Geopolitical appeasement with a planned meeting between Trump and Putin arouse the hope of a cease-fire in Ukraine. Meanwhile, the XRP remains resilient despite a 50 % drop in its exchange volumes on the derivative markets and an increasingly favorable bias for sellers.

Pending news from the front, the market marks a break

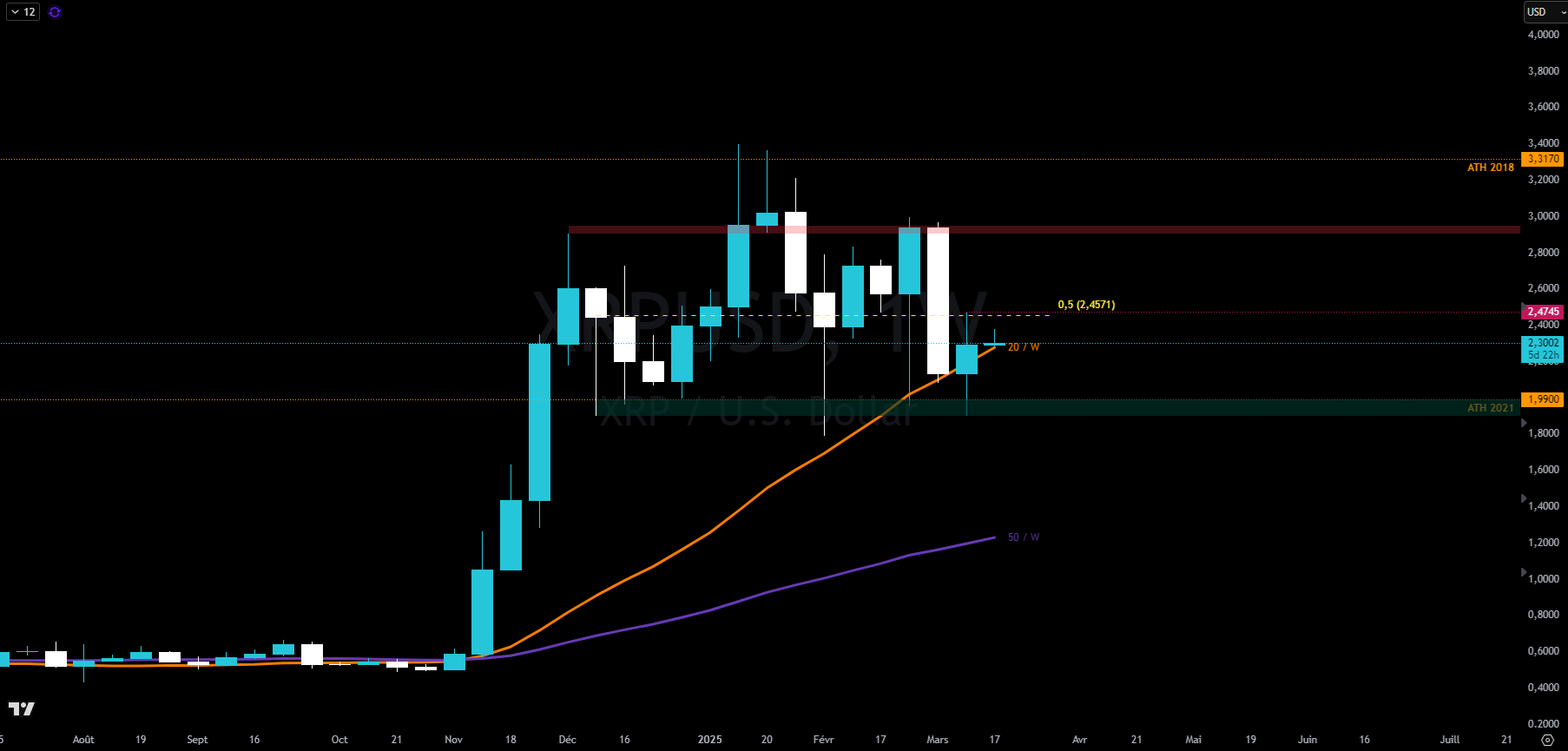

We are Tuesday March 18, 2025 and the price of the XRP evolves around 2.3 dollars.

Our latest technical analysis of the XRP dates back to March 11, 2025, while the asset was evolving around $ 2.10. During this period, the markets crossed a violent correction, fueled by uncertainty linked to American political instability.

Since then, the climate has been peaceful: the American president has slowed down the rhythm of his shock statements and geopolitics have been experiencing some positive advances. In addition, market attention turns to Ukraine, where an exchange between Donald Trump and Vladimir Putin is planned today.

This meeting nourishes the hope of a cease-fire between Russia and Ukraine, which, if it materializes, could help appease international tensions, especially in Europe. The stakes are high, because Russia, struck for months by Western sanctions, remains a key player in the world economy.

Trade cryptos on binance, exchange n ° 1 in the world

Since our latest analysis, activity on the derivative markets has slowed heavily. Although the XRP remains one of the assets most drawn by speculators, its exchange volume has dropped by around 50 %, reaching $ 3.1 billion.

Open interests (OI), which represent the total of the capital on derivative contracts, still evolve laterally. However, financing costs are increasingly reflecting a change in bias in favor of sellers.

This situation continues to promote the accumulation of liquidity upwards, but it should be nuanced, taking into account the general decline in speculative interest in the derivative markets since the beginning of the year, in particular on the XRP.

Still 4ᵉ among cryptocurrencies, with a capitalization of $ 133.55 billion, the XRP showed resilience at the start of 2025.

| Pairs with XRP | 24 hours | 7 days | 1 month |

| XRP/ USDT | -1.70 % | +14.00 % | -17.60 % |

| XRP/ Bitcoin | -1.80 % | +8.00 % | -3.40 % |

👉 The best sites to buy ripple (XRP)

Keep this key level to preserve your ambitions

The 20 -week mobile average plays a key role in building an upward trend. Its importance is not trivial, since it represents an average price calculated over the last five months.

In itself, a break in this downward level is nothing dramatic: the market can blow, especially in a consolidation phase. However, a fence under this threshold would send a weakness signal for the XRP.

The market was not mistaken: for two weeks, this SMA20 has been actively defended at the end. However, current pressure should soon lead to resolution.

Long or shorts over 100 cryptos with hyperliquid

In the first scenario, the XRP manages to cross the polarity of its range by settling in the sustainably above 2.5 dollars, while maintaining its position above the mobile average at 20 weeks. This configuration would open the way to an attempt to exceed 3 dollars, with a new historic summit in sight.

In the second, the asset is struggling to confirm its upward dynamic and continues to evolve in its range, based on the support of the 2 dollars. This scenario would mark a break in the impulsive phase and could require a return to the mobile average at 50 weeks – currently around 1.20 dollars – before a possible rebound.

Finally, a third option would be a prolonged lateralization between $ 2 and 3 over several weeks. In this case, the SMA50 would end up catching up with prices, placing the XRP in the face of a decisive deadline: either a bounce bounce, or a more marked correction.

📈 Discover our selection of the best Perpetuals trading platforms

XRP graphic in weekly

In summary, The XRP crosses a key moment: either it exceeds 2.5 dollars to target a summit beyond 3 dollars, or it stagnates in the lower part of its range, between 2 and 2.5 dollars, or even corrected up to $ 1.20 before a possible rebound. A prolonged lateralization phase also remains possible before a major movement.

So, do you think that the Ripple crypto can revive up the 2 dollars? Do not hesitate to give us your opinion in the comments.

Have a nice day and we meet next week for a new XRP analysis.

Trade cryptos on binance, exchange n ° 1 in the world

Sources: tradingview, quince, glassnod

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital