An IPSOS study commissioned by the European Central Bank (ECB) has just been unveiled. We see many aspects of payment studied there, in particular cryptocurrencies. And surprise: France is among the bottom of the class. However, our country is ahead in regulation, and many international crypto companies choose France to set up.

Only 9% of French people own cryptocurrencies

Is France behind on the crypto file? Although we have innovative companies on the subject, it seems that the population is not following. France is one of the countries in Europe where people own the fewest cryptocurrencies.

In any case, this is what we can conclude by reading figures from an Ipsos study commissioned by the European Central Bank : “ Study on consumer payment attitudes in the Eurozone “. Several aspects of payment are scrutinized, such as contactless payments, bank cards, cash or checkbooks.

We see, for example, that cash is still far from disappearing, despite a clear decline in cash payments after Covid-19. For what interests us, cryptocurrencies, two paintings are interesting : the share of cryptocurrency holders by country (figure 1), and the use that these holders make of cryptocurrencies (figure 2).

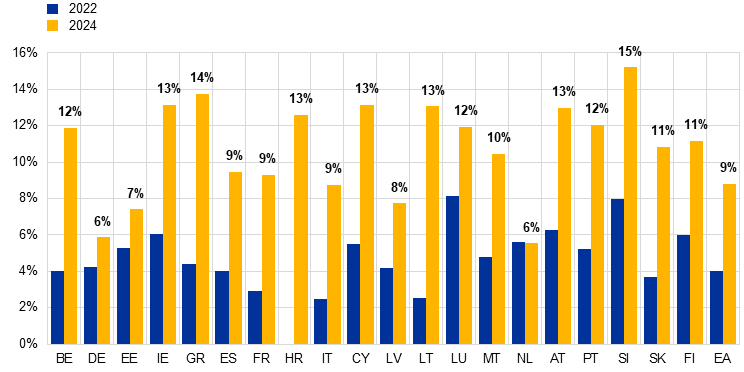

Figure 1: Proportion of population holding cryptocurrencies by country in 2022 and 2024.

However, the situation is slightly better in 2024 than in 2022. At the time, France was second to last with only 3% of crypto holders, barely ahead of Italy at 2%.

🌍 Which countries hold the most Bitcoin?

How to explain such a delay? While many shows and media relay news around cryptocurrencies, the subject remains reserved for a fraction of the population.

The number of people who own cryptocurrencies is an important indicator. The first step to understanding cryptos, bitcoin or DeFi is to participate. Without this, especially in a sector as abstract as digital assets, it is difficult to get an idea.

Moreover, Cynthia Lummis, the fiercely pro-crypto senator from Wyoming, declared that she had fallen into “ rabbit hole » cryptocurrencies after his son-in-law made him buy bitcoin.

Own cryptocurrencies, it is the first step in the evolution of mentalities.

In 2024, only 9% of the French population owns cryptocurrencies, according to this study. An increase of 300% compared to 2022 when this score was 3%. For comparison, they are 6% in Germany, 9% in Spain and Italy, and 15% in Slovenia, the highest number.

The eurozone average is 9% in 2024 and it was 4 in 2022. This proves that there is still a lot of work to be done. Initiatives, like that of Sarah Knafo who defended the idea of a strategic Bitcoin reserve in the European Parliament, must multiply.

Open an account on Binance, the world's #1 crypto platform

France, a country that really uses cryptos?

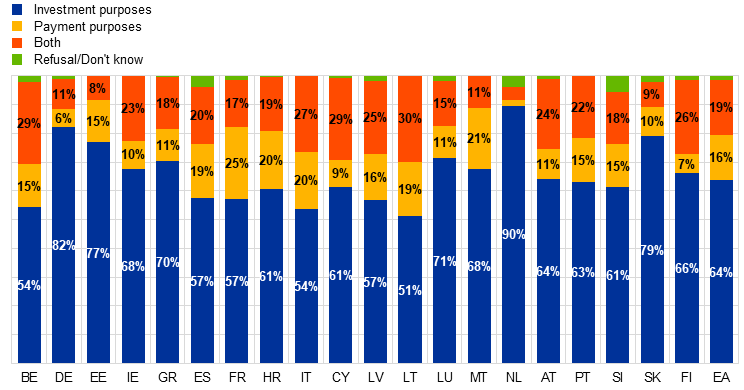

The survey then asked people who reported owning cryptocurrencies “what use do you make of your cryptos?“.

In the Netherlands, 90% of people surveyed say they own cryptos solely to invest.

In Germany, 82% do it to invest, 6% do it to make payments, and 6% for both reasons.

🥇 A US senator proposes to legalize Bitcoin payments!

France is the country with the smallest gap between the two uses: only 57% of those surveyed use cryptocurrencies for purely speculative purposes, and 25% use them only to make payments. This is the highest score in the euro zone.

Figure 2: Use of cryptocurrencies by country in 2024

The results of this study are therefore mixed for France. Certainly, on the one hand, only a small portion of the population owns cryptocurrencies, and the road to democratization is still long.

On the other hand, France is the eurozone country where people use cryptocurrencies the most. This is proof that the work of explanation and evangelization carried out by professionals in the sector for years has not been in vain.

In France, people are not in cryptocurrencies to trade, but to exploit the power of this revolutionary tool. Cocorico!

Coinbase: register on the most famous crypto exchange in the world

Source: ECB

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital