Bitcoin is once again showing strength, marking minds with a bullish break in its dominance and exceptional incoming institutional flows. In this context, what room is left for the outperformance of the strongest altcoin in recent weeks, the SUI token?

Bounce on 2 dollars to conquer a new ATH?

It is Friday October 18, 2024 and the SUI price is around 2 dollars.

Sui is a layer 1 blockchain that is based on the foundations of technologies developed by Meta/Facebook. It uses the Move language for the development of its smart contracts and has a parallelized architecture, offering exceptional scalability potential.

The project has experienced significant growth in recent weeks and hype certain. The value of the token increased significantly, going from $0.47 on August 5, 2024 to $2.36 on October 13. A remarkable performance since it is the best progression among the largest capitalizations in the ecosystem over the period.

Now in 23rd position in the ranking of cryptocurrencies, with $5.69 billion in market capitalization for only 28% of its supply in circulationthe SUI project still seems to attract the attention of investors. SO, where are we technically on the SUI token?

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

| Pairs with SUI | 24 hours | 7 days | 1 month |

| SUI/USDT | +0.30% | +6.30% | +77.10% |

| SUI/BTC | -0.80% | -4.20% | +56.00% |

| SUI/ ETH | -0.10% | -2.00% | +55.40% |

👉 Find our selection of the best platforms for buying cryptocurrencies

More volatility expected for SUI crypto?

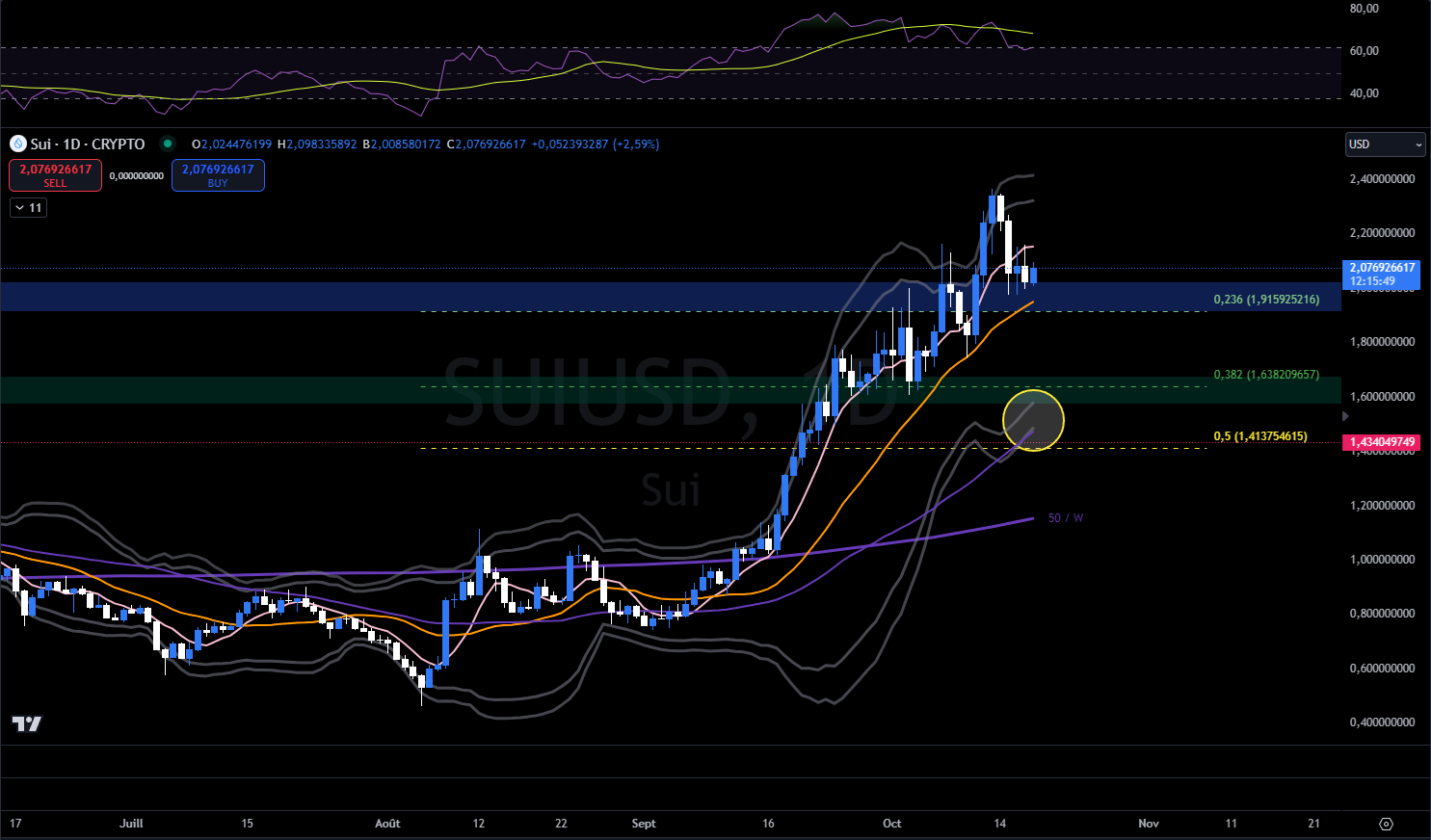

The SUI token is still in an impulsive bullish phase. In recent days, it has managed to cross $2, continuing on its way to a new historic high on October 13, 2024 at $2.35.

Since its ATH, reached only 4 days ago, the SUI has consolidated around 2 dollars, a psychological and historical level which could be a major pivot for the rest of the movement.

On a daily basis, the price action nevertheless shows a need for delay. The upper Bollinger band is weakening, with an RSI which, at the same time, reveals bearish divergences.

Join the Cryptoast community on Discord

If no bullish continuation scenario can be excluded in view of the strong trend displayed by SUI, the probabilities tend more favorably towards a consolidation which would allow digestion of the last movement.

The Fibonacci retracement from the August 5 low to the October 13 high reveals several areas of interest:

- The zone to be protected to maintain the current dynamic is emerging at the confluence of the 0.5 retracement, the daily low Bollinger band and the 50-day moving average: between 1.40 and 1.50 dollars;

- The 0.382 retracement in confluence with the historical zone in green around 1.60 dollars is also interesting to monitor in the idea of a relaunch of the impulsive movement;

- Finally, the area drawn in blue above the 0.236 Fibonacci retracement at $1.91 is support above which we could see a reaccumulation phase taking shape that could offer a particularly explosive resolution.

In any case, on a weekly basis, the Bollinger bands are well open, which suggests that medium-term volatility could continue to be part of the price action.

As the charts currently stand, the SUI token seems to be moving favorably towards a bullish continuation scenario towards $4. This scenario could develop particularly quickly if consolidation above $1.91 is confirmed, thus structuring a retest of the exit zone of an accumulation phase of several months.

SUI token price graph on a daily basis

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

In summary, the SUI token remains one of the strongest tokens in the crypto market. Crossing the psychological level of $2 is a significant step forward towards a goal of $4. It will nevertheless be necessary to maintain a high consolidation to envisage a continuation of the price action towards new peaks.

So, do you think SUI can continue to outperform the crypto market? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.