After the excitement of memecoins, the Solana blockchain faces challenges. Declining income, evolution of transactions… What are the signals to watch for the future of this ecosystem? Discover in this article an in-depth analysis of the data and insights for Solana.

Is the Solana blockchain in free fall?

After several months of excitement around memecoins, a phenomenon which particularly benefited the Solana blockchain, the hype seems to have dissipated (for the moment).

Indeed, following the election of Donald Trump as President of the United States, “dinocoins” captured a large part of the attention of the crypto community by displaying exceptional performances. The explosion of most of these cryptos is linked to an anticipation of more flexible regulations regarding them.

This anticipation gave a new lease of life for the altcoin sector in generalthus diverting the attention that was mainly focused on memecoins at that time. However, the loss of interest in the memecoin sector has also caused FUD on the native token of the Solana ecosystem, SOL.

Since SOL briefly reached its all-time high (ATH) at $265, it has been in a downtrend channel for 28 days :

SOL price in daily data

SOL price in daily data

The price of SOL has thus corrected by around 34% since its ATH.

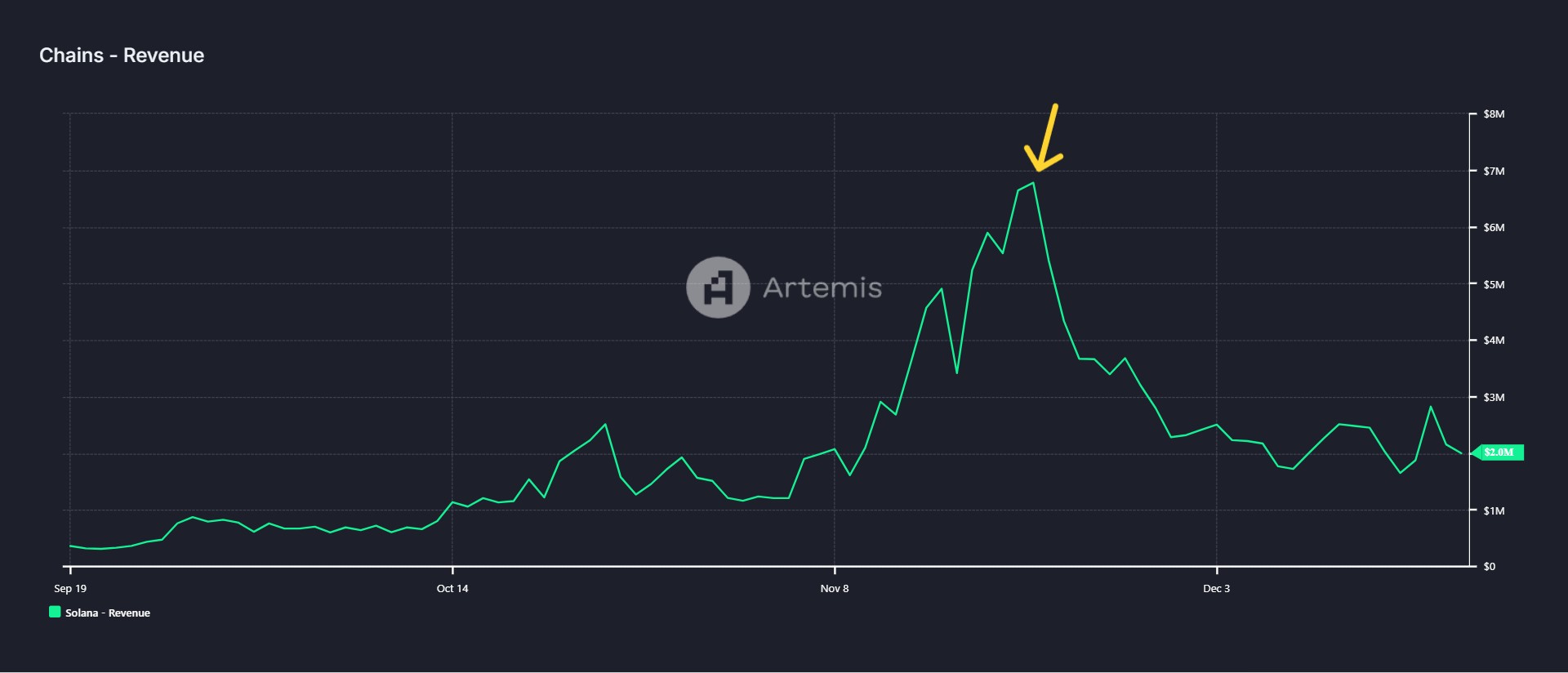

Beyond the simple price of Solana’s cryptocurrency, Blockchain revenues have dropped drastically since November 21 :

Solana blockchain revenues for the last 3 months, with the yellow arrow indicating the ATH of its revenues (November 21)

So, the reduction in hype around memecoins materialized in a fall in the price of SOL and a drastic reduction in revenues from the Solana blockchain.

In this article, we will first look at on-chain data from the Solana blockchain to try to determine whether the network is only temporarily losing speed or whether contextual changes are having a more profound impact on Solana. Secondly, we will discuss the fundamental changes to come for the Solana ecosystem, as well as the promising projects that are developing there.

Reserve your plot now

Advertisement

The health of the Solana blockchain from an on-chain perspective

First, let's look at the recent evolution of Total Value Locked (TVL) within Solana. This metric generally represents in a relevant way the overall health of a project.

Chart representing the TVL of the Solana blockchain over the last 3 months, with the yellow arrow indicating the date November 21 (8.7 billion TVL)

As we can observe in the graph above, Solana's TVL continued to increase despite the decrease in interest around the memecoin sector. Thus, we can assume that blockchain attracts capital on a regular basis, beyond just the memecoin sector.

To note

The recent drop in TVL can be attributed to the crypto market as a whole, which has been showing particularly high volatility over the past few days.

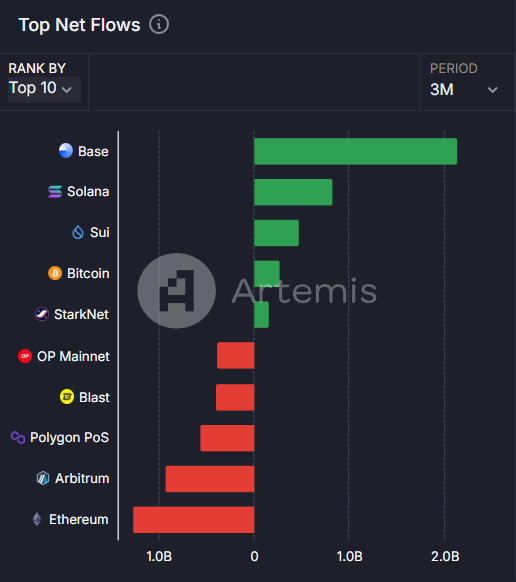

This hypothesis can be confirmed by observing the net capital flows on the Solana blockchain:

Net capital flows on various blockchains

Net capital flows on various blockchains

Over the past 3 months, the Solana blockchain has recorded $828 million in net flowsthus placing it in 2nd position in this metric behind layer 2 Base. If we reduce our field of observation to the last 30 days, i.e. since the drastic drop in network revenues, the net flows still amount to $329 million.

With more than a third of net capital flows recorded in the last 30 days over a 3-month period, this data demonstrates that investors continue to be interested in the Solana blockchain.

👉 Discover our top 5 of the best platforms to buy SOL

As we can see in the 2nd graph, revenues from the Solana blockchain have dropped drastically since November 21. Let us now observe the evolution of volumes on decentralized exchanges (DEX):

Chart representing volumes on Solana DEXs, with the yellow arrow indicating the date November 21

Chart representing volumes on Solana DEXs, with the yellow arrow indicating the date November 21

From this graph we can see that despite the drop in revenue on Solana, volumes on DEXs never fell below the acceleration zone that they experienced at the beginning of November.

Thus, we can establish a certain retention of cryptocurrency exchanges on Solana DEXs despite less hype in the memecoin sector.

🤖 What is an AI agent and what is its role in crypto?

From the perspective of daily active addresses on Solana, they do not show a clear decline. As for daily transactions, they continue to increase:

Graph representing the number of daily transactions on the Solana blockchain

Graph representing the number of daily transactions on the Solana blockchain

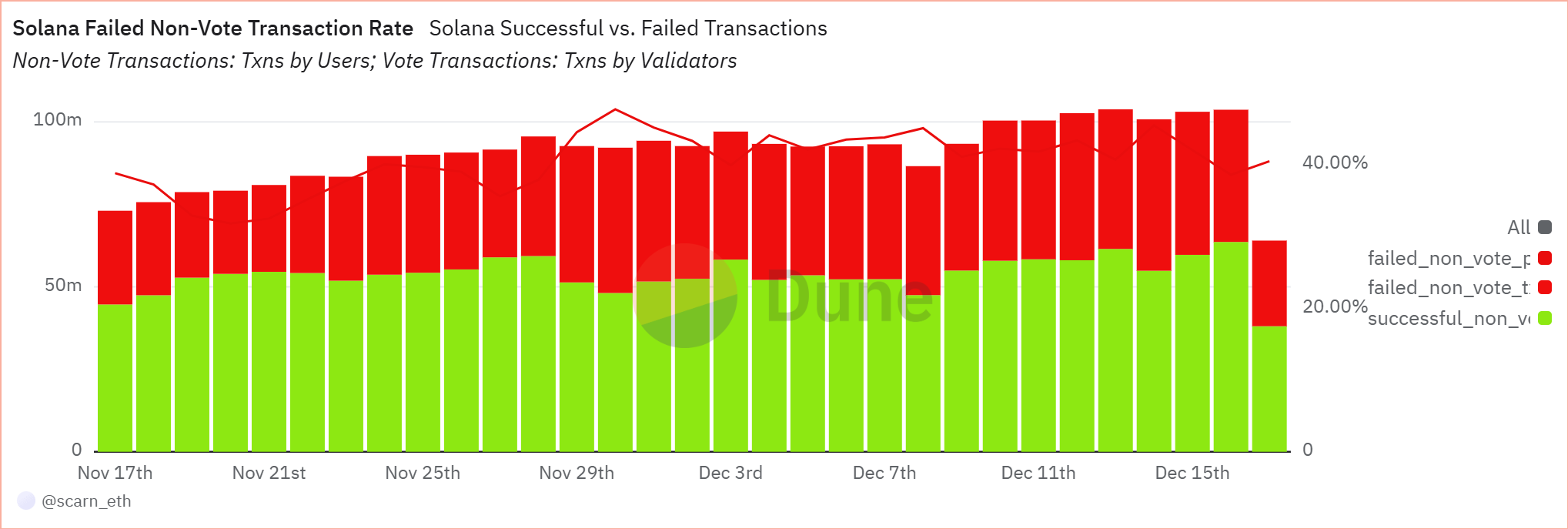

Although the number of daily transactions demonstrates strong activity on the Solana blockchain, this data must be put into perspective. Indeed, it is common knowledge that a large number of bots are present on this blockchain and that many transactions are rejected:

Graph representing the rate of rejected transactions on the Solana blockchain

So, almost 40% of transactions are rejected on the Solana blockchain. To summarize our chapter focused on the observation of Solana's on-chain data, we were able to demonstrate that the network shows great resilience despite the recent drop in revenue and the loss of value of the SOL.

🗞️ Pre-order our newspaper n°5 with exclusive content, including Cryptoast21

Solana from a fundamental point of view

Beyond on-chain data demonstrating a certain resilience in the activity present on the blockchain, numerous projects with interesting fundamentals are being developed on Solana.

For example, already proven projects have decided to deploy on the Solana blockchain to benefit from its intrinsic capabilities: high scalability and generally low transaction fees.

Among these, we can cite Render, a decentralized graphics rendering project using blockchain. We also find Maker, a major project in the decentralized finance (DeFi) sector and Helium, a project aiming to develop a decentralized internet/telephone network.

In addition, projects such as Hivemapper have great ambitions by directly competing with GAFAM with its mapping solution similar to Google Maps.

Discover Cryptoast Academy's analysis on Hivemapper by joining the community 👇

Don't miss the bullrun, join our experts on Cryptoast Academy

Advertisement

From the point of view of future technical improvements on the Solana blockchain, we can mention Firedancer, a scalability solution in development or SOON, a network extension acting on top of the main blockchain.

So, although Solana already has significant scalability, numerous projects aimed at improving it are under development and could allow Solana to continue to shine by offering a solution adapted to many use cases.

Outlook for the Solana blockchain

As we have been able to see through this article, in particular by observing numerous on-chain data, The Solana blockchain is not in danger following the disinterest of the memecoin sector. On the contrary, the ecosystem seems to have taken advantage of this period by creating a certain retention of its users.

Although the network's revenues have fallen drastically since November 21, many promising projects, coupled with the intrinsic capabilities of the blockchain, can portend a good year 2025 for Solana.

🗞️ Will Hyperliquid be the next target of North Korean hackers?

Sources: Artemis Terminal, Dune

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital