MARA Holdings, a leader in Bitcoin mining, has raised $1 billion through an issue of interest-free convertible notes, strengthening its strategic position. With this operation, the company acquired an additional 6,474 BTC and plans to purchase another $160 million, consolidating its key role in the crypto ecosystem.

MARA: a “Bitcoin Standard” company according to Michael Saylor

MARA Holdings, world leader in the field of BTC mining, has just finalized a major financial transaction.

The company announced the closing of its issue of interest-free convertible senior notes, a financing instrument that allows it to raise funds without having to pay interest.

The Notes were sold to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act. […] The offering of the Notes was made only by means of a private offering memorandum.

This $1 billion operation with a deadline of 2030 aims to strengthen the company's position on the market and support its growth ambitions.

♻️ Bitcoin Training – How does Bitcoin mining influence the energy sector?

Thanks to this offer of convertible notes, it will announce a few days later that it has acquired an additional 703 BTC, 6,474 BTC were therefore acquired by the company in the month of November.

With this new purchase, the company now holds 34,794 BTC, currently valued at $3.3 billion. A strategy supported by Michael Saylor on the social network X:

$MARA is a company on the #Bitcoin Standard. https://t.co/RmIlSesEHT

— Michael Saylor⚡️ (@saylor) November 22, 2024

Open an account on N26, the crypto-friendly bank

MARA prepares to acquire another $160 million worth of Bitcoin

These notes can be converted into company stock or cash, depending on the holders' preferences. This flexible model allows investors to convert their securities at advantageous prices while offering strong profitability potential and reducing risks for the company.

The conversion rate of the Notes is initially 38,502 shares of MARA common stock for the principal amount of the Notes of $1,000, which equates to an initial conversion price of approximately $25.9133 per share. The initial ticket conversion price represents a premium of approximately 42.5% over the average price.

Thus, on the one hand, investors can convert their shares when the performance of the MARA share exceeds a predefined threshold, and on the other hand, the company can repurchase the convertible notes before their maturity, thus offering great financial flexibility and an easier capacity to respond to market fluctuations.

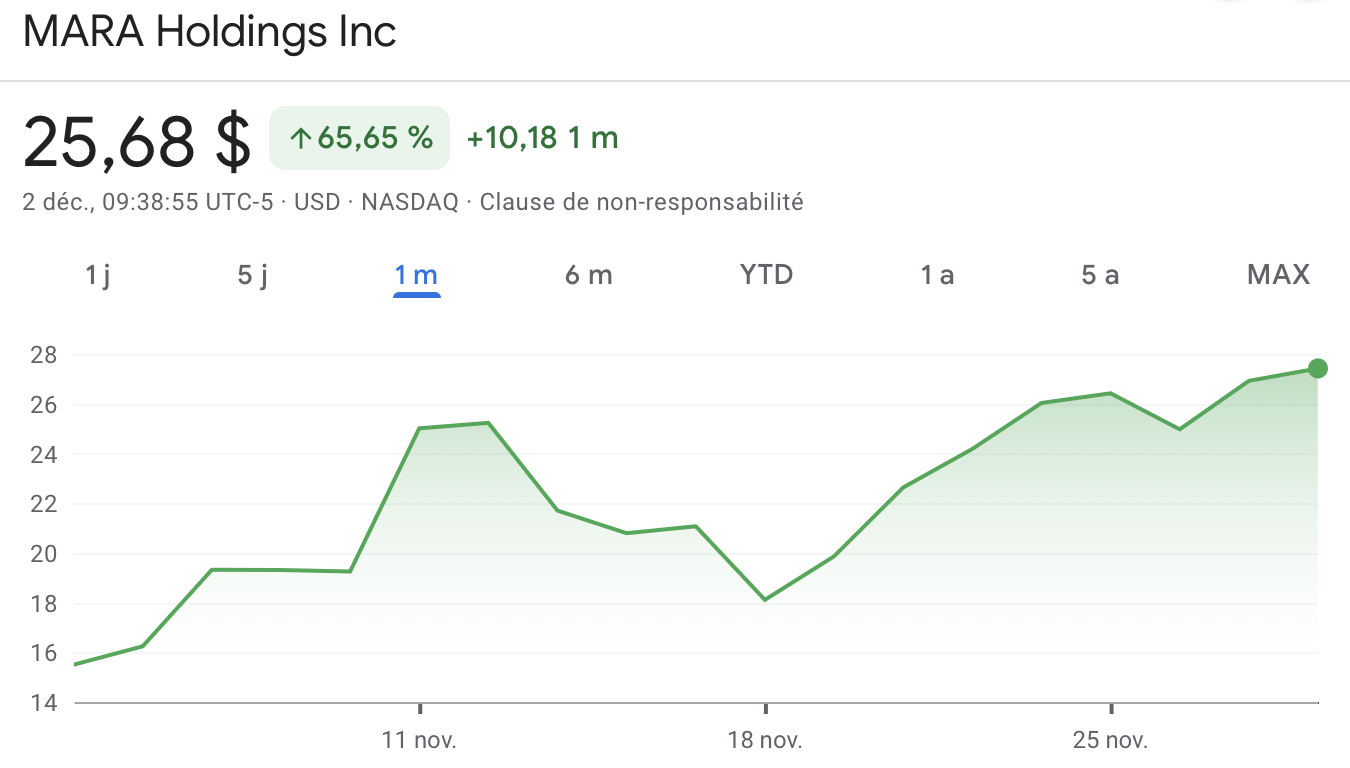

Since this announcement, the share price has increased by 11.8%, reflecting the confidence attributed to this long-term strategy of a company which occupies a growing role in the cryptocurrency ecosystem.

Evolution of the MARA Holdings share price over the last month

The bulk of these funds, approximately $781 million, will be used by MARA to acquire more Bitcoin. The company also plans to use part of these proceeds to repurchase some of these existing convertible notes, particularly those maturing in 2026.

👉 In the news – Michael Saylor tried to convince Microsoft to create a strategic reserve of Bitcoins (BTC)

Nearly $200 million of that billion was allocated to repurchase its convertible bonds maturing in 2026, while the rest of the funds will be used to purchase Bitcoin. In other words, MARA plans to acquire another approximately $160 million worth of BTC.

The addition of Bitcoin as a flagship asset in MARA's strategy is part of a logic of capitalizing on the growth of blockchain, an increasingly present integration in the global economy.

This operation could be an accelerator for the future of the company, helping it to respond to the challenges and opportunities of a global market increasingly focused on the technologies of tomorrow.

Black Friday: – 75% on Cryptoast Academy, don't miss the bullrun, join our experts

Source: MARA

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital