MicroStrategy continues its investments in Bitcoin. With 5,262 BTC added to its holdings, the company further confirms its bold strategy of massive exposure to the currency, an approach that inspires more and more institutional players to follow suit.

Buying more and more Bitcoins is Michael Saylor’s strategy

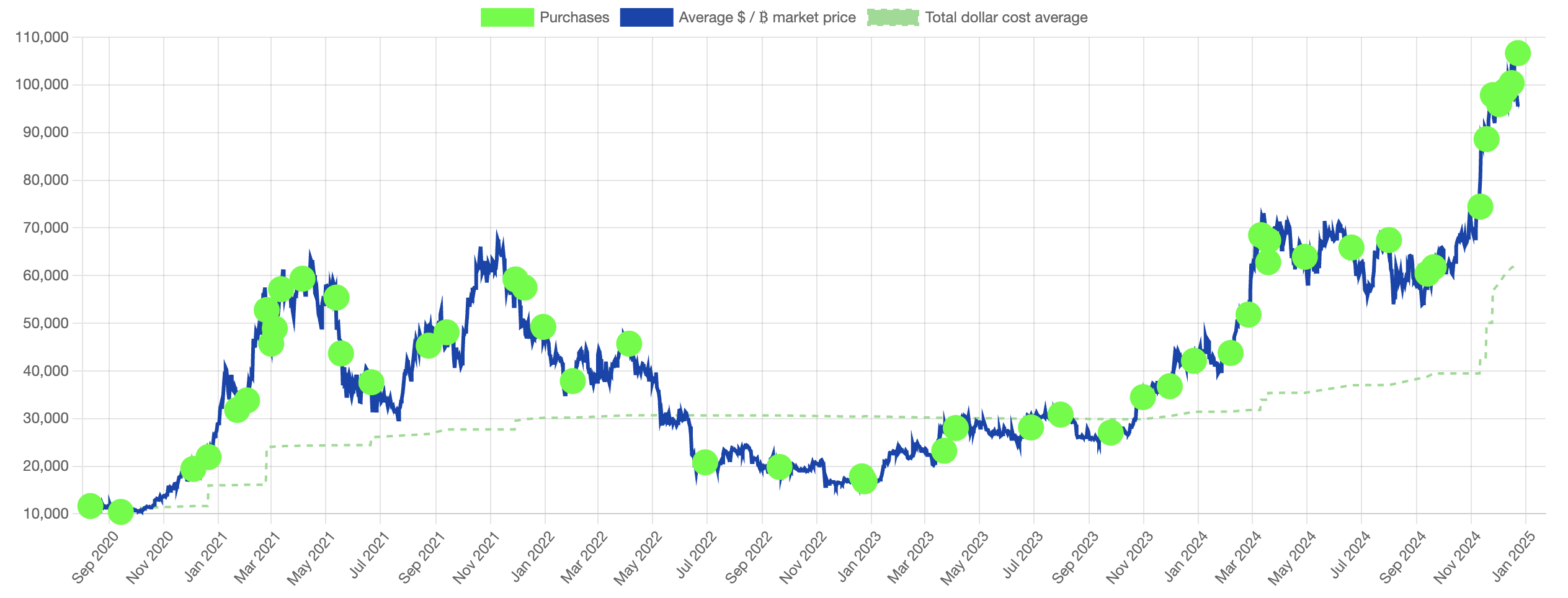

Since 2020, MicroStrategy, a US company specializing in business intelligence, has invested heavily in BTC. This strategy made its actions an indirect way for investors reluctant to use the Bitcoin blockchain to gain exposure to changes in the price of BTC without directly owning it.

Today, the company is primarily recognized for its commitment to the Bitcoin ecosystem, a strategic choice that has relegated its core activities to the background.

👉 Have you ever wondered: Who has the most Bitcoins? Discover our top 10 entities richest in BTC

Today, as MSTR stock joins the Nasdaq 100, Michael Saylor, CEO of MicroStrategy, announced the acquisition of an additional 5,262 Bitcoins for a total amount of $561 millioncorresponding to an average price of $106,600 per unit.

BTC purchases by MicroStrategy since 2020

Now MicroStrategy owns 444,262 Bitcoins, worth an estimated $42.2 billionthus realizing a capital gain of 14.5 billion dollars.

Download Bitstack and earn €5 in Bitcoin with code CRYPTOAST5*

* After saving for €100 of BTC purchase

The risks of such a concentration of BTC

In addition to MicroStrategy's performance, the launch of spot Bitcoin ETFs in the United States has significantly amplified interest in BTC.

This growing adoption has encouraged many companies and institutions to position themselves on the currency, including MetaPlanet, a Japanese company active in finance and real estate. Likewise, several American pension funds have followed this strategy, testifying to the growing influence of Bitcoin in the institutional and financial sectors globally.

📰 Also read in the news – How will Europe monitor your crypto transactions from December 30 with TFR?

Thus, between MicroStrategy, ETFs, governments and institutions, more than 3 million Bitcoins are held by a few players, representing nearly 15% of the total supply of BTC in circulation.

This concentration may raise concerns, as it gives these entities significant leverage over the price of Bitcoin, with the possibility of coordinating their actions to disrupt its stability.

Additionally, MicroStrategy's acquisitions were made largely with borrowed funds, which could force the company to liquidate its holdings in the event of a sharp drop in the price of BTCin turn leading to strong downward pressure.

However, one of Bitcoin's greatest strengths lies in game theory. This suggests that, if an actor tries to take control of the network, its opponents will also seek to position themselves there, strengthening in spite of themselves its decentralization and its neutrality.

This dynamic is particularly visible in 2024. While at the start of the year, Donald Trump and certain influential companies spoke about BTC, at the end of the year, geopolitical opponents of the United States, like Russia and other BRICS member countriesalso began to take an interest in it.

Ledger: the best solution to protect your cryptocurrencies 🔒

Sources: MicroStrategy, SaylorTracker

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital