While cryptocurrency prices continue to fall, Bitcoin (BTC) is now reaching a 3 -month lower. Among the elements adding a sales pressure to the market, we can note significant releases on the ETF.

Bitcoin (BTC) continues to fall

It's a difficult week for cryptocurrencies, with capitalization that has lost 12.4 % since Monday. In this context of decrease, Bitcoin (BTC) first broke the level of $ 90,000to continue its breakthrough to pass slightly under 82,000 dollars, before recovering.

When writing these lines, the price of a bitcoin is 85,500 dollars, and the range built in the past 3 months seems to lead to one output from below:

BTC courses in daily data

👨🏫 Take the market with serenity thanks to our experts from Cryptoast Academy

While the assets now undergo a more marked correction of its post-presidential upper American race, it is clear that the news internal to the ecosystem are no longer sufficient to explain price movements, at least since the previous cycle.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

The ETF accuse the blow

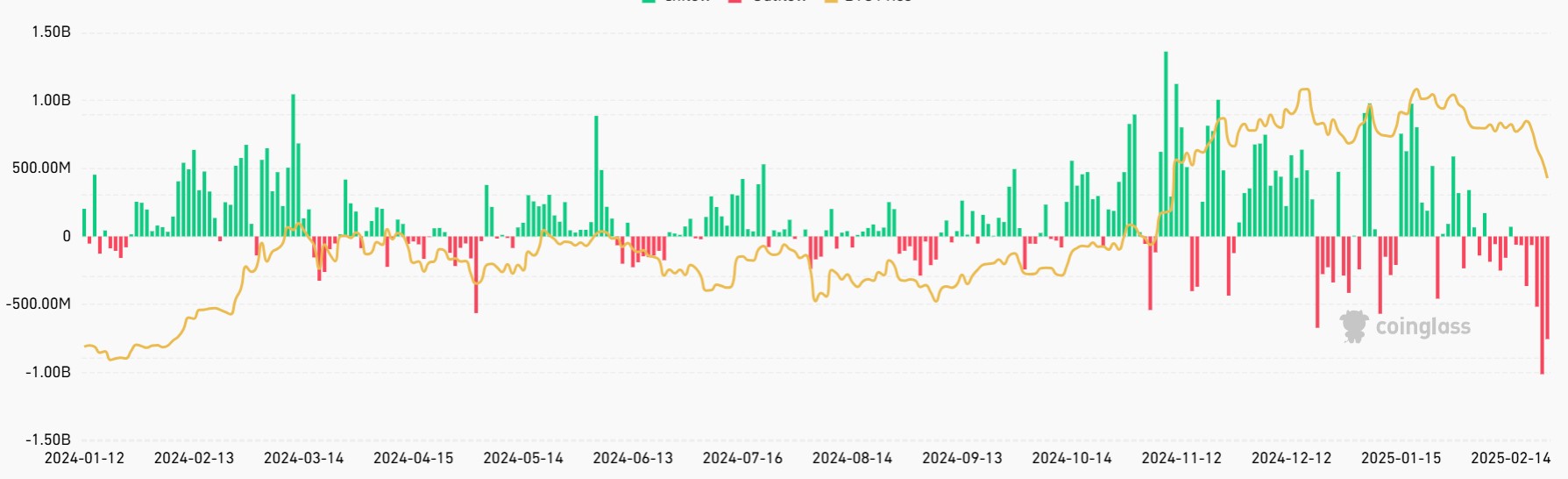

In an uncertain macro-economic climate, these same institutional investors who had carried the sector in 2024, through ETFs, now fall. In this regard, we can also see, on the graph below, that Tuesday and Wednesday days are the 2 worst days since the creation of BTC ETFs in net outingsrespectively with $ 1.01 billion and $ 754.6 million from Outflow:

Entrances and outputs on American Bitcoin ETF

For the moment, the course of events therefore echoes the scenario of Arthur Hayes, who estimates that the BTC could affect $ 70,000. However, this does not necessarily mean an end of Bull Run, and we were also able to return to more optimistic opinions, like that of Richard Teng, the CEO of Binance, who argued in favor of a “tactical decline».

If we take a little height on these ETFs, we can also see that the quantity of assets under management (AUM) was in reality not affected as much by the outings and the decrease in prices. As an indication, this AUM, of 105.57 billion dollars currently, observes a drop of 16 % since its highest historic on January 23, where the BTC lost 20 % over the same period:

Amount of assets under the management of American BTC ETF

👉 In the news also – for the CEO of Binance, the fall of cryptocurrencies is only a “tactical decline”

In a more global way on all cryptocurrencies, we note liquidations amounting to more than $ 770 million on derived products from centralized exchanges. If this amount, certainly important, is not necessarily striking compared to other red days observed in the past, it should however be noted that during the first 3 days of the week, nearly 2.8 billion dollars were liquidated.

Buy and trade crypto on the most efficient Dex in Solana

Sources: tradingView, quince

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital