Thanks to significant capital inflows this week, the amount of assets under management of BlackRock's Bitcoin ETF has exceeded that of the gold ETF. Let's take stock of the amounts involved.

BlackRock sees its Bitcoin ETF surpass its gold ETF

One month after its launch last January, BlackRock's spot Bitcoin ETF achieved the strongest performance in the last 30 years in terms of capital inflows. Despite a slowdown in the spring and summer, the result of the American election was able to remove uncertainty, thereby allowing for BTC to resume its bullish run by once again surpassing its all-time high (ATH).

💡 How to buy Bitcoin ETF (BTC) in France?

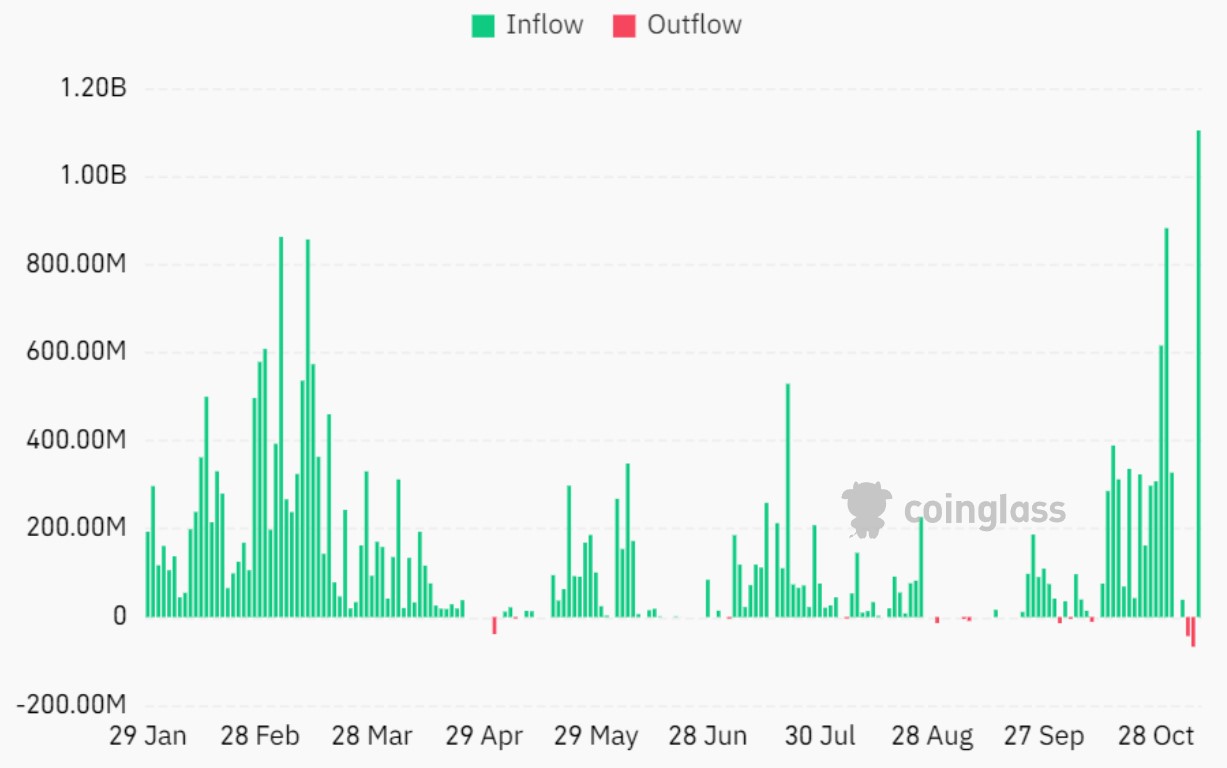

It is in this context that liquidity flows once again flowed into ETFs, to the point that IBIT recorded $1.1 billion in net inflows on Thursday, namely the best day since its creation:

History of flows on the IBIT ETF

Thus, all this liquidity now allows IBIT to bring together nearly $34.34 billion in assets under management. In addition to the fact that this now represents more than 2.26% of Bitcoin's capitalization, a new milestone has been reached: the overtaking by this ETF of that on gold.

And for good reason, the IAU ETF, although launched in 2005 by BlackRock and which has managed to weather major crises such as that of subprimes or Covid, has $32.35 billion in assets under management.

With an acceleration of the bull run which seems to be looming, this performance could soon take another turn, although it is already particularly remarkable.

👉 On the same subject — Thanks to BlackRock, spot Bitcoin ETFs record record daily net inflows

As for the spot assets themselves, BTC still has significant room for improvement against gold. Indeed, the famous precious metal is capitalized at $18,075 billion, compared to $1,514 billion for Bitcoin.

At the time of writing, BTC is trading at $76,650, up 0.88% in 24 hours.

Trade Republic: Buy Cryptos and Stocks in 5 Minutes

Source: Coinglass

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.