Brian Armstrong, CEO of Coinbase, opposes the strategic reserve of cryptocurrencies announced by Donald Trump, which includes BTC, ETH, XRP, soil and ADA. Armstrong criticizes the lack of clarity of this strategy and calls for a simpler and transparent approach for the allocation of digital assets.

Trump administration is more involved in cryptocurrencies

During his presidential campaign, Donald Trump, now at the White House, had promised to create a Bitcoin strategic reserve and to make the United States the capital of cryptocurrencies. Senator Cynthia Lummis had even presented a bill to create a reserve of one million BTC.

However, as you would expect, Donald Trump's interest in Bitcoin seems purely political, it seems to be far from really understanding the interest of the creation of Satoshi Nakamoto. Indeed, yesterday, Donald Trump officially announced the creation of a strategic reserve of cryptocurrencies including not only the BTC, but also the Ether, the XRP, the soil, and the ADA, in addition to the BTC.

💡 How to buy bitcoin (BTC)?

Many questions about the motivations behind this reserve had naturally emerged as soon as the idea was announced several weeks ago.

Some Internet users have noticed in particular A close link between this reserve and Bitwiseone of the asset managers offering an ETF Bitcoin and Ether Spot. Indeed, Donald Trump had named David Sacks as “Crypto Tsar”, entrusting him with the mission of analyzing the implications of this initiative.

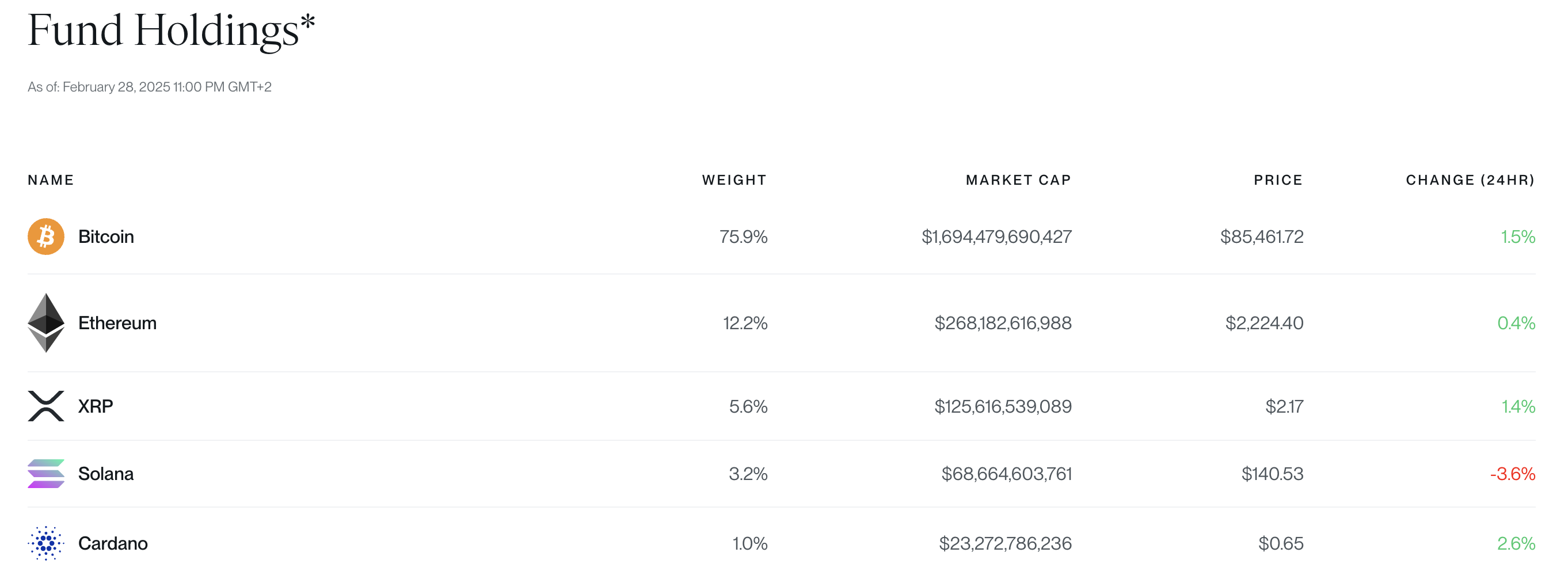

Top 5 of the Bitwise 10 Crypto index Fund (BitW) allowance

However, David Sacks is a Seed Investor, or Investor in French starter, from Bitwise. It turns out that the 5 main cryptocurrencies of the Bitwise 10 Crypto Index Fund (BitW), a cryptocurrency fund managed by the company, are precisely Bitcoin (BTC), Ether (ETH), Ripple (XRP), Solana (Sol) and Cardano (ADA).

Like the launch of the same Trump and Melania, this situation raises serious questions about potential conflicts of interest.

Ledger: the best solution to protect your cryptocurrencies 🔒

CEO of Coinbase criticizes the Cryptomonnaie Strategic Reserve of Donald Trump

In response to Donald Trump's announcement, Brian Armstong, CEO of Coinbase, was critical, denouncing a lack of clarity in this strategic reserve.

According to Armstrong, Trump should either be limited to Bitcoinor, at least, create a weighted index by capitalization in order to “remain impartial”.

Excited to Learn More. Still Forming An Opinion On Asset Allocation, But My Current Thinking is:

1. Just Bitcoin Would probably be the best option – Simplest, and Clear Story as successor to Gold

2. If Folks Wanted More Variety, You Could do A Market Cap Weight Index of Crypto… https://t.co/jv8gcn8n2s– Brian Armstrong (@brian_armstrong) March 3, 2025

“I can't wait to find out more. I still have an opinion on the allocation of assets, but here is my current reflection: 1. Limiting yourself only to Bitcoin would probably be the best option: this is the simplest solution and it offers a clear story as a successor to gold. »»

📰 Also read in the news – Strategy launches its “Bitcoin Hub”, a giant coworking space dedicated to the BTC

The addition of bitcoin to national reserves would amount to extending traditional gold reserves to their digital equivalentthus offering a clear and coherent strategy.

On the other hand, include other cryptocurrencies – assets created, promoted and developed by private companies – contributes to strengthening the image of “large anything” started with the previous same.

Coinbase: Register on the most famous Crypto exchange in the world

Source: Bitwise

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital