The price of bitcoin stabilizes below the symbolic threshold of $100,000. How far can BTC grow before running out of steam? Discover Prof. Chaîne’s analysis.

How far can Bitcoin grow before running out of steam?

After an explosive month of November, with a return of more than +30%, the price of bitcoin (BTC) stabilizes below the symbolic threshold of $100,000 that so many expect to exceed.

Having looked at the overall investor response to the March ATH crossing in our previous analysis, today let's take a closer look at the long-term dynamics of the market.

How far can BTC go before, perhaps, falling again?

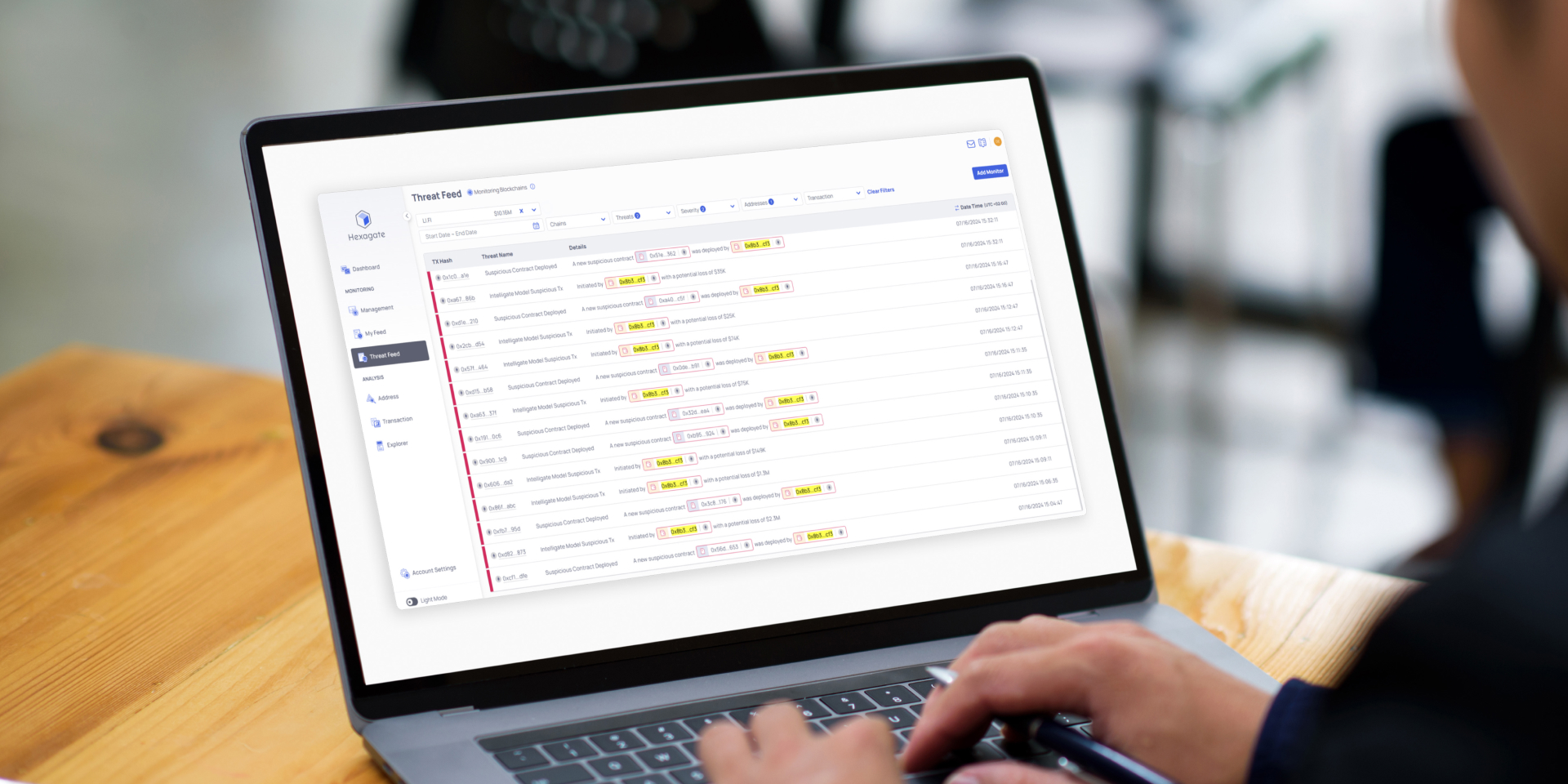

Figure 1: Daily price of Bitcoin

👉 Find the exclusive analyzes of Prof. Chaîne on Cryptoast Academy:

Black Friday: – 75% on Cryptoast Academy, don't miss the bullrun, join our experts

Long-term outlook on BTC

As the bull market is in full swing, and as the BTC market advances towards new ATHs, it becomes increasingly relevant to compare the on-chain context with previous bullish cycles.

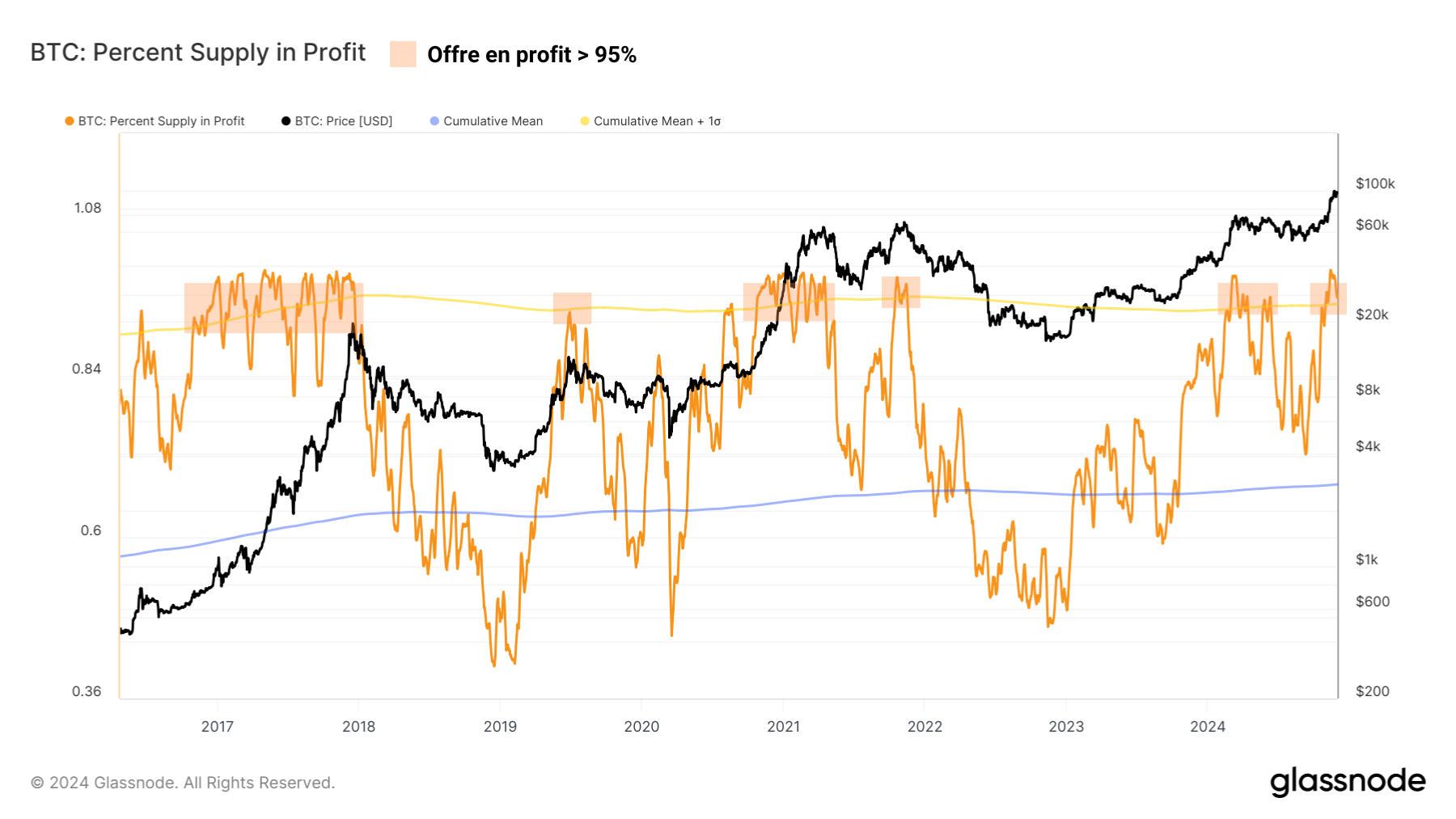

One of the first parameters to observe is the BTC profit supply percentage, which gives an overview of the overall profitability state of the market.

With nearly 98% of the circulating supply held in profit currently, the bull market is in its advanced phasewhere almost all investors are profitable and feelings of euphoria and panic quickly overlap.

Historically, these periods can last several months (see 2017 or 2021)and are punctuated by successions of bullish expansions and rapid corrections in an environment of high volatility.

Figure 2: Percentage of offer in profit

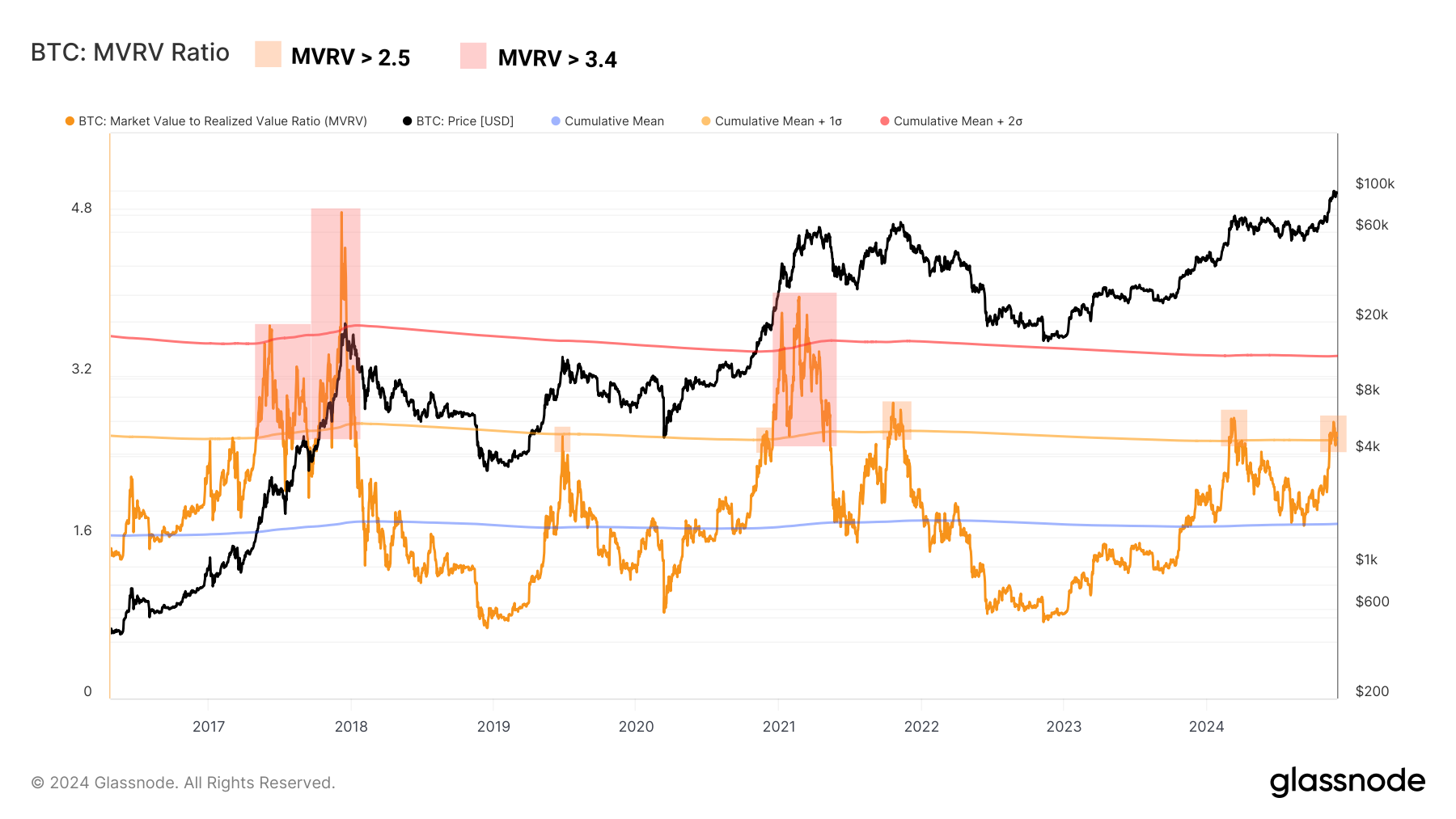

In addition to the quantity of supply held in profit, the current magnitude of latent profit corresponds to that of pivotal periods.

The average investor incubates a theoretical gain of +150%aligning the present market context with the local highs of July 2019, November 2021 or March 2024, periods where supply pressure may have exceeded demand and precipitated a market correction.

Try Hyperliquid: a decentralized trading platform!

It is therefore crucial to see whether current profit taking will be absorbed by new influxes of demandso that the market expansion continues and the MVRV rises above 3.4, where previous bull markets recorded their cyclical highs.

Figure 3: MVRV ratio

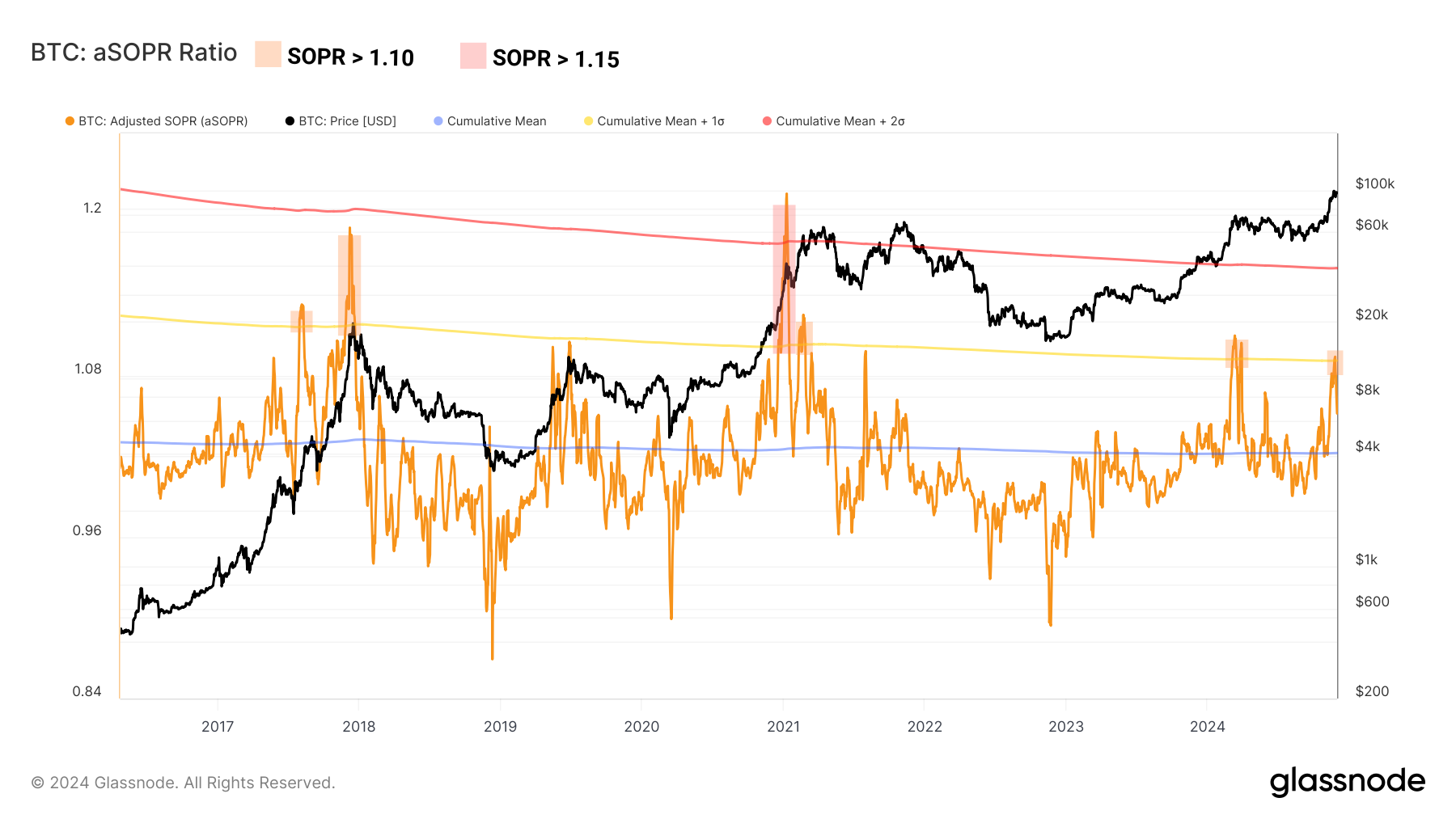

The current scale of profit taking also reaches a significant levelcoinciding with several historic local summits, including March 2024.

Although selling pressure appears to be intensifying over the past few weeks, the degree of profit made remains below the levels recorded during the bull market ends of 2017 and 2021.

Investors are still holding plenty of profits in reserve, waiting for six-figure prices to boost their sales.

Figure 4: aSOPR ratio

Additionally, short-term spending behavior, a proxy for market sentiment at lower time frames, remains positive despite the recent consolidation below $100,000.

As illustrated below, the STH-SOPR seems to remain above the neutral zone (SOPR = 1)using it as support to establish new bullish expansion cycles.

This structure, typical of sustained bullish market contexts, indicates that short-term trend remains robusthighlighting investor confidence and interest.

Figure 5: STH-SOPR ratio

Buy cryptos on eToro

Cyclical Summit Objectives

It is now clear that the BTC market has not reached its maximum saturation point. Let us then try to define bullish limits at which BTC could record a potential cyclical peak.

The following graph models the Realized Price of STH, as well as:

- its cumulative average, which serves as a statistical reference;

- the upper standard deviation of the cumulative average, as a short-term upper bound for the BTC price;

- the lower standard deviation of the cumulative average, as a short-term lower bound for the BTC price.

Historically, the BTC price forms its peaks near or above the upper statistical limit, currently located at $109,467. This gives us a first perspective for a local summit in the short term.

Figure 6: Realized price of STH & statistical variants

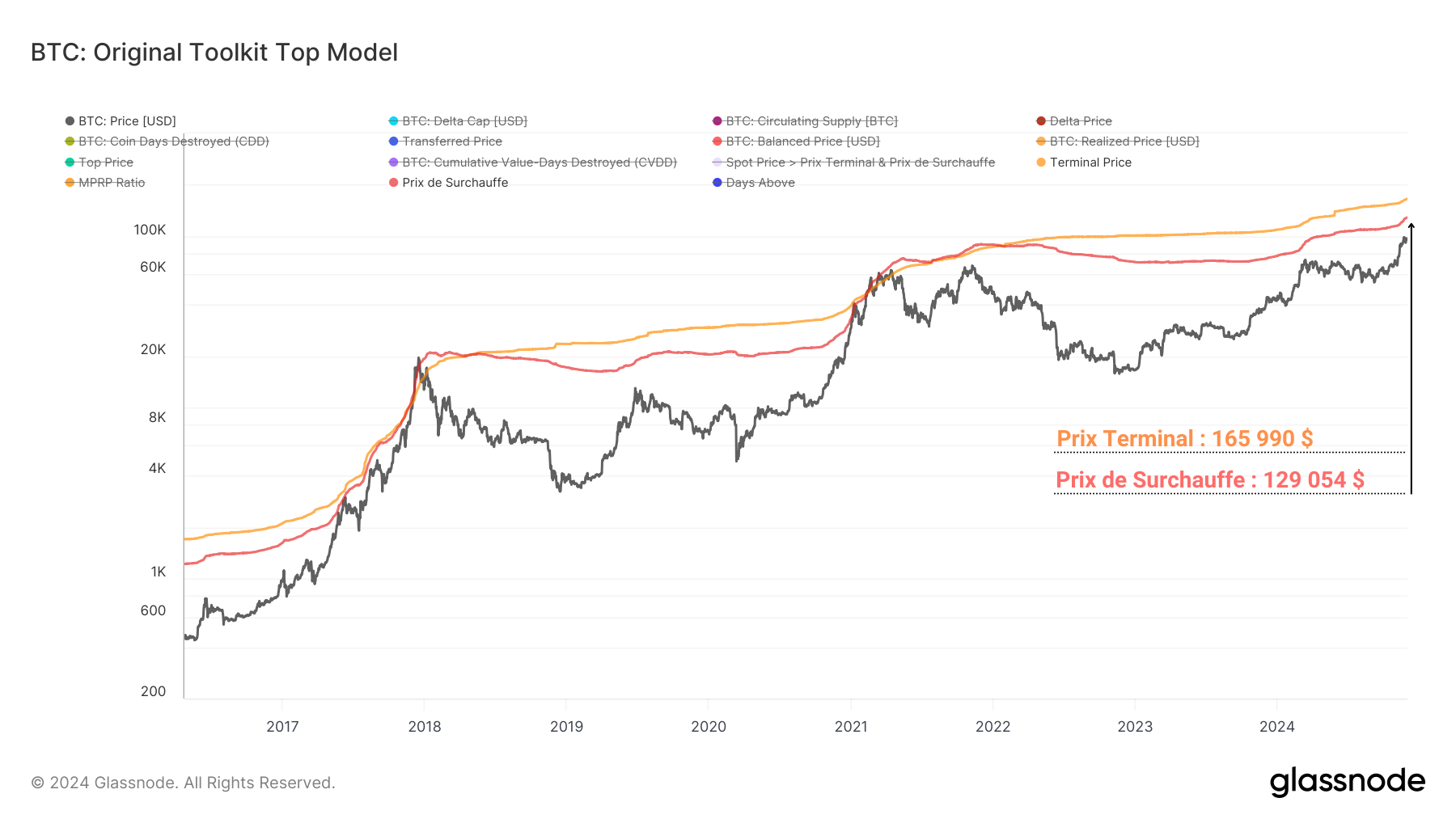

Then, the Overheating Price and the Terminal Price bring long-term upper limits for BTC price.

Historically, the price of BTC forms its cyclical peaks just above these metrics, currently located at $129,054 and $165,990. This gives us a first perspective for a long-term cyclical top.

Note that these metrics follow the underlying dynamics of the market and tend to increase during parabolic phases at the end of the bull market.

So, a rough estimate of a cyclical top between $150,000 and $200,000 seems realistic for the coming months.

Figure 7: Overheating Price & Terminal Price

Try dYdX now: the preferred DEX for crypto traders!

Summary of this on-chain analysis on Bitcoin

Ultimatelythis week's data suggests that the present market context aligns with those of the local summits of July 2019, November 2021 or March 2024.

Investors, however, keep many latent profits in reservewaiting for 6-figure prices to boost their sales. In the short term, the upward momentum remains sustainable.

A first estimate for a short-term local top is around $110,000, while price targets for a cyclical top range between $150,000 and $200,000.

Find exclusive analyzes from Prof. Chaîne on Cryptoast Academythe ideal place to make your investments in cryptocurrencies successful. You will learn how to position yourself on strategic price levels, spot investment opportunities and anticipate price movements. Join us now and take charge of your crypto investments.

Black Friday: – 75% on Cryptoast Academy, don't miss the bullrun, join our experts

Sources – Figures 1 to 7: Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital