Pre-market platforms allow you to buy and sell cryptos before their official listing on the exchanges. Pre-market trading gives access to these tokens at potentially more attractive prices than those during listing. Discover the top of the best crypto pre-market platforms.

Comparison of the best crypto pre-market platforms

If you are interested in crypto pre-market platforms, there are 2 types: centralized and decentralized.

Decentralized crypto pre-market platforms are available on different blockchains, while centralized platforms simplify trading by allowing access to different tokens via a single account, regardless of the underlying network.

Here is an overview of the main crypto pre-market platforms and their characteristics:

| Aevo | Drift | Whale Market | Hyperliquid | Binance | OKX | |

| Supported Blockchains | Ethereum, Arbitrum and Optimism | Solana | Solana, Starknet, BNB Chain, TON, Ethereum | Hyperliquid | / | / |

| Major strong point | Significant liquidity | Also allows staking | Allows you to trade protocol points Many blockchains supported |

Very low fees | Allows you to trade tokens received via Launchpool campaigns | Wide choice of cryptos available in pre-market |

| Trading Fees | Maker: -10 bps Taker: 25 bps |

Maker: -1 bps Taker: between 10 and 3 bps |

Between 0.5% and 2.5% | Taker: 0.025% | Standard platform fees | Standard platform fees |

| Go to the platform 👉 |

Trading on Aevo |

Trading on Drift |

Trading on Whales Market |

Trading on Hyperliquid |

Trading on Binance |

Trading on OKX |

Don't miss the bullrun, join our experts on Cryptoast Academy

The 4 best decentralized crypto pre-market platforms (DEX)

Decentralized crypto pre-market platforms provide early access to tokens not yet in circulation and which could be subject to an airdrop. Unlike centralized platforms, decentralized exchanges (DEXs) do not require identity verification (KYC) and can be used with a wallet.

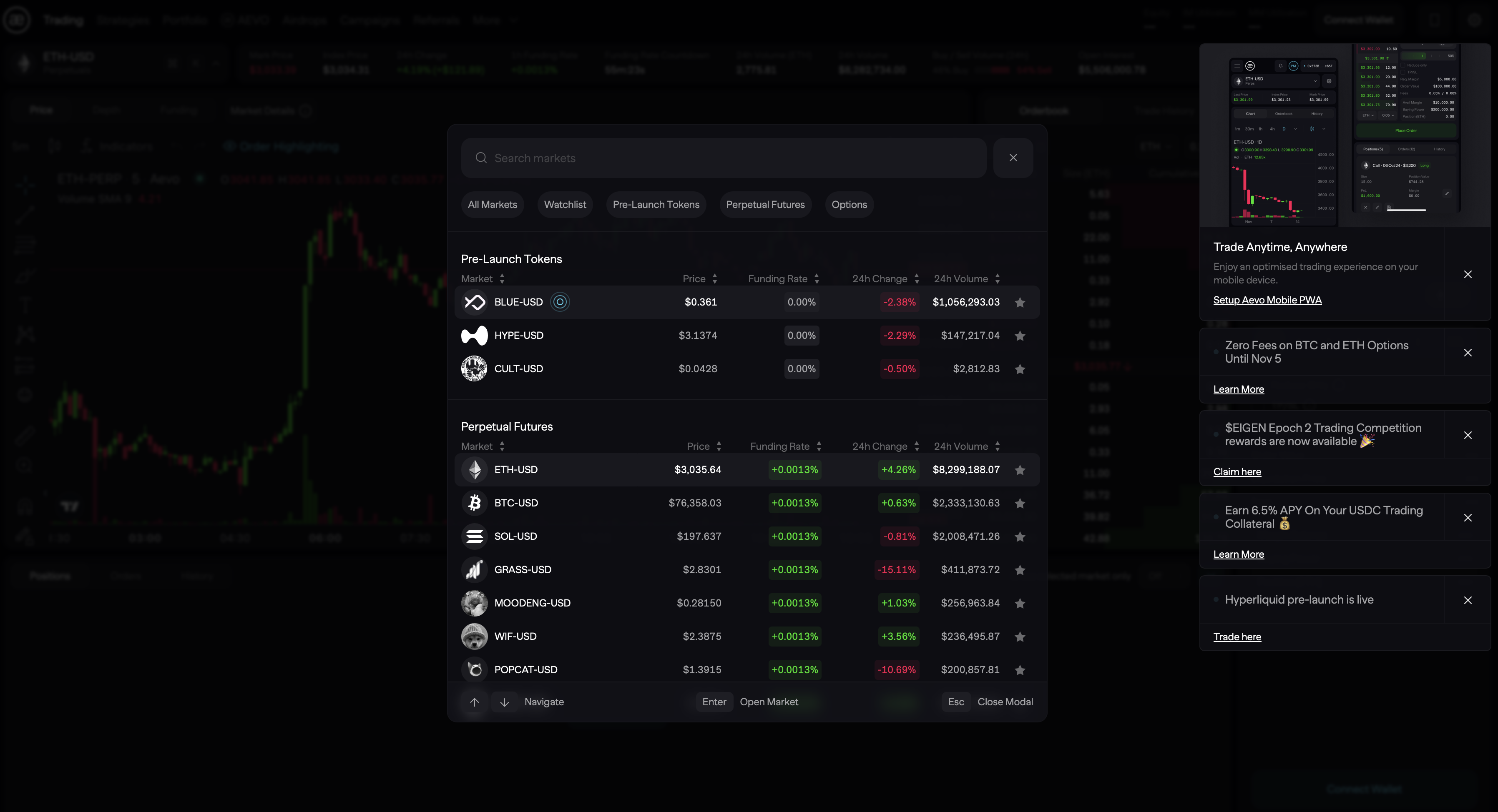

Aevo

Aevo is a decentralized crypto perpetual exchange (DEX) platform available on the Ethereum, Arbitrum and Optimism blockchains.

Aevo was created in 2022 as a decentralized cryptocurrency options exchange, before expanding its offering to perpetuals trading in May 2023.

Aevo's Pre-Launch Token functionality allows you to trade cryptocurrency perpetuals before their official listing. Prices are solely determined by supply and demand on the platform and users are subject to the following trading conditions:

- Leverage limited to x2;

- Maintenance margin set at 48%;

- Maximum position capped at $50,000.

After listing a token on the spot market, two scenarios are possible for positions opened on Aevo:

- If the estimate of the total supply is correct, the positions are automatically transferred to a perpetual futures market;

- In the event of an incorrect estimate, an average price is calculated and the positions are closed.

Tokens marked with a blue circle on Aevo will be airdropped. Traders who have staked at least 101 AEVO tokens and using the pre-market functionality can accumulate units of the token in question.

The number of tokens received during the airdrop depends on the trading volume and AEVO staked. Different third parties also allow you to maximize your earnings:

- Silver third: Boost x1;

- Third party gold: Boost x1.5;

- Third-party Platinum/Diamond: Boost x5.

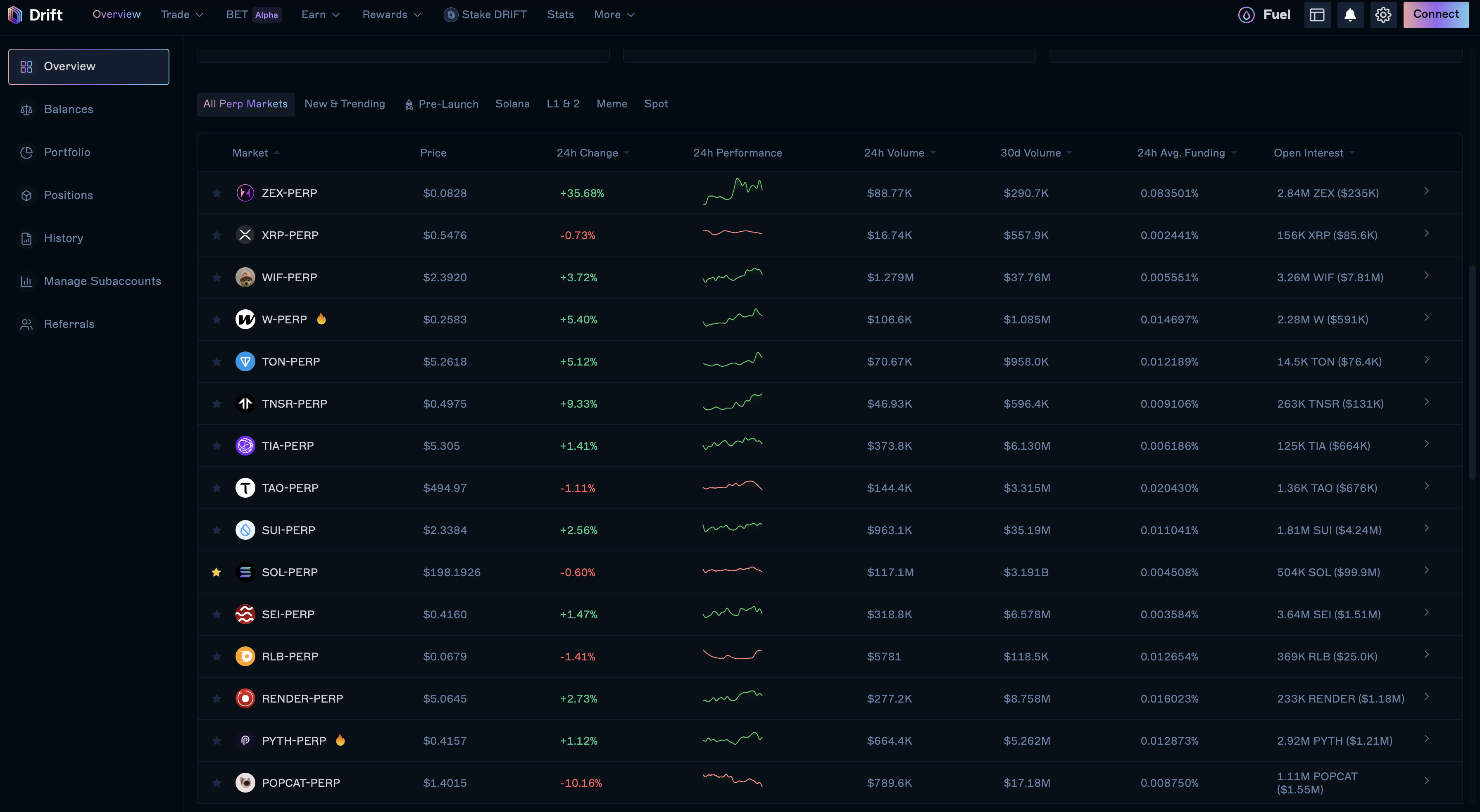

Drift

Drift is a decentralized perpetuals exchange platform available on the Solana blockchain. Drift also offers pre-market crypto trading on Solana.

To use Drift's pre-market functionality, traders must use a sub-account that meets the following conditions:

- No loan or perpetual position must be opened;

- Profits must be fully claimed and losses must be fully paid.

Gains and losses made on Drift are denominated in USDC. To protect users from market manipulation, the platform uses an oracle to set a maximum price, thus limiting the risks of liquidation in the event of strong increases. Once the TGE takes place, the token automatically moves from the pre-launch market to the perpetual market.

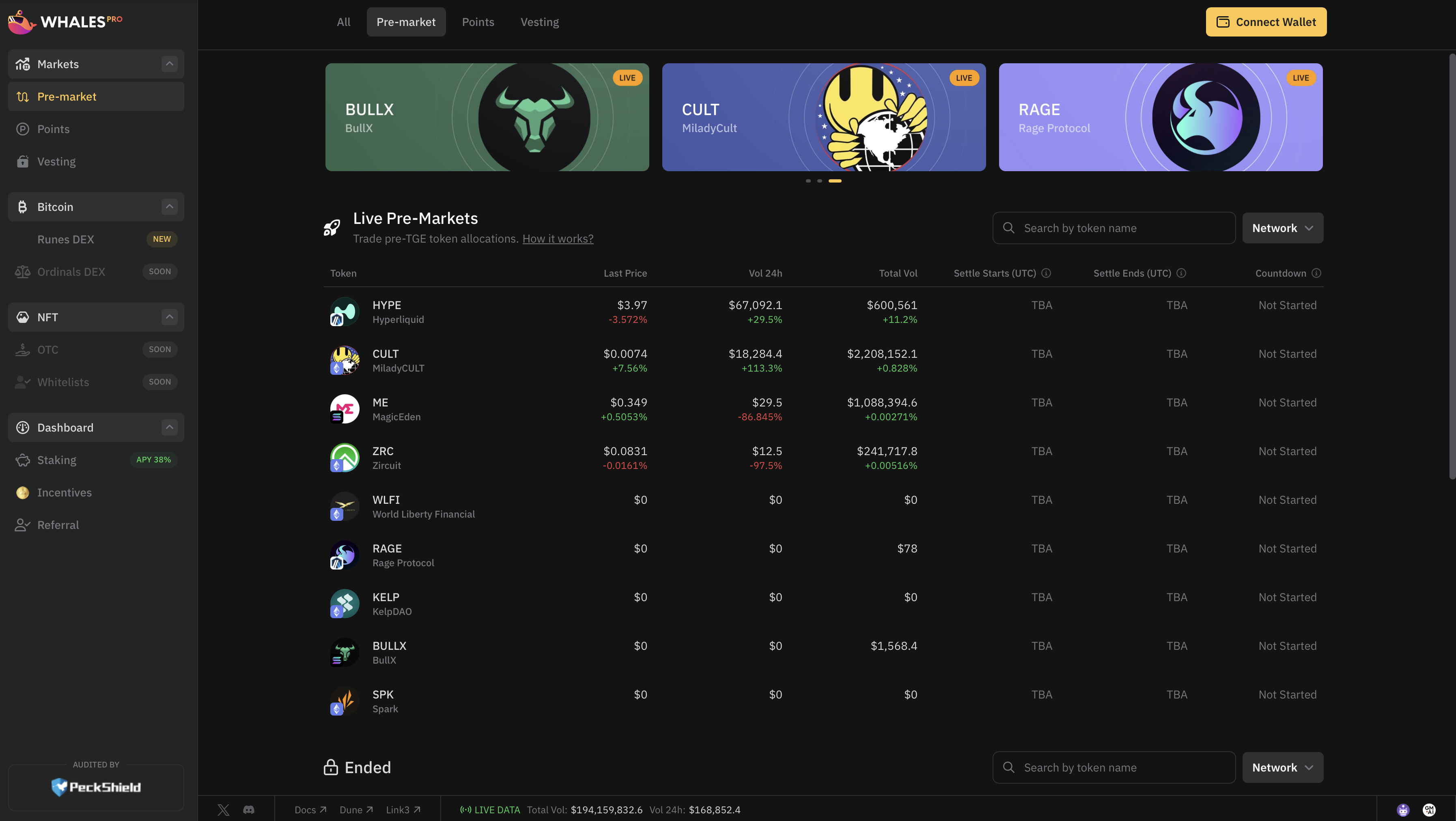

Whale Market

Whales Market is a decentralized platform dedicated to pre-market trading, designed to democratize access to this market while reducing the risk of scams, common in over-the-counter (OTC) transactions.

Whales Market allows you to buy and sell token allocations via two options:

- By responding to a sale offer to buy;

- By creating a purchase offer to sell.

Users can use the “partial fill” function to partially respond to a sale offer or “single fill” to acquire it in full. Purchase offers may be closed before being fully fulfilled, allowing the seller to recover any remaining funds.

Once the tokens are issued on the spot market, a period of 24 hours begins, during which sellers recover their locked-in collateral, while buyers receive their tokens. If a seller fails to meet this deadline, the buyer can cancel the order and recover its funds, taken from the seller's collateral.

Don't miss the bullrun, join our experts on Cryptoast Academy

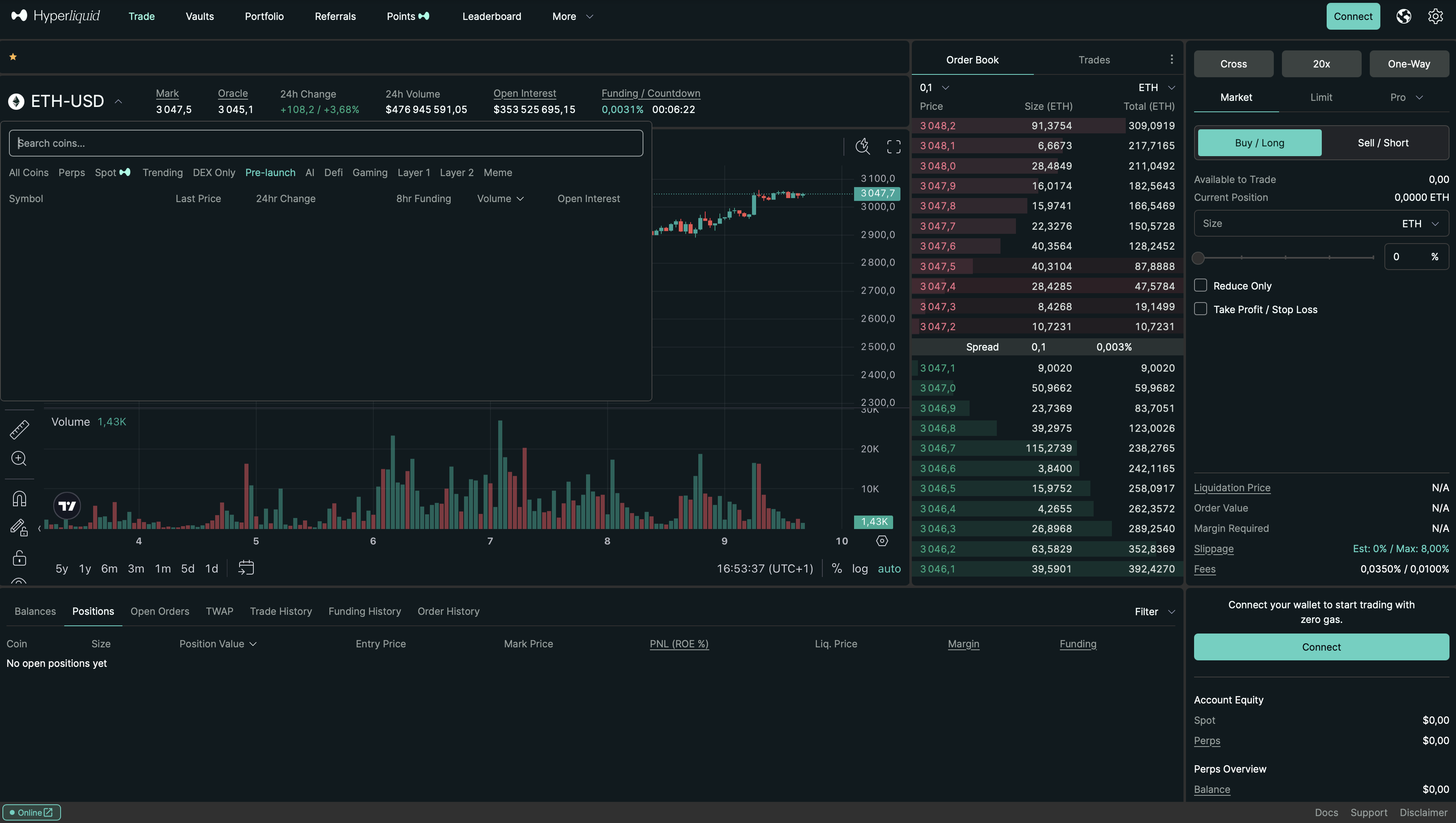

Hyperliquid

Hyperliquid is a decentralized exchange platform specializing in the trading of perpetuals, deployed on its own eponymous blockchain. Hyperliquid also offers a module pre-launch dedicated to pre-market trading.

At the end of the pre-market phase, when the tokens become available on the market, they are automatically converted into perpetual contracts. Funding rates, essential for adjusting positions between buyers and sellers, are updated every 8 hours.

Try Hyperliquid: a decentralized trading platform!

The 2 bestcentralized crypto pre-market platforms (CEX)

Centralized crypto pre-market platforms allow you to purchase cryptocurrencies before their official listing, directly from a user account that is easier to use than a decentralized wallet, and on a regulated platform. Unlike decentralized platforms, centralized platforms require identity verification (KYC). In France, the only platforms with PSAN status and offering crypto pre-market are Binance and OKX.

Binance

Binance is the most widely used cryptocurrency exchange in the world thanks to its many advanced features, including pre-market trading.

Binance's pre-market trading functionality is complementary to Launchpool, allowing users who have obtained tokens via BNB staking to sell them before their official listing on the spot market. However, participation in the Binance Launchpool is not a requirement to benefit from pre-market trading.

Open an account on Binance, the world's #1 crypto platform

For each token, Binance provides purchase limits per user, but no sales limit is imposed. Once the pre-market phase is completed, Binance activates deposits and transfers and the token is available on the spot market.

Here are the main advantages of pre-market trading on Binance:

- Buy tokens before they are available on the spot market;

- Complementary functionality to Launchpool, but accessible to everyone;

- High liquidity, guaranteeing fast and uninterrupted transactions;

- No additional fees compared to standard spot trading;

👉 Find our full review on Binance

OKX

OKX is one of the most widely used centralized exchange platforms. OKX offers a pre-market trading functionality with relatively conservative conditions, aimed at protecting its users.

Here are the main features of pre-market trading on OKX:

- Leverage is limited to x2 and positions are capped at $10,000;

- Trading is only done on isolated margins;

- The price of the token is determined by supply and demand;

- Trading pairs are in USDT, to guarantee high liquidity.

The cryptos available in pre-market on OKX are not systematically listed on the spot market after the total issuance of the tokens (TGE), and in cases where they are not, the contracts are likely to be delisted upstream .

Pre-market trading: definition

Pre-market trading allows you to buy cryptocurrencies, but also to sell them, before the issue of their tokens (Token Generation Event, or TGE) and their official listing on the exchange spot market. Pre-market trading is carried out via perpetuals which allow you to speculate on the rise or fall in the price of a cryptocurrency.

Although the pre-market offers the opportunity to acquire tokens at prices often lower than post-listing, it also presents increased risks given the particularly high volatility of tokens during this phase.

With the emergence of dedicated platforms, pre-market trading is now accessible to a wider audience and is no longer reserved for experienced traders or restricted circles. In addition, pre-market platforms make it possible to further structure over-the-counter transactions, which are now traceable and benefit from better liquidity.

Don't miss the bullrun, join our experts on Cryptoast Academy

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital