Bionexusus gene Lab, a company listed in Nasdaq, has approved an unprecedented strategy for a public company through business cash dedicated to Ethereum (ETH). What are the reasons for this choice?

The company Bionexus Gene Lab, listed at Nasdaq, approves cash in eth

In the cryptocurrency sector, Bitcoin is placed in an undeniable favorite with institutional investors, in particular with in figurehead, strategy and its 499,096 BTC. However, a company listed at Nasdaq, responding to the name of Bionexusne gene Lab, would like to break the status quo After approving the first cash in ETH for a public company ::

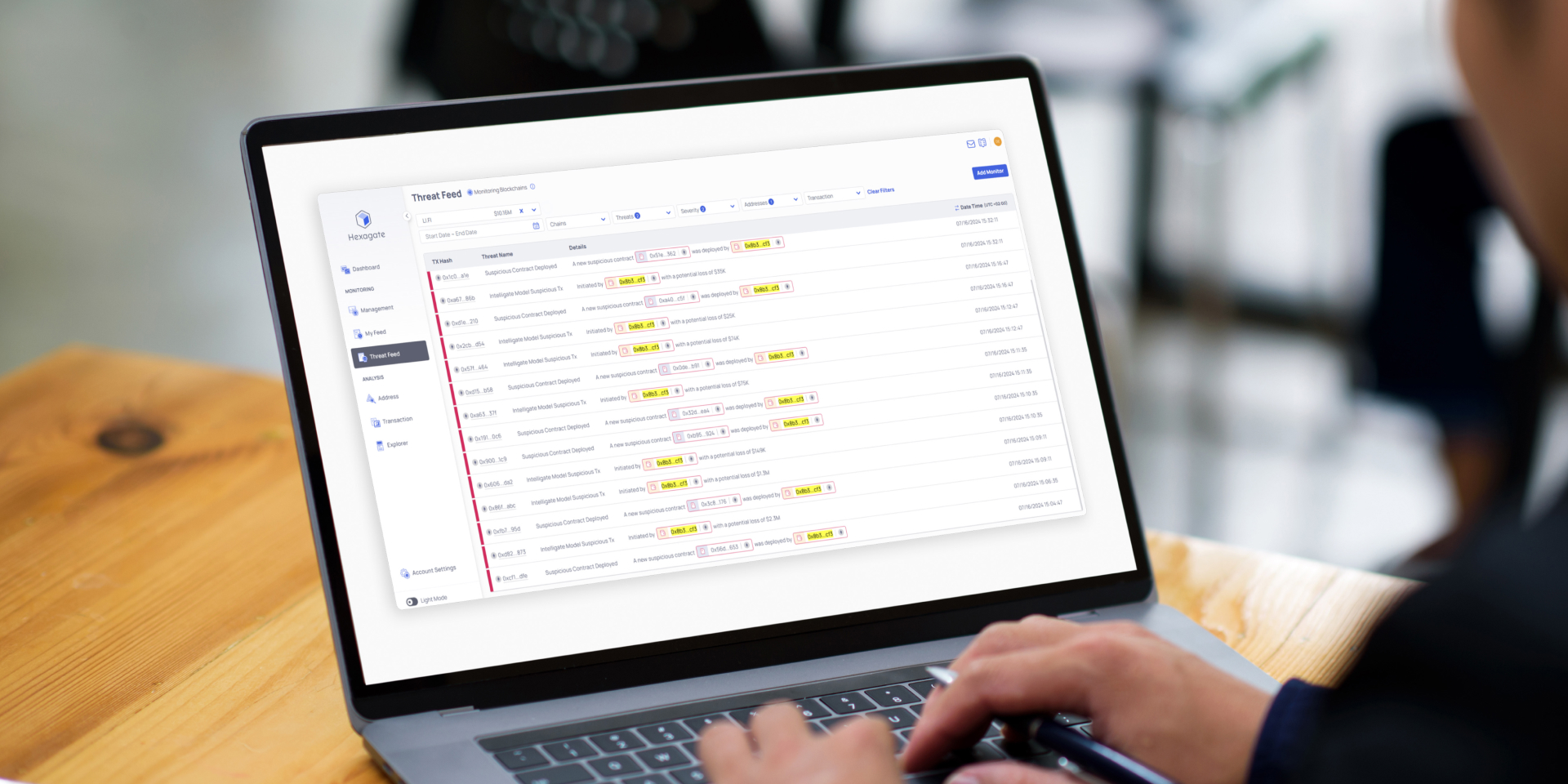

While the financial landscape continues to evolve, digital assets appear as a viable cash management solution. Bionexusus gene lab corp. (BGLC) is the pioneer of a business strategy that focuses exclusively on Ethereum (ETH) as a cash reserve ratio, recognizing its unique assets in terms of liquidity, security and financial infrastructure.

💡 How to buy ethreum eth?

In a Whitepaper published for the occasion, the company detailed the reasons that pushed it to favor Ethereum to the detriment of Bitcoin.

Among other things, the yield of ETH thanks to Staking is highlighted, as well as its central role as a global financial platform generating for example “Thousands of billion [de dollars] transactions»On stablecoins like the USDC and the USDT.

Generate interests about your cryptos with Meria

If this reasoning can make sense, let us recall, however, that Ethereum and Bitcoin are indeed different technologies, meeting different needs, and that comparisons can therefore sometimes find their limits.

Anyway, the announcement is unprecedented and could mark a turning point in the adoption of ETH to Wall Street, even though the ETFs were indexed there until then, was much less popular than those on the BTC. Despite everything, Bionexusus gene lab corp. said his confidence in the role that Ethereum blockchain will play in the future ::

We believe that Ethereum is more than a digital asset: it is a new financial paradigm. BGLC's commitment in favor of a cash strategy focused on Ethereum underlines our confidence in its stability, its institutional growth and its transformation potential.

👉 Also read-Has Ethereum validated its low point? Technical analysis of Ether on March 6, 2025

To take a little height, it should be noted that this novelty could take years before producing tangible effects, given the limited scale of the company. And for good reason, the BGLC action is currently capitalized at $ 6.14 million.

Do not miss the Bullrun, join our experts on Cryptoast Academy

Advertisement

Source: BGLC

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital