What links unite China and Bitcoin? Between the bursting of the real estate bubble, youth unemployment and sluggish consumption, the Chinese macroeconomy is going through major turbulence. Find out how these challenges are prompting Chinese investors to turn to Bitcoin, and why China could play a key role in the bull run.

China, a key macroeconomic player

In recent years, China has risen to the rank of the world's leading economic powers, the latter now weighing considerable weight on the dynamics of international financial markets.

At the same time, the cryptocurrency market, and more particularly Bitcoin, has experienced a phase of very strong growth in recent months, commonly known as a “bull run”.

Faced with these 2 significant trends, it is natural to wonder about the potential links that may exist between the Chinese macroeconomic situation and the evolution of the price of Bitcoin.

👉 Which country has the most Bitcoin?

In this article, we will analyze this intriguing correlation in detail. We will begin by examining the major challenges currently facing the Chinese economy, before examining how they may influence the attractiveness of Bitcoin in the eyes of Chinese investors.

Finally, we will look at indicators that seem to suggest a significant influence of the Chinese market on the price of Bitcoin.

China faces major macroeconomic challenges

Despite its dominant position on the global economic scene, China is currently facing several major challenges that are weakening its growth model.

The bursting of the real estate bubble: a systemic crisis with serious consequences

One of the main concerns is the bursting of the real estate bubble that formed in China over the last few years. This bubble, fueled by years of rampant speculation and unwavering government support, eventually burst, leading to serious consequences for households, banks and real estate developers.

🏠 Discover our presentation of RealT, the platform that makes real estate accessible thanks to blockchain

The origins of this bubble date back to the rapid urbanization experienced by China, combined with policies favorable to the real estate sector on the part of the authorities. For years, real estate prices have soared, reaching levels completely disconnected from economic fundamentals. When the bubble finally burst, the impact was devastating, with prices falling sharply and numerous failures in the sector.

The Chinese government has attempted to stabilize the market through various measures, such as the so-called three red lines », imposing stricter debt ratios on promoters. But these interventions have had only a limited effect so far, and the crisis continues, weakening the entire Chinese economy.

RealT: invest in real estate from $50

Weak consumption and youth unemployment: a brake on growth

Furthermore, the Chinese economy is struggling to sustainably stimulate domestic consumption, partly because of the decline in household purchasing power and widespread economic uncertainty. Moreover, youth unemployment reaches particularly high levels in Chinawhich aggravates socio-economic tensions.

These factors contribute to creating a climate of concern among the population, pushing many Chinese to turn to investment alternatives, such as Bitcoin, to preserve their savings in the face of the erosion of the yuan and the bleak economic outlook.

Bitcoin, a safe haven in the face of Chinese economic turbulence

In this context of crisis, Bitcoin is increasingly appearing as an interesting option for Chinese investors keen to secure their savings.

Download Bitstack and earn €5 in Bitcoin with code CRYPTOAST5*

* After activating a savings plan and accumulating at least €100 in BTC purchases

Capital flight and the search for stability: fertile ground for Bitcoin

The devaluation of the yuan and strict capital controls implemented by the Chinese government are prompting many investors to seek assets outside the traditional financial system. Bitcoin, due to its decentralized nature, its resistance to censorship and its potential for capital preservation, represents an attractive alternative in this regard.

👉 Everything you need to know about Bitcoin and its properties

Despite government restrictions, the Chinese have developed ingenious methods to access Bitcoin. They use over-the-counter (OTC) exchange platforms, which allow them to circumvent controls, as well as VPN networks to hide their activities.. These solutions, although sometimes complex to implement, demonstrate the existing demand for Bitcoin among Chinese investors.

Analysis of Bitcoin price movements on the Asian market: an indicator of Chinese influence

The evolution of Bitcoin prices during trading hours in Asia seems to be a good indicator of the importance of Chinese demand in this market.

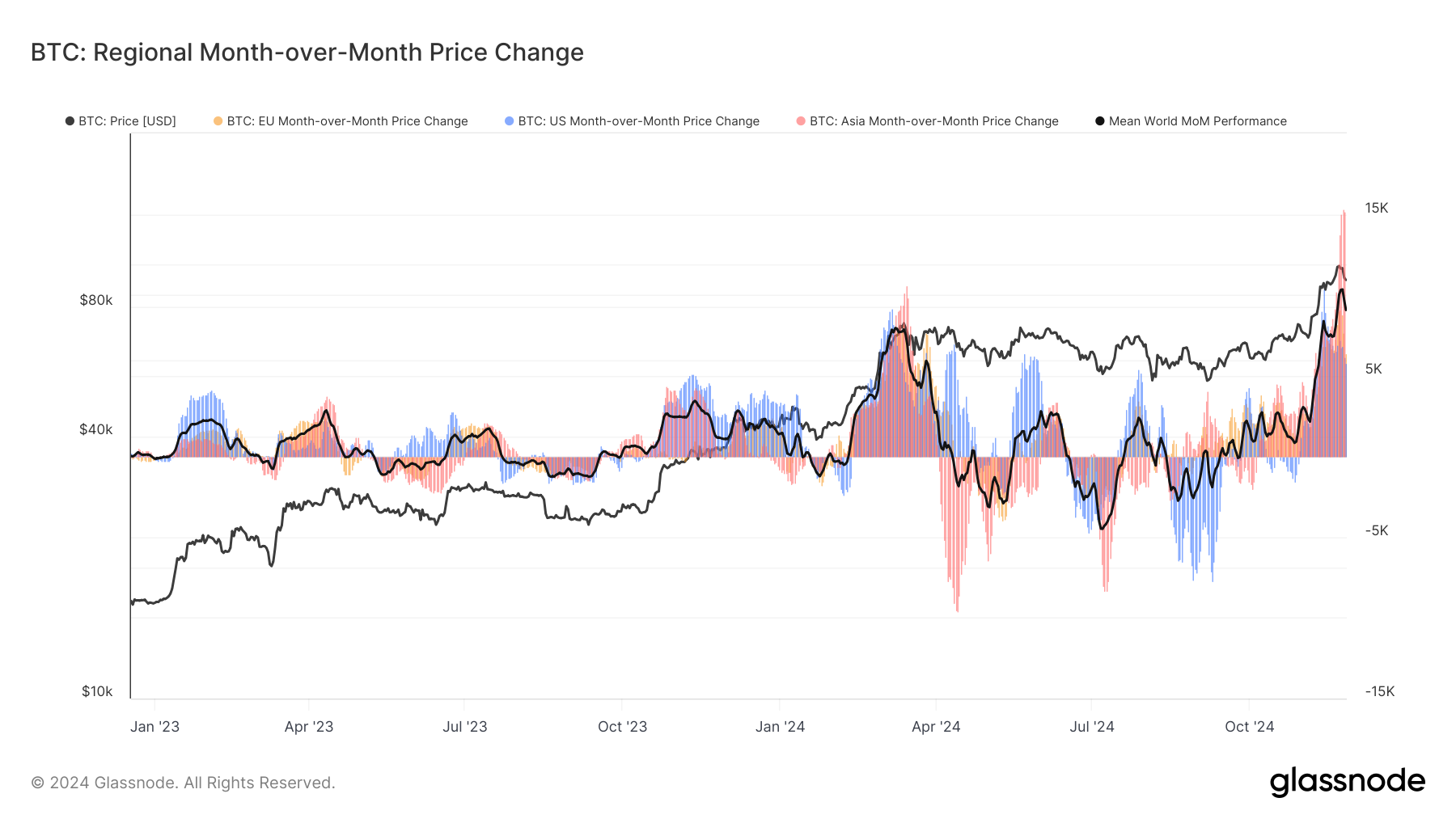

As shown in the picture below, Asian trading sessions have shown particularly positive performance in recent months, including when other regions saw more mixed results :

Changes in the price of Bitcoin depending on the geographical area

Changes in the price of Bitcoin depending on the geographical area

This indicator reveals the 30-day change in overall regional prices during working hours in Asia, North America or Europe.

The calculation is done in 2 steps: price movements are first allocated to regions based on time zones, then regional prices are determined by calculating the cumulative sum of price variations in the time allocated to each region. This provides insight into the monthly trading session performance for each geography.

Interestingly, we observe that since October-November, all regional sessions are unanimously positive, suggesting that demand across markets is significant. It would therefore seem, in view of this data, that Asian investors, and in particular Chinese, play a preponderant role in this upward dynamic..

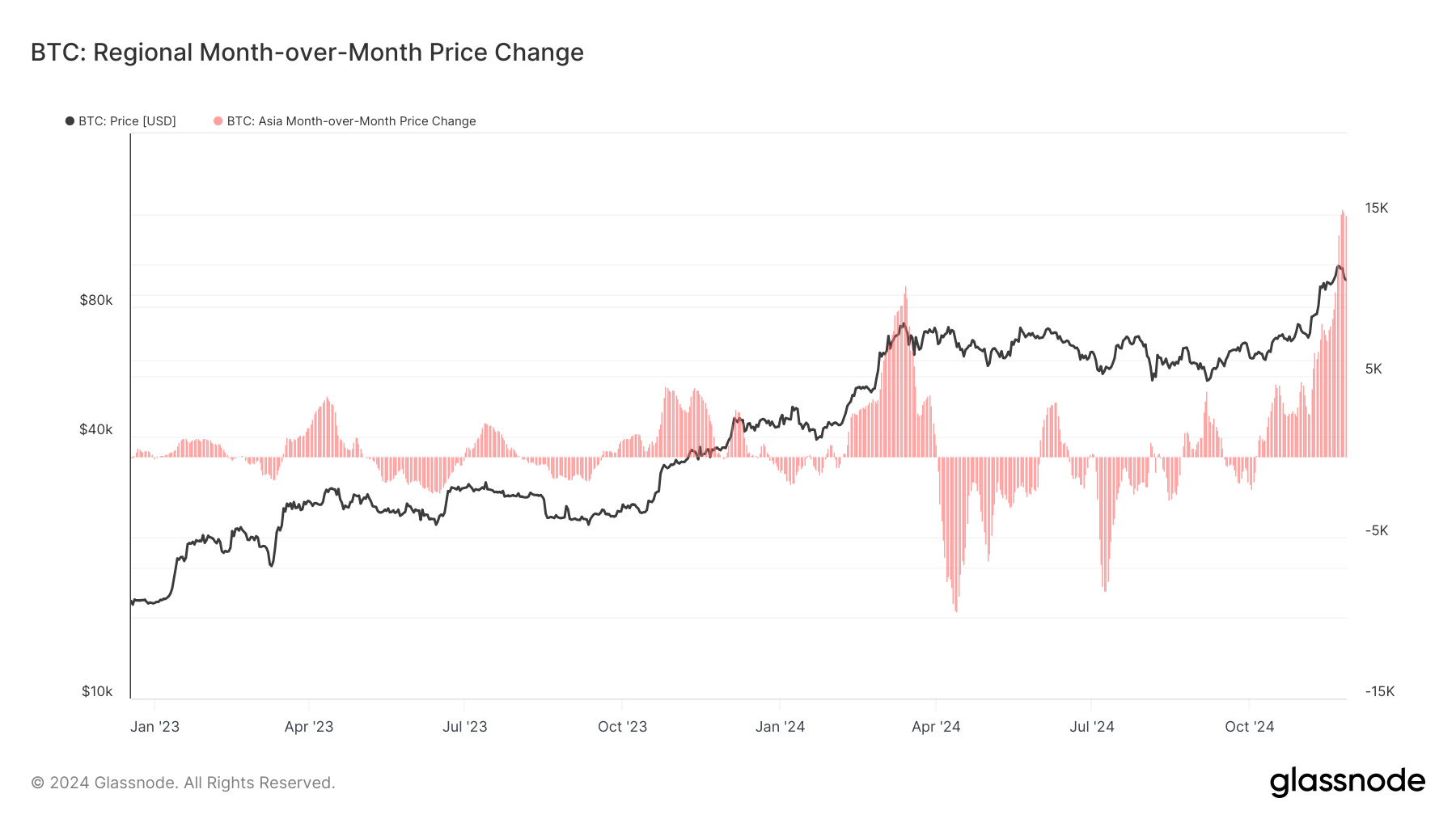

The image below confirms this hypothesis, highlighting that the monthly price variation of Bitcoin in the Asian market is often higher than the global average :

Evolution of the price of Bitcoin by isolating Asian data

Evolution of the price of Bitcoin by isolating Asian data

This supports the idea that China exercises a major influence on the price of Bitcoin, with a significant part of the demand coming from this country.

However, although Hong Kong-listed Bitcoin ETFs offer another investment opportunity, their accessibility remains limited for Chinese investors due to government restrictions.. This reduces their direct impact on the price of Bitcoin, to the benefit of other investment channels used by Chinese investors.

Trade Republic: Buy Cryptos and Stocks in 5 Minutes

China, a potential driver of the bull run for Bitcoin

In summary, the difficult macroeconomic situation that China is going through, characterized by the bursting of the real estate bubble, weak consumption and high unemployment, seems to encourage many Chinese investors to turn to Bitcoin as a safe haven.

This translates into sustained demand in the Asian market, as evidenced by the remarkable performance of trading sessions in this region.

It is therefore essential to carefully monitor developments in the Chinese economic situation and the monetary policies implemented by the government, because they could have a direct impact on the dynamics of the Bitcoin market. If China persists in both its monetary stimulus and financial asset support efforts, she could become a major driver during this bullrun.

In this context, it will be essential to continue to analyze the price movements of Bitcoin, in particular by focusing on the differences in performance between different geographic areas. Particular vigilance should be paid to indicators suggesting a preponderant influence of Chinese investorssuch as price changes during Asian trading sessions.

👉 Discover our opinion on the best sites to buy Bitcoin

Beyond purely technical considerations, it will also be necessary to keep in mind that the macroeconomic situation in China, with its fragilities and uncertainties, could have profound repercussions on the future development of the Bitcoin market. Close monitoring of these complex dynamics, which evolve according to announcements from the Chinese government, will therefore be essential to anticipate future movements in the price of Bitcoin.

Finally, let us point out that according to Changpeng Zhao, the founder of Binance, China may already be accumulating Bitcoin in great secrecy. A plausible theory but which will be difficult to confirm due to the usual opacity of the Chinese government.

We thank Prof. Chaîne for the graphics presented in this article, which were an essential resource for structuring and strengthening the arguments developed.

You can find it every week on Cryptoast Academy for exclusive analyzes 👇

Don't miss the bullrun, join our experts on Cryptoast Academy

Source: Article by Arthur Hayes

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital