If we look at the price of the soil as well as the TVL within the DEFI, the month of February has been the worst since the FTX crisis for Solana. What do the figures say?

Solana (soil) accuses the blow of a negative February

In the wake of a red week for cryptocurrencies, we also had the monthly fence of February, which turns out to be not very pleasing. About it, The Solana (soil) ecosystem has experienced its worst decline since November 2022, during the collapse of FTX.

💡 How does the Solana blockchain work?

That it is both on the total locked value (TVL) in decentralized finance (DEFI), as on the price of the soil, these 2 data dropped by 36 % over the period studied. During the writing of these lines, the ground is also exchanged at 143 dollars, up 11 % in 24 hours, after reaching a lower 6 months on Friday:

Daily data soil course

Try Hyperliquid: a decentralized trading platform!

Although the price of the soil had dropped slightly more in April 2024, TVL in Solana's DEFI comes to accentuate this red Februaryfrom $ 10.82 billion to $ 6.93 billion.

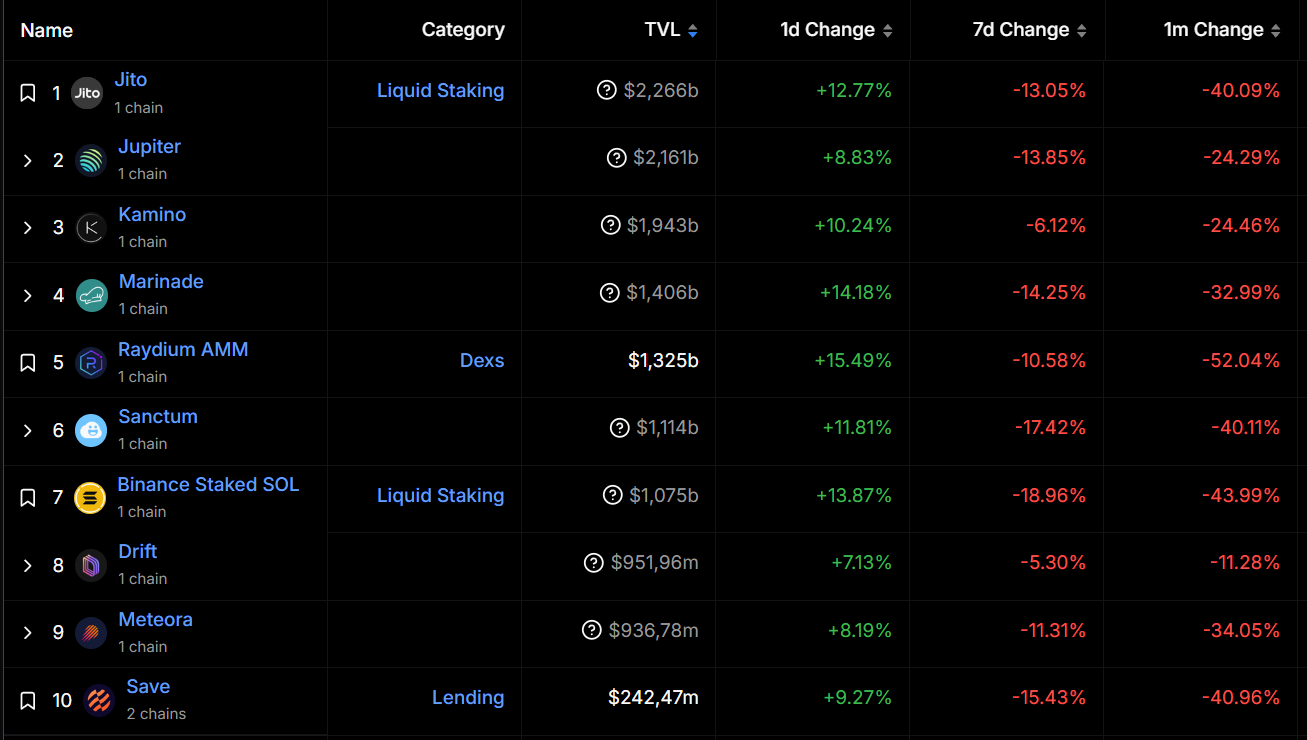

At the level of the 10 most important protocols in terms of TVL, we can see that several of them fell by more than 40 % in 1 month, and even up to 52 % for Raydium, which could also see Pump.

TVL DES SOLANA DEFI Protocols

Info block

If the total of the above figures appears higher than Solana's TVL, it is that certain protocols, identified by a “?” », Not integrated there, in particular due to a double counting of certain remaining functioning functions.

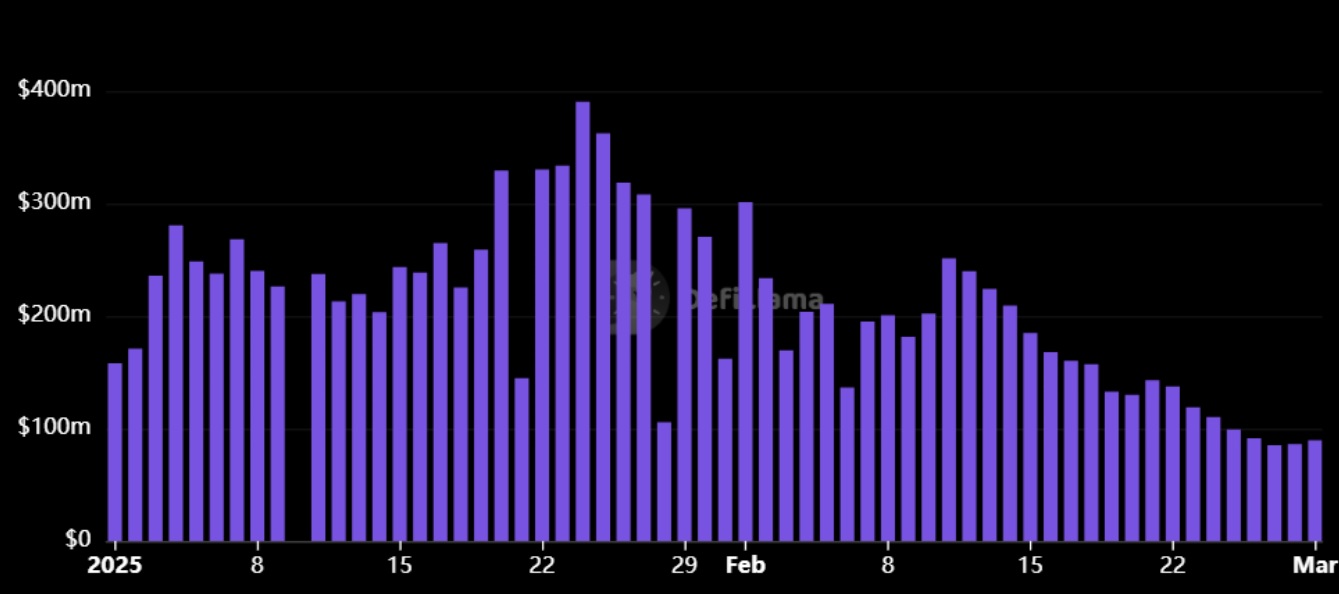

Regarding Pump.fun precisely, Solana's current difficulties seem to be accompanied by a decline in the madness of the same. This is felt on the flagship protocol, which saw its volumes drop by more than 70 % between February 1 and 28, in continuity with a decline observed since the last week of January:

Daily volumes on Pump.fun since the start of the year

👉 In the news also – Addition of Bitcoin and Solana: Metamask presents all the new features to come in his roadmap

If more broadly, March begins with an increase after 5 particularly negative days, another assessment can be done in the coming weeks, in order to estimate whether the low point of these different statistics is already behind us, or if the correction will continue.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Sources: tradingView, Defillama

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital