title Nvidia fell 2.1% on Wednesday's session. As of this writing, the stock is down another 4% in pre-market trading:

Figure 2 – Nvidia stock price in daily data

Despite this decline, the title still maintains its place as the 2nd most capitalized action in the world. With a total of nearly 3,090 billion dollars, this represents an increase of more than 150% since the beginning of January.

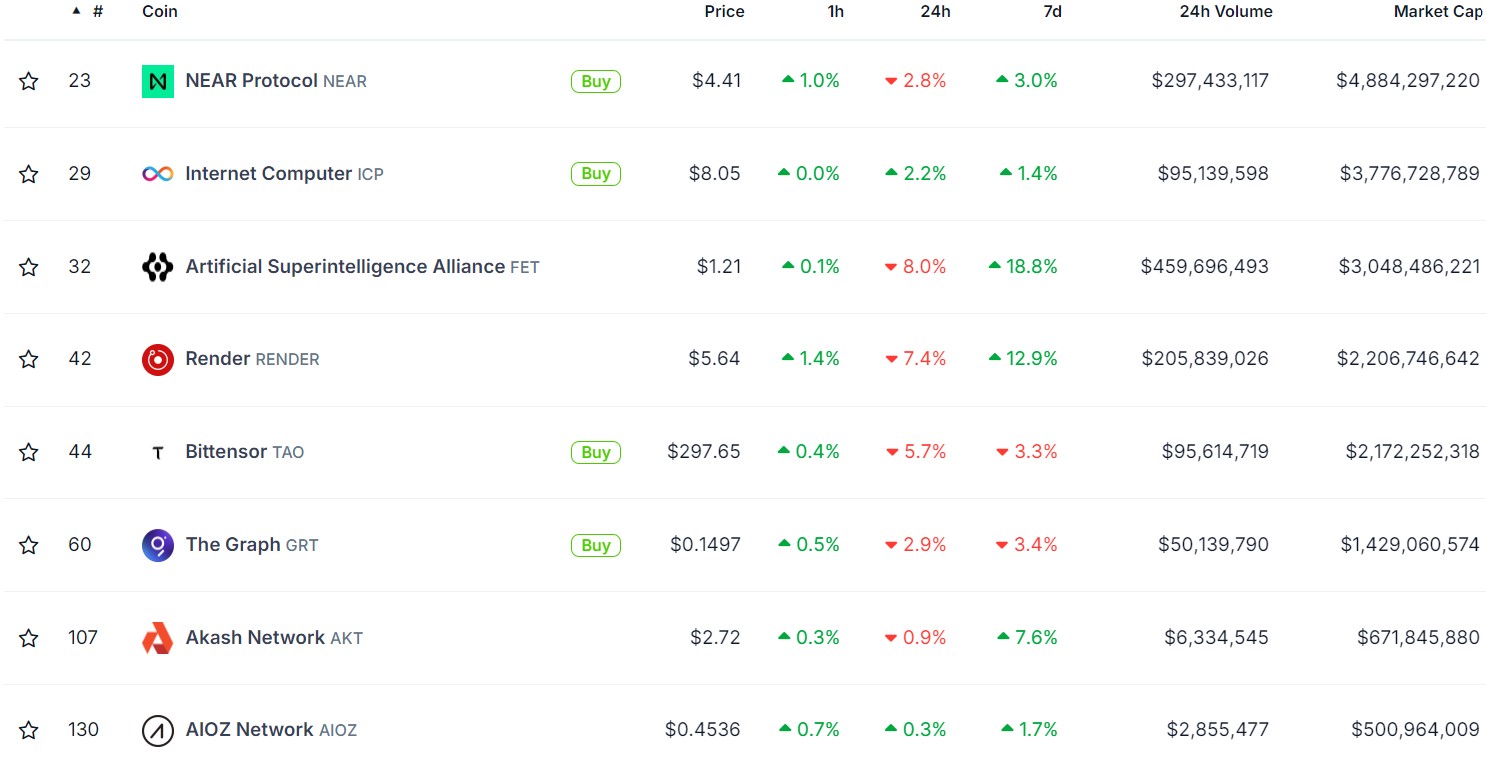

In the wake of this decline, cryptocurrencies labeled “IA” have also suffered a drop in their price:

Figure 3 – Prices of IA category cryptocurrencies

👉 Also in the news – Hamster Kombat: we officially know the date of the “biggest airdrop of all time”

Although these drops reach up to 8% in 24 hours, it is nevertheless necessary to put things into perspective when looking at the weekly increases.

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Source: Nvidia

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.