Siam Commercial Bank, Thailand's oldest bank, announces the launch of an international stablecoin transfer service. This partnership with Asian fintech Lightnet aims to offer faster cross-border payments, available 24 hours a day and at lower costs, meeting the growing demand for more modern and efficient financial solutions.

Siam Commercial Bank (SCB) moves into stablecoins

In recent months, many institutions have started to adopt cryptocurrencies, notably through the Bitcoin and Ethereum spot ETFs launched earlier this year, like the banks Goldman Sachs and Morgan Stanley. Some companies, like MicroStrategy, which now holds more than 200,000 BTC, and Japanese company Metaplanet, have also invested large amounts of equity.

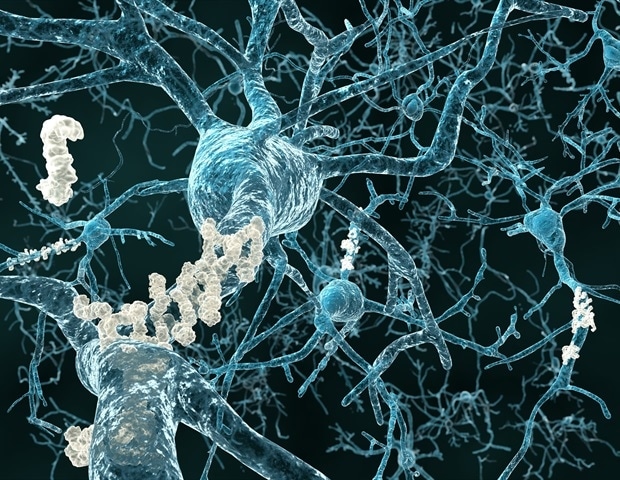

Among the most widely used digital assets are stablecoins, including Tether's USDT, capitalized at almost $120 billion, and Circle's USDC, capitalized at $34.5 billion. These assets allow many unbanked people to hold and trade dollars, the world's most widely used fiat currency, simply through a mobile phone and internet connection.

💶 Find our file on the regulation of stablecoins within the European Union

Recently, Siam Commercial Bank (SCB), the oldest Thai bank and the 4th largest in the country, announced that it will launch an international transfer and payment service via stablecoins.

This service, developed in partnership with fintech Lightnet, aims to offering funds transfers available 24/7, while benefiting from faster and cheaper international transactions thanks to the blockchain technology on which these tokens are exchanged.

Lightnet is an Asian fintech specializing in cross-border payments, using blockchains to provide fast, affordable and accessible transfers, with a strong focus on financial inclusion in Southeast Asia.

Buy cryptos on eToro

What do we know about this new service?

Few details are available about this service soon to be launched by Siam Commercial Bank. It remains to be determined whether a stablecoin backed by the local currency baht will be introduced or whether the bank will simply offer access to existing stablecoins.like USDT.

According to the media CoinTelegraph, this new service was tested as part of the “sandbox” set up by the Central Bank of Thailand. This scheme was designed to allow Thai financial institutions to experiment with digital assets without risking legal action.

📰 Also read in the news – PayPal: in less than 2 months, the PYUSD lost more than 40% of its capitalization — What happened?

Interestingly, it is the Thai baht and its symbol (฿) which inspired the Bitcoin logowith not one, but two bars crossing the capital B from top to bottom.

Thailand is gradually opening up to the world of cryptocurrencies. In March 2024, it adopted a decree exempting cryptocurrency gains from income tax, intended to strengthen the economy and attract investment. This measure also encourages fundraising via investment tokens, a tool that can be used by local businesses.

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: Nikkei Asia, CoinTelegraph

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.