Although the memecoin sector is the center of attention in the crypto community, DeFi has also performed interestingly in recent weeks. However, it seems that these 2 sectors are closely linked. How can we explain it?

DeFi is the 2nd best performing sector for 1 month

Over the past few days and weeks, a phenomenon has grown more and more, memecoins. And this, to the point that the hypothesis of a hypercycle based on the latter is gaining popularity.

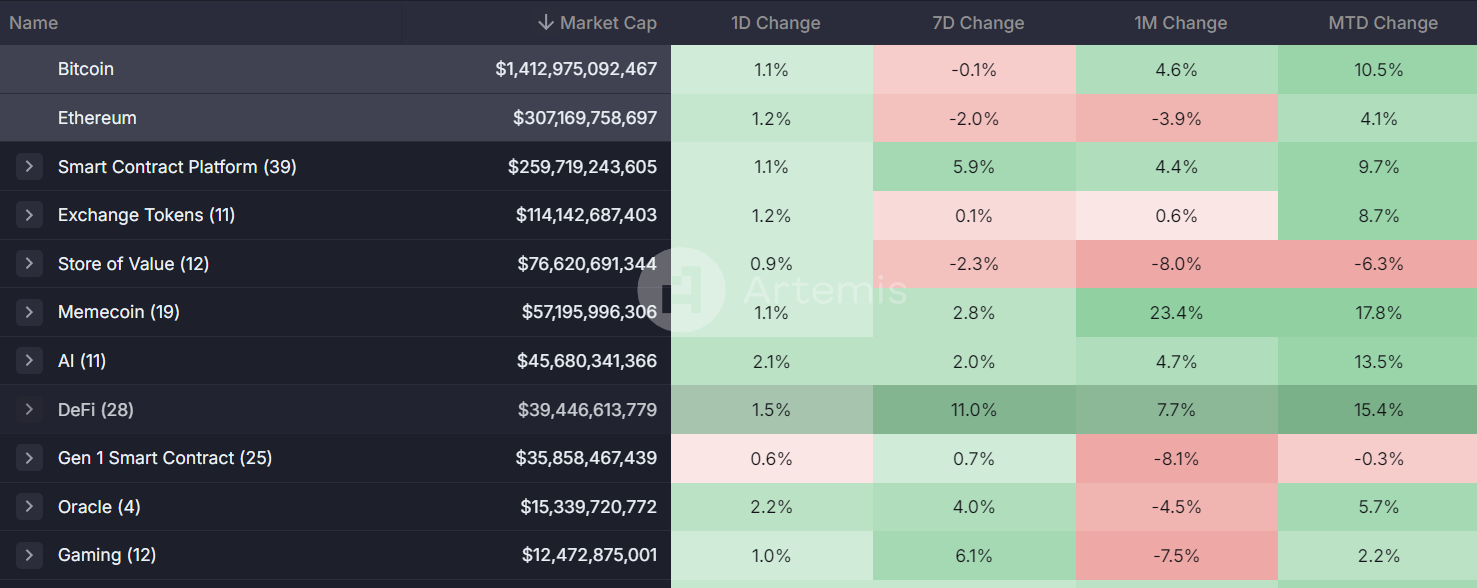

With memecoins taking up much of the crypto community's attention, the performance of decentralized finance (DeFi) has almost gone unnoticed. However, by referring to the table below which sets out the performance of the different crypto sub-sectors, we can realize that DeFi has been in 2nd position for 30 days.

🔎 To dig deeper – Are memecoins truly decentralized?

Over the last 7 days, DeFi has even positioned itself in first place, ahead of memecoins by more than 8%..

Table representing the performance of crypto sub-sectors

Table representing the performance of crypto sub-sectors

Information

Although this data is only based on indices representing panels of cryptos for each sub-sector, it can still tell us in which direction it may be interesting to focus our attention.

Open an account on N26, the crypto-friendly bank

The best performing DeFi projects over the last 30 days

During the last 30 days, many DeFi projects have shown good performance, either in terms of valuation of the underlying token or by increasing the total value locked (TVL) of the project.

💡 How to find the best protocols and narratives through revenue analysis?

In the diagram below, you will find the main projects linked to DeFi which have performed the best over the last 30 days. For example, RAY, the token of the Raydium protocol based on Solanarecorded an increase of 70% during this period. The project for its part gained 65% TVL over this same time scale.

Overview of DeFi projects that performed over the last 30 days

We can see from the diagram above that most of the projects which have performed both in terms of the evolution of the price of their token and in terms of TVL are attached to the Solana blockchain ecosystem.

Among the projects that are not on Solana and represented in the diagram, only the Aerodrome protocol really stands out in terms of the evolution of the price of its token and the increase in its TVL.

To find a complete analysis of the Aerodrome protocol in the format “ Token of the week », join the premium Cryptoast community, Cryptoast Academy.

Information

The “Token of the Week” format is a complete analysis of a project and its tokenomics in all its forms: fundamental analysis, on-chain analysis and technical analysis. Each of these parts is produced respectively by one of our experts who pool their work to have a 360° vision of a project. Every week, the Cryptoast Academy community votes to see their favorite project studied. So it's Aerodrome's turn, whose analysis will be released next Monday!

Cryptoast Academy: Don’t waste this bull run, surround yourself with experts

Why do certain protocols stand out?

Although the DeFi sector is showing remarkable performance over the past few days/weeks, it is very likely that this boom is linked to memecoin trading.

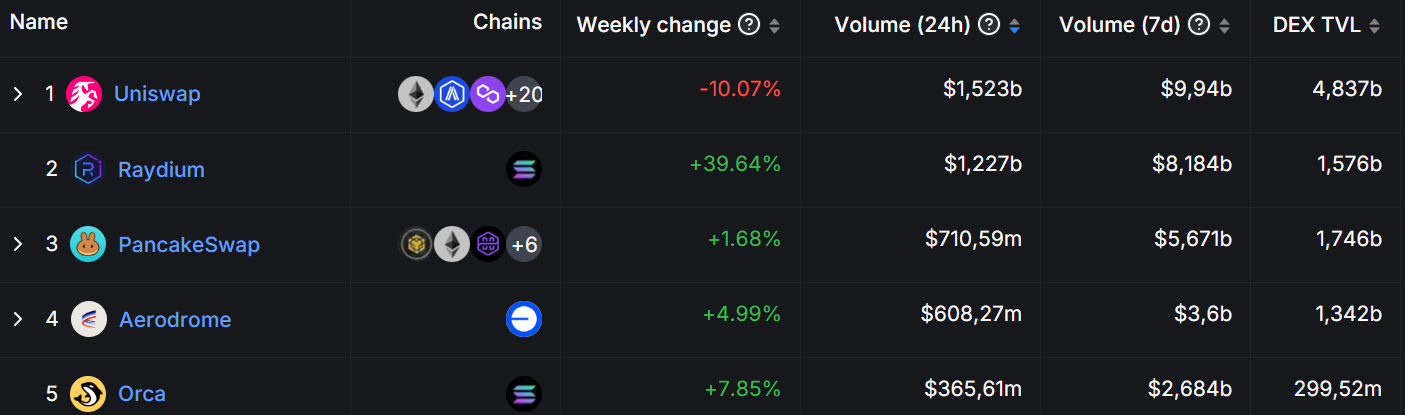

Indeed, the decentralized exchanges (DEX) that recorded the largest volume increases over the last 7 days all offer a flagship memecoinwhich could explain the attraction of the latter.

The 5 largest DEXs in terms of volume

The 5 largest DEXs in terms of volume

For example, among the 5 DEXs recording the highest volumes, take Raydium and Orca, both present on the Solana blockchain. They record respectively an increase of 40% and 8% in their volumes over the last 7 days. This increase could partially be explained by the strong attraction of investors in memecoins.

Additionally, a memecoin has recently been in the news a lot. This is the Goatseus Maximus (GOAT), a token inspired by a meme from the 2000s. Its particularity making it unusual is that an artificial intelligence (AI) called Terminal of Truth (ToT) is at the origin of its hype.

Internet users then seized on the story and invested massively in this memecoin. As I write these lines, the GOAT token has just entered the top 100 most capitalized cryptos on Coingecko with nearly $800 million in market capitalization.

💲 Our tutorial for buying crypto easily

During the last 24 hours, GOAT token recorded nearly $432 million in volume. For comparison, SHIBA, which is the 15th most capitalized crypto on the crypto market, only recorded $419 million in volume over the same period. Still according to Coingecko data, more than 50% of the volumes on this memecoin currently pass through the Raydium and Orca DEXs.

It should be noted that the GOAT memecoin was launched on the Solana blockchain, via the Pump.fun launcher. Thus, the GOAT memecoin would not be unrelated to the large volumes trading on Solana DEXs.

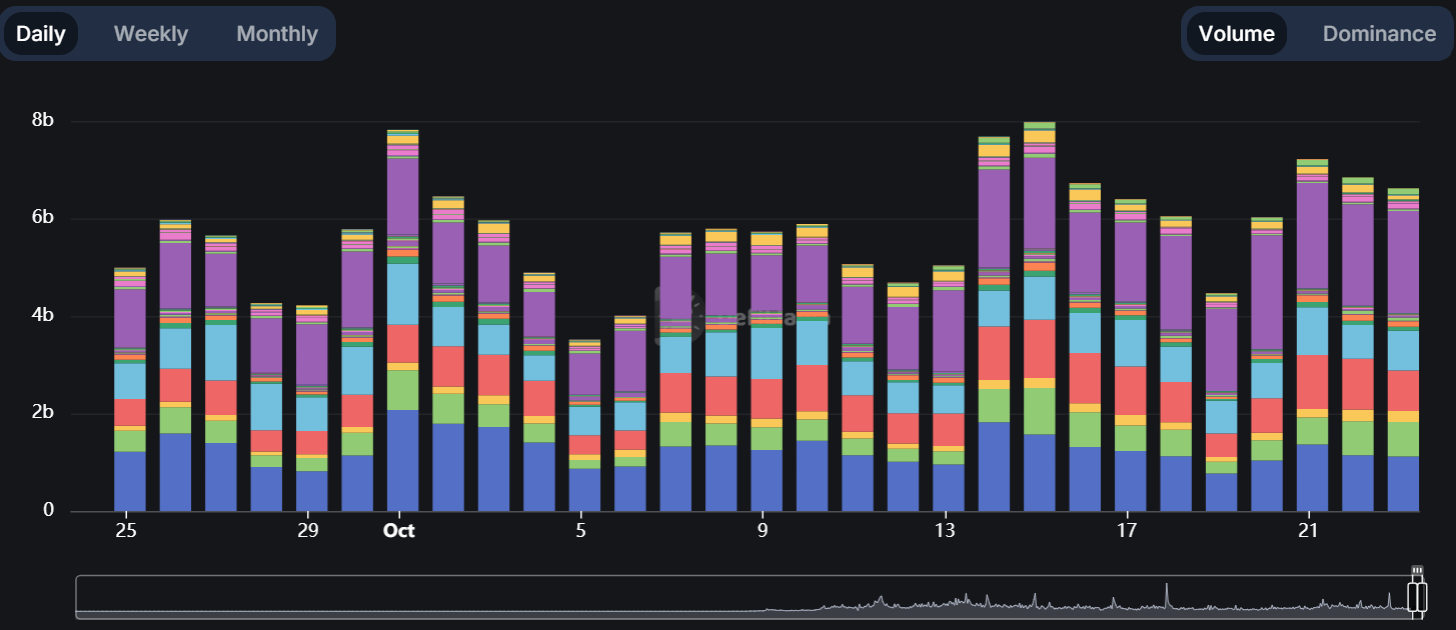

On the graph below, we find the daily volumes recorded on DEXs according to their respective blockchains.

DEX volumes by blockchain, with Ethereum in dark blue and Solana in purple

DEX volumes by blockchain, with Ethereum in dark blue and Solana in purple

For 11 consecutive days now, Solana has largely surpassed Ethereum in this same metricwhich proves a real enthusiasm for this blockchain.

Although the Ethereum blockchain is historically the most popular for DEX trading, particularly with its flagship Uniswap protocol, Solana is currently making a spectacular catch-up in terms of volumes on its different protocols.

However, it seems that this significant activity on Solana is more linked to speculation around memecoins than to lasting organic activity.

Buy cryptos on eToro

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.