While the Federal Reserve (FED) pivot is expected on Wednesday, September 18, several parameters must be considered in order to properly anticipate the impact in terms of trend on the bitcoin price.

BTC & FED pivot, here are the 7 possible scenarios

As the market awaits the first week of September for all the most important US statistics regarding the US labor market, High finance is still projecting a pivot by the FED during the monetary policy decision on Wednesday, September 18. The market's hesitation concerns the number of rate cuts, 1 (25 bps) or 2 rate cuts in one go (50 bps).

The doxa considers that the FED pivot is a fundamental bullish factor for the stock market and, by correlation effect, bullish for the price of bitcoin and altcoins.

This consensus is largely wrong because it does not take into account the parameters of the pivot and the possible fundamental combinations that lead to this change in monetary policy by the FED.

The pivot parameters are the US inflation rate and unemployment rate and there are scenarios where the pivot could have a stock market crash impact on stocks and BTC price.

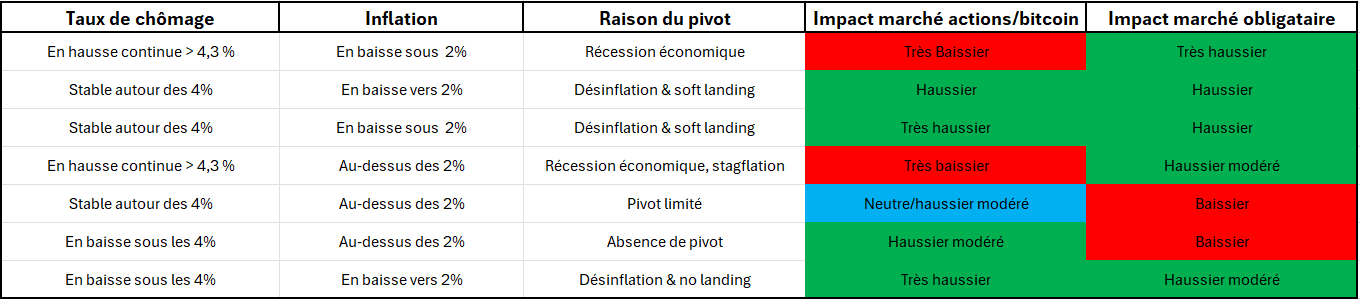

So I suggest you look at the table below.

This table reveals the 7 possible scenarios of a FED pivot and the impact in terms of trends to be expected on the stock market, BTC and the bond market.

You have to keep in mind that these parameters will decide the reason for the FED pivot and the number and pace of rate cuts over the next 12 months. With disinflation well underway, it is the US employment statistics (especially the NFP report) that will have a dominant impact on the nature of the FED pivot and the future trend of the bitcoin price.

Next week sees the release of the highly anticipated NFP report on Friday, September 6th to assess the likelihood of a recession in the United States. If the FED were to pivot to an economic recession, it would have a bearish impact on BTC.

In order to get the bull run we are all waiting for, it is mandatory that the FED pivots for one of the 5 good reasons (out of 7) described below.

Cross-tabulation produced by Vincent Ganne and which reveals the 7 possible scenarios for the stock market (correlated to BTC) and the bond market depending on the nature of the FED pivot

Buy crypto on eToro

Bitcoin Bullish Release Expected for October

It has been almost 7 months since the bitcoin price was locked in a sideways transition phase below its historical record. The market is suffering the consequences of having gotten too far ahead at the beginning of the year by reaching its ATH several weeks before the halving.

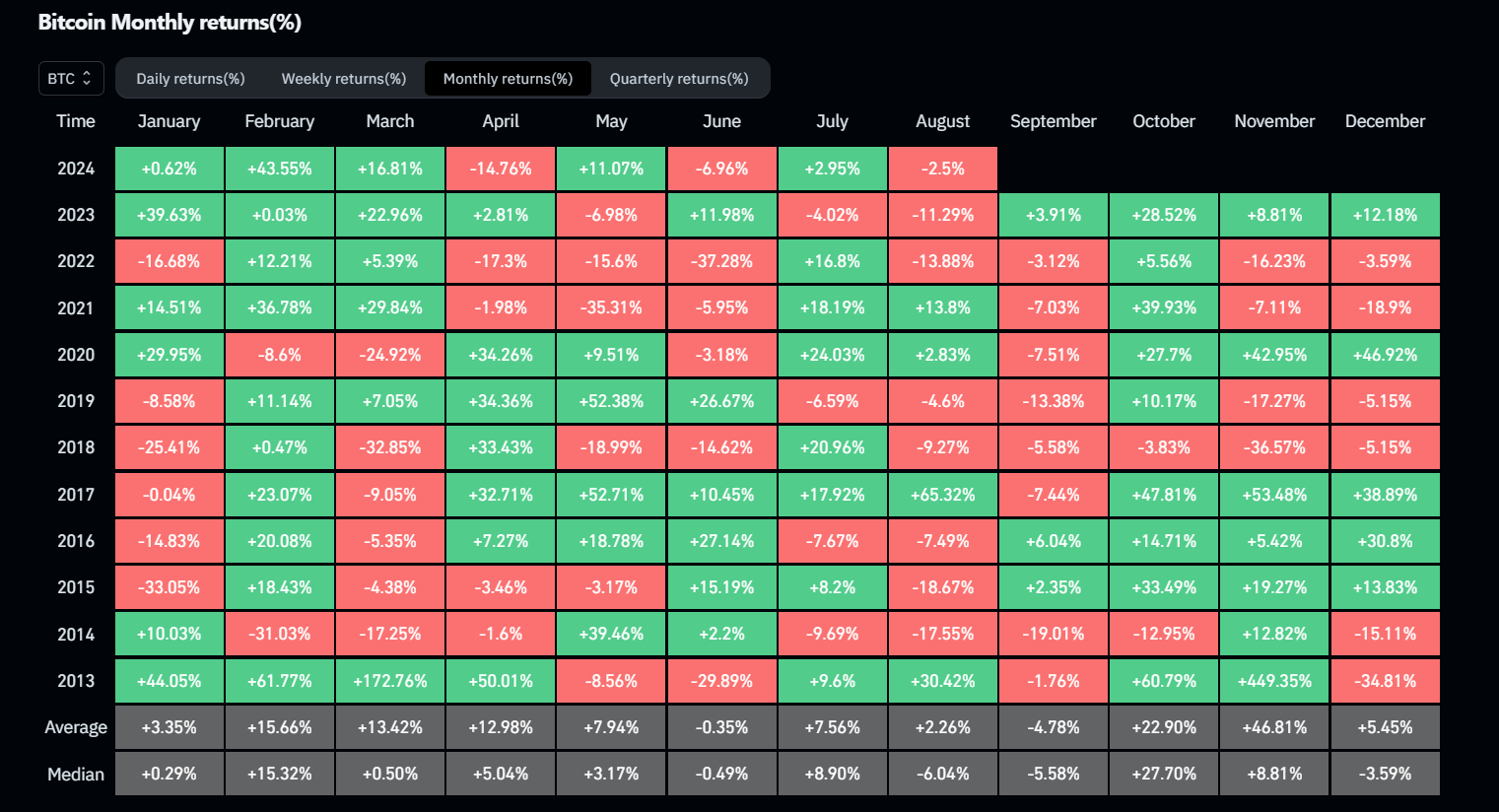

When will BTC finally break its ATH? It could be October-November 2024 with a particularly favorable seasonality over these 2 months of the year.

📈 You want to have every morning the trading opinion of Vincent Ganne on Bitcoin as well as his best configurations on altcoins, then join the professional service Cryptoast Research! Satisfied or refunded for 15 days so don't hesitate any longer!

Table that describes the average performance of BTC according to the months of the year

Trade Republic: Buy Crypto and Stocks in 5 Minutes

Source: Coinglass

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.