The United States Federal Reserve has unveiled its monetary and macroeconomic action plan for the year 2025. Inflation, employment, economic growth, interest rates, neutral rate, Vincent Ganne reviews the Fed's new expectations. What is the monetary framework that awaits the price of Bitcoin in 2025?

The Fed reveals hawkish monetary positioning

The Fed therefore lowered the US federal funds interest rate to 4.5% and revealed its macroeconomic projections for the year 2025 as well as its forecasts for its own key interest rate. Jerome Powell has sharply moderated his optimism for disinflation in 2025 following the slight overheating of inflation in the last quarter of 2024.

📈 To get my daily trading opinion on the Bitcoin price, join me on Cryptoast Academy!

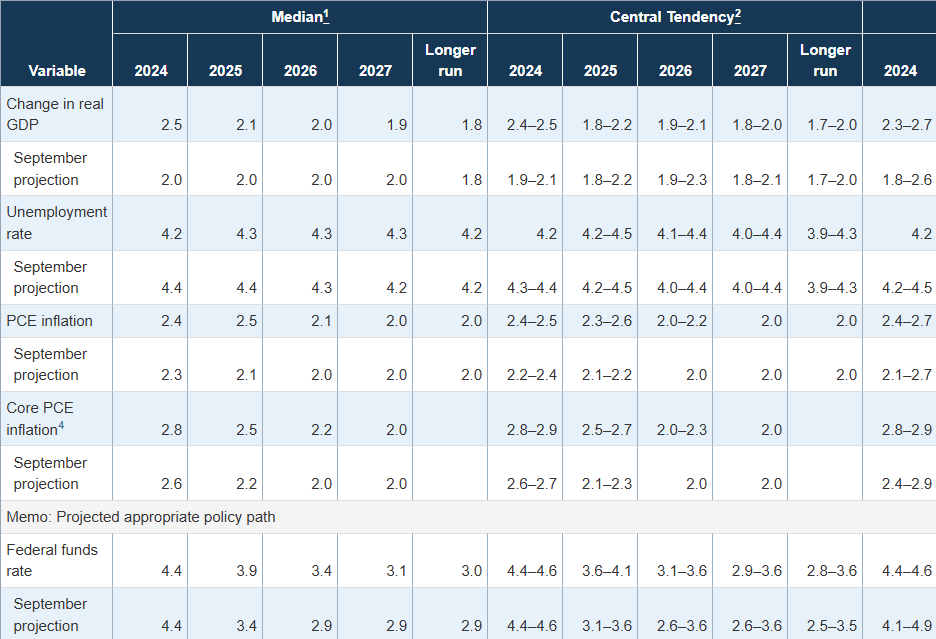

Here is what to remember from the prospective monetary framework for the year 2025.

- Federal Funds Interest Rate: the Fed is considering only 2 rate cuts for the year 2025 with a pause at the start of the year, the time to obtain confirmation of the resumption of disinflation in the United States;

- Neutral rate : the Fed did not confirm its so-called neutral interest rate at 2.9%, increased it to 3% and does not plan to reach it before 2027;

- PCE inflation: the 2% target has been confirmed but should not be reached before 2027, compared to the end of 2025 previously. Much reduced confidence for nominal and underlying disinflation, probably cautious forecasts pending the effects of the Trump Administration's action;

- Unemployment rate : the alert threshold is lowered to 4.3% of the active population, and the Fed still estimates that the labor market will remain solid, as will its anticipation of real economic growth in the United States.

🕐 Is it too late to invest in Bitcoin?

This double prospective monetary/macro framework is more difficult to the upward trend of risky assets on the stock market in terms of interest rates but from the point of view of economic growth, it should continue to accompany the bull run of Bitcoin, the latter expected to find its final high point during the year 2025.

Table showing the new macroeconomic projections from the United States Federal Reserve (FED)

Bitpanda: receive €50 bonus in BTC by creating an account

Bitcoin, corrections are always opportunities in the initial phase of bull run

The price of Bitcoin reacted significantly to the Fed's latest annual monetary policy decision. In the wake of Jerome Powell's press conference, BTC retraced and stabilized on support at $100,000.

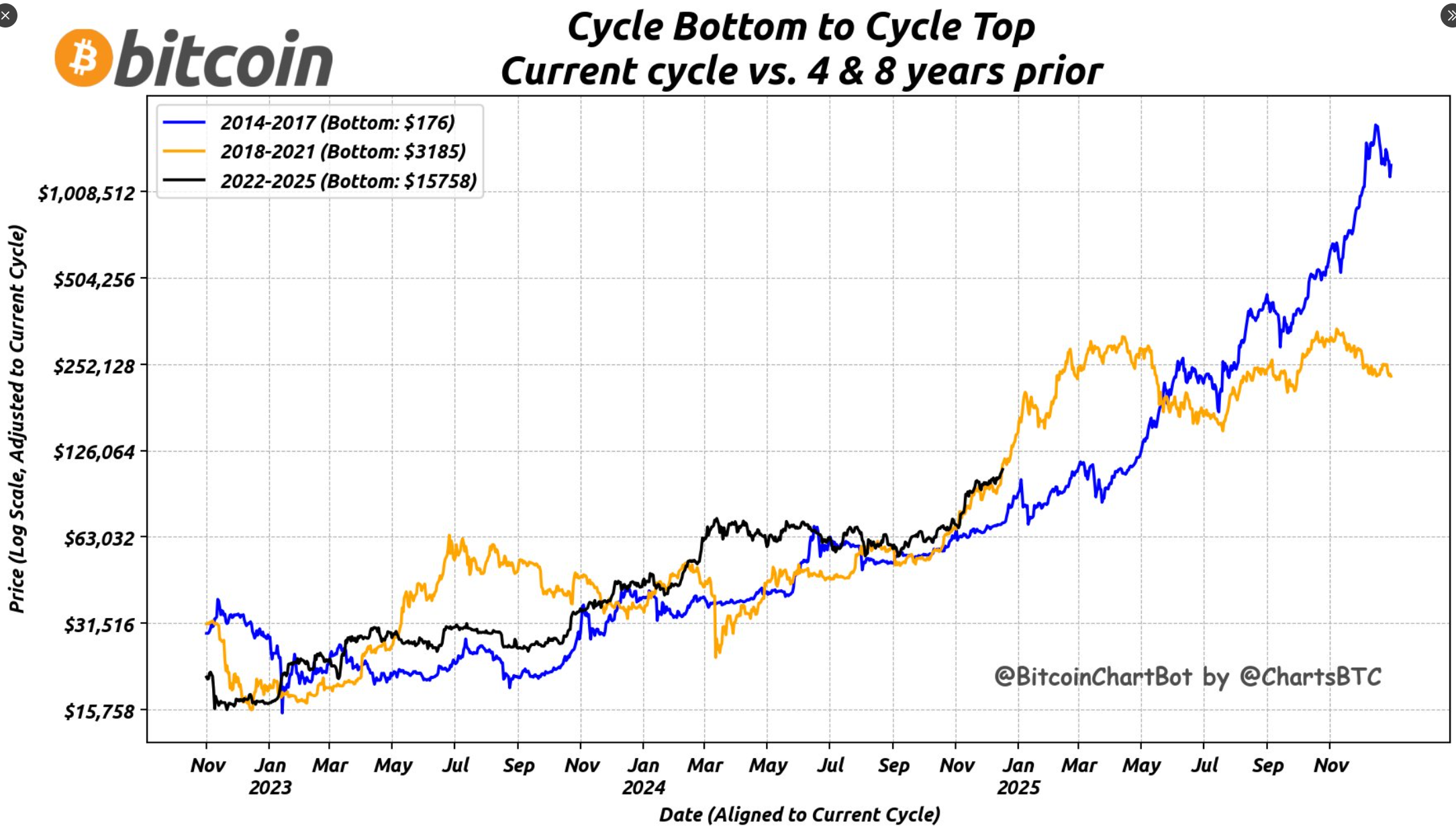

It is interesting to note that if the repetition of cycles on a calendar basis is confirmed (comparison with the 2 previous cycles, that of 2016 and that of 2020), then the market could rebound at the end of December once the dust linked to the announcements of the Fed will have fallen back.

If the support at $100,000 gives way, the retracement will extend to $90,000/$92,000, before the rise resumes.

Chart which proposes a “cycle repeat” approach by comparing the current cycle with the 2 previous cycles on a calendar basis adjusted to the current cycle

Chart which proposes a “cycle repeat” approach by comparing the current cycle with the 2 previous cycles on a calendar basis adjusted to the current cycle

Bitpanda: receive €50 bonus in BTC by creating an account

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital