There are times when everything seems to clear up on the markets, the planets align with a favorable seasonality. Many people, at the beginning of this week, are expecting to see the signals sent after the FED meeting on September 18 confirmed. However, everything is not yet in place to envisage a big breath of fresh air on the Bitcoin price and the crypto market!

It is Monday, September 23, 2024, and the Bitcoin price is hovering around $63,500.

The FED pivot is now underway! This will probably not have escaped your notice since this event has been expected for many months. This rate cut, which aims to revitalize the economy, is a good signal for risky assets. This is particularly the case in an economic context that, for the moment, seems resilient, although the risks concerning employment and inflation remain in the balance.

Therefore, the market is satisfied with the latest events. It has been expressing itself positively since last Wednesday. This Monday morning, at the opening of the professional markets, the reactions seemed to continue in the direction of optimism. The BTC even approached $65,000 overnight. Since then, it has been consolidating, no doubt waiting for the opening of the New York authorities for a session that should reveal the future trend to us.

The macroeconomic event of the week is due to inflation, since the PCE figures for August will be published on Friday at 2:30 p.m.These are expected to fall slightly for the raw version and to stagnate for the value devoid of the most volatile elements (energy and food).

| Pairs with Bitcoin | 24 hours | 7 days | 1 month |

| Bitcoin / USDT | +1.20% | +7.80% | -1.00% |

| ETH / Bitcoin | +1.50% | +6.20% | -3.20% |

📈 Ride the bull run by surrounding yourself with experts! Join us now on Cryptoast Research

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

Return of institutions?

The last 2 weeks have been notable for the return of inflows to Bitcoin Spot ETFs. The data shows a net positive movement of $545 million. However, these inflows do not offset the outflows that spot ETF products saw in the first week of the month (around $700 million).

Similar to our analysis from 2 weeks ago, we note that Blackrock’s ETF remains neutral; the flagship is sticking to its guns. This confirms the importance of watching the flows of this particular product. The next long-term buy or sell signal could come from IBIT if it were to string together several consecutive days of similar flows.

Latest US Bitcoin Spot ETF Data

Buy crypto on eToro

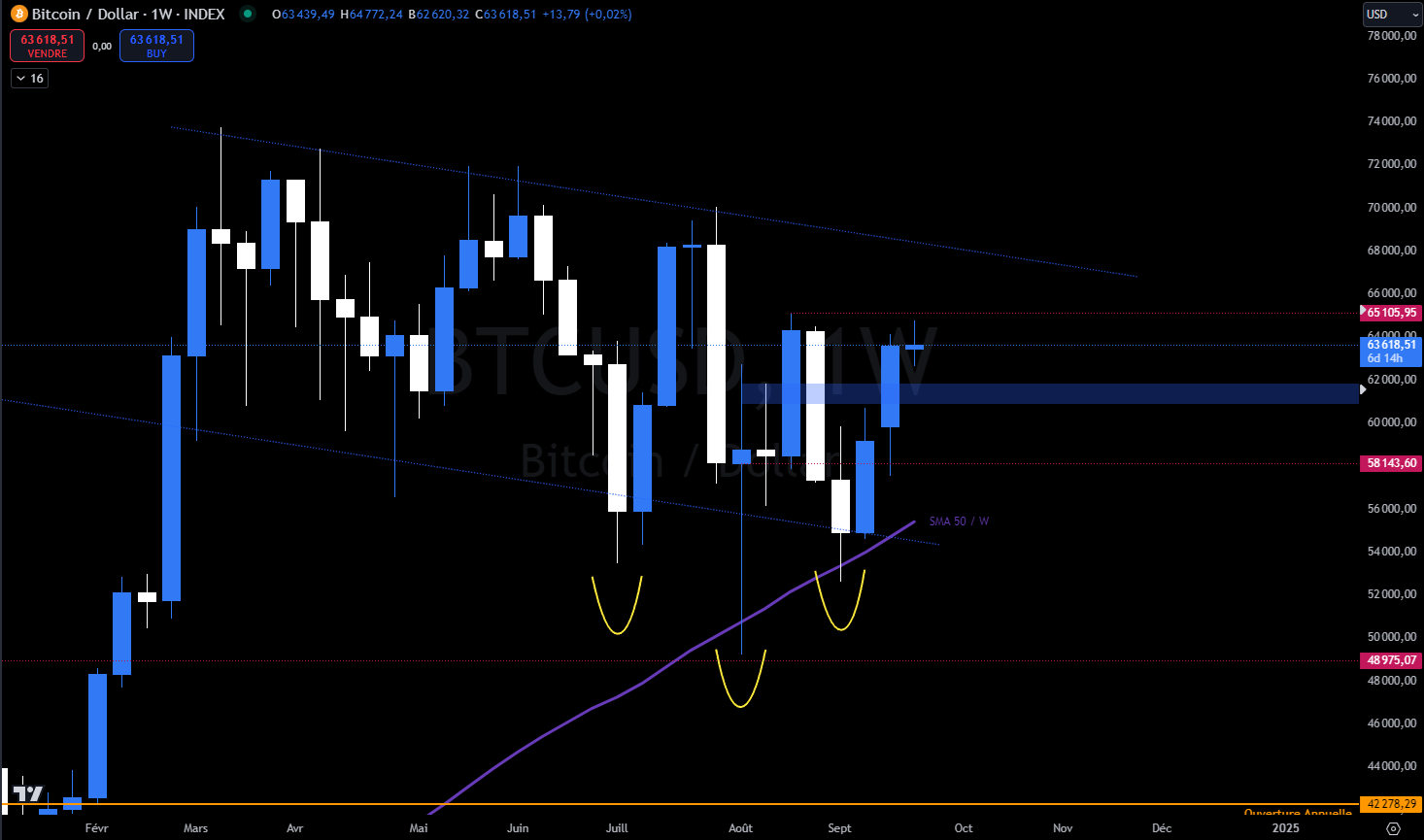

Bitcoin, to cross $65,000 before consolidating?

BTC remains in a downtrend until it breaks above $65,105. This level would allow it to make a new higher high than the previous one, and would realign the weekly upward trend following the Dow law.

Bitcoin is unlikely to settle directly above this level, although this scenario remains plausible, especially in a context where optimism would be the course of action displayed by the market.

At this point, the most likely scenario would be to break above $65,100 before retracing to consolidate and regain strength by marking a new low higher than the September 6 low.

It is in this price structure that BTC could prepare in good conditions for an increase that would aim to sustainably cross $65,000 in search of a new phase of price discovery.

👉 How to easily buy Bitcoin (BTC) in 2024?

The short-term invalidation is due to a reintegration below the zone drawn in blue. This zone, located between $61,000 and $62,000, would mark a change in polarity that could lead to a retest of $58,000 before deciding on the next move.

Indeed, if the $58,000 manages to support prices, we could once again see a positive reaction with the construction of a range between this level and $65,000. The $61,000 to $62,000 area could act as an equilibrium.

However, This would again demonstrate weakness. failing to reach a new high. This would not be a very good technical sign in the medium term, the consequence being an increase in the probabilities in favor of a bearish continuation.

The targets in case of a recovery towards the south are located near $50,000, with, in case of crossing, an area of interest between $42,000 and $44,000.

Bitcoin Price Chart Weekly

👉 Want to discover more technical analysis on Bitcoin or altcoins? Join our premium group Cryptoast Research where we share altcoin analysis charts every week!

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

In summaryBitcoin remains in a weekly downtrend as long as it fails to break out of the $65,000 mark. To the south, the $58,000 mark should be safeguarded at the close to maintain the idea of a bullish recovery. In the short term, the $61,000 to $62,000 area indicates the polarity of the BTC price, this level should be preserved in order to prepare for the crossing of $65,000.

So, do you think BTC can return to an uptrend? Please feel free to give us your opinion in the comments.

Have a great day and we'll see you next week for another Bitcoin analysis.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.