The year 2024 marks a record for Binance Pay and in the development of cryptocurrency payments. Long perceived as a simple investment asset, cryptos are now established as a real means of payment for everyday life. Binance Pay records dazzling growth, continuing to mark a global change in the adoption of cryptocurrencies.

Binance Pay: A massive adoption of cryptocurrency payments

The Cryptos payment market experienced a strong acceleration in 2024especially with Binance Pay which allows Binance customers to send or receive payments in cryptocurrencies.

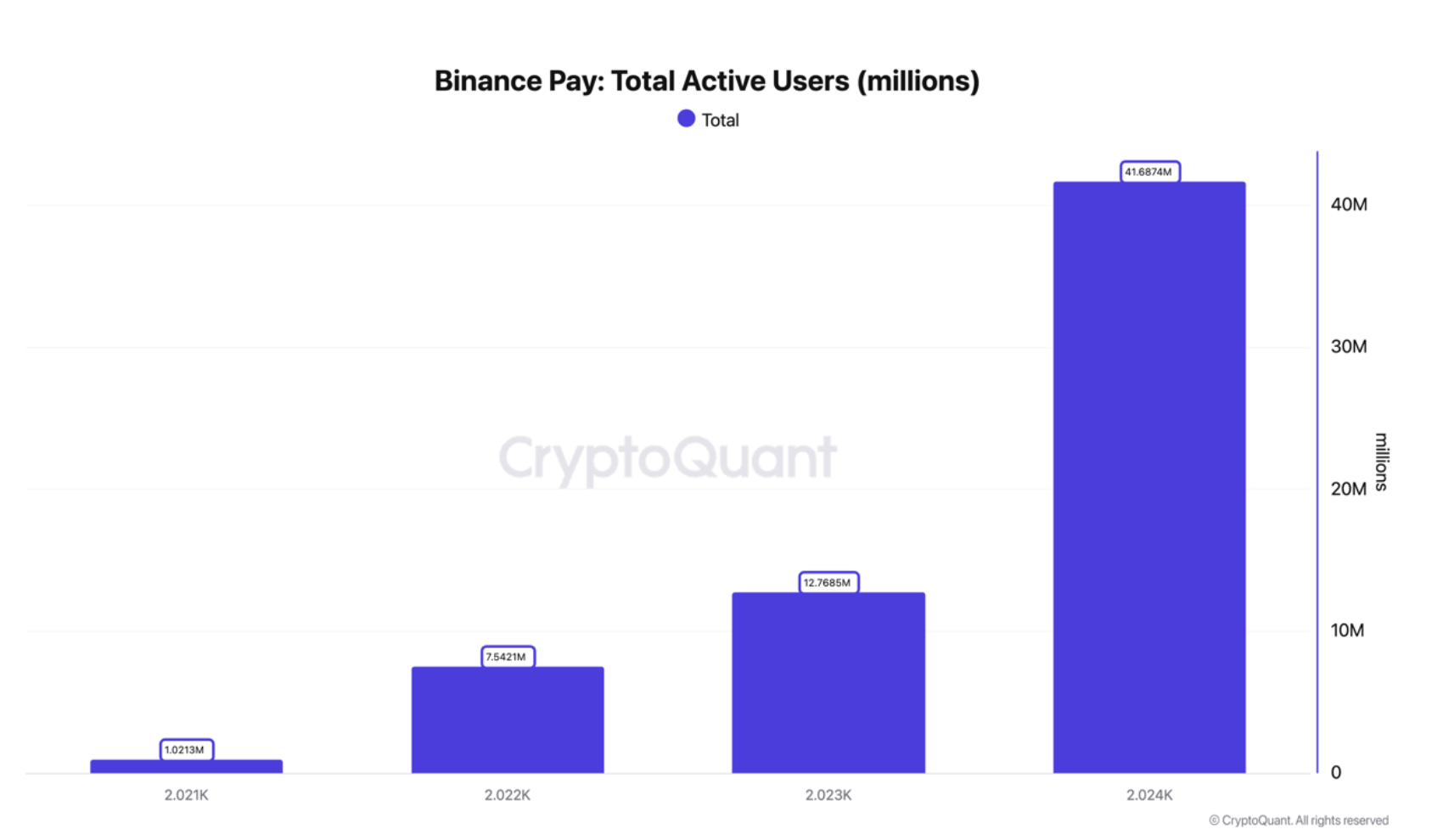

According to the data provided by the company, The number of users of Binance Pay has tripled in one yearaccumulating a total of 41.7 million people. These results show growing confidence in cryptocurrencies as a means of payment to make your daily purchases.

Evolution of the number of users of Binance Pay

👉🏻 Our opinion on the Binance platform in 2025

The total volume of transactions processed via Binance Pay has also exploded, reaching $ 72.4 billion in 2024against only 2.5 billion in 2021.

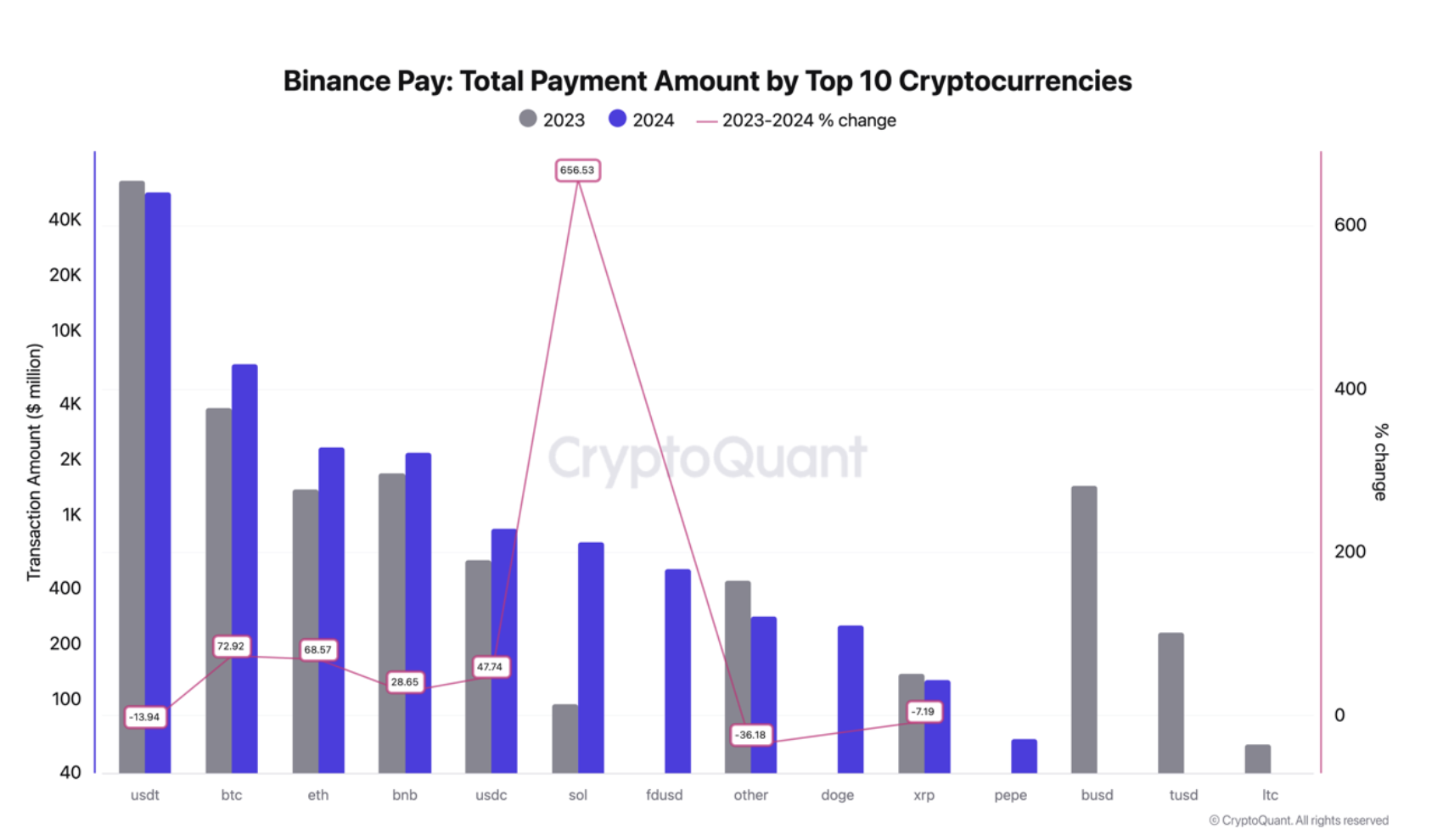

One of the key engines of this growth is the predominance of stablecoins. In 2024, the USDT of Tether alone represented 80 % of payments made via Binance Paya colossal volume of $ 57 billion.

The other popular cryptocurrencies include Bitcoin (BTC) with $ 6.6 billion in transactions, ETHR (ETH) with $ 2.4 billion and Binance Coin (BNB) with $ 2.2 billion.

Volume of payments by cryptocurrency on Binance Pay

Certain cryptos like Solana (soil) have experienced rapid adoption, with a volume of transactions reaching $ 724 million, an increase of 656 % compared to the previous year.

Buy crypto on binance, exchange n ° 1 in the world

The prospects and challenges for the future

The dazzling success of Binance Pay is part of a broader context of transformation of the cryptocurrency market. The total number of crypto holders increased by 34 % In 2024, reaching more than 600 million users around the world.

Institutional adoption also plays a key role in this expansion, with massive investments in Bitcoin via ETF in the United States, supported by a policy favorable to cryptos since the arrival of Donald Trump in power.

However, This growth raises questions about regulating the sector. While cryptocurrencies become a real means of payment, the financial authorities could seek to supervise these new practices.

Moreover, traditional banking actors are forced to innovate In order not to lose ground in the face of this rise in power of Crypto payment solutions.

🗞️ Hack of Bybit: The funds began to be transferred by the criminals

Be that as it may, the ascent of Binance Pay proves a paradigm shift, cryptocurrencies are no longer just a speculative asset, but become a full -fledged transaction tool.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Source : Cryptocurrency

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital