While the price of Bitcoin adopts an uncertain structure, investors hold their breath hoping for a recovery. What to expect from the BTC market? We take stock together!

A difficult start to the year

While the Bitcoin price adopts an uncertain structure, investors hold their breath hoping for a BTC cover over 100,000 dollars.

If the sale pressure from future markets decreases, the price of the BTC is close to critical support levels for its long -term trend.

What to expect from the BTC market? We take stock together!

Figure 1: Bitcoin hourly lesson

Transform crypto crashes into opportunities 🚀 Receive 7 exclusive tips to succeed where 90% fail!

Welcome cleaning on the Crypto market

Despite the important losses made in the short term and a clear degradation of the market feeling, This correction has enabled derivative markets to clean themselves very effectively.

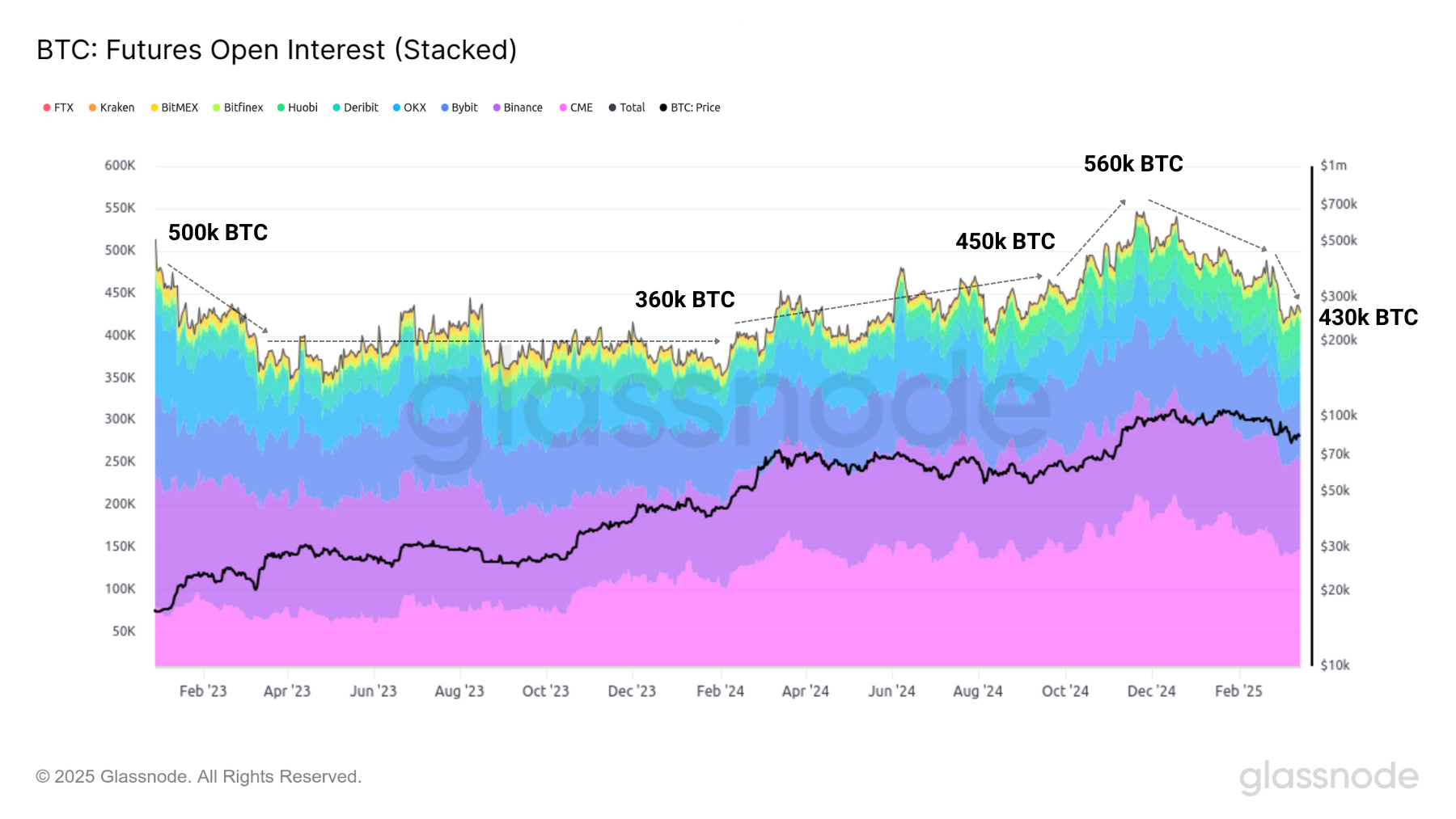

Indeed, the open interest of future contracts, proxy of speculative appetite of derivative markets has dropped considerably since December 2024, with more than 100,000 BTC having left future contracts.

Most of this fall comes from the CME, bybit and Binance, which represent almost 80 % of the total open interest.

This lever effect purge is A positive consequence of current dynamicsallowing the price action to express themselves in a more organic and natural way.

Figure 2: Open interest in future contracts for BTC

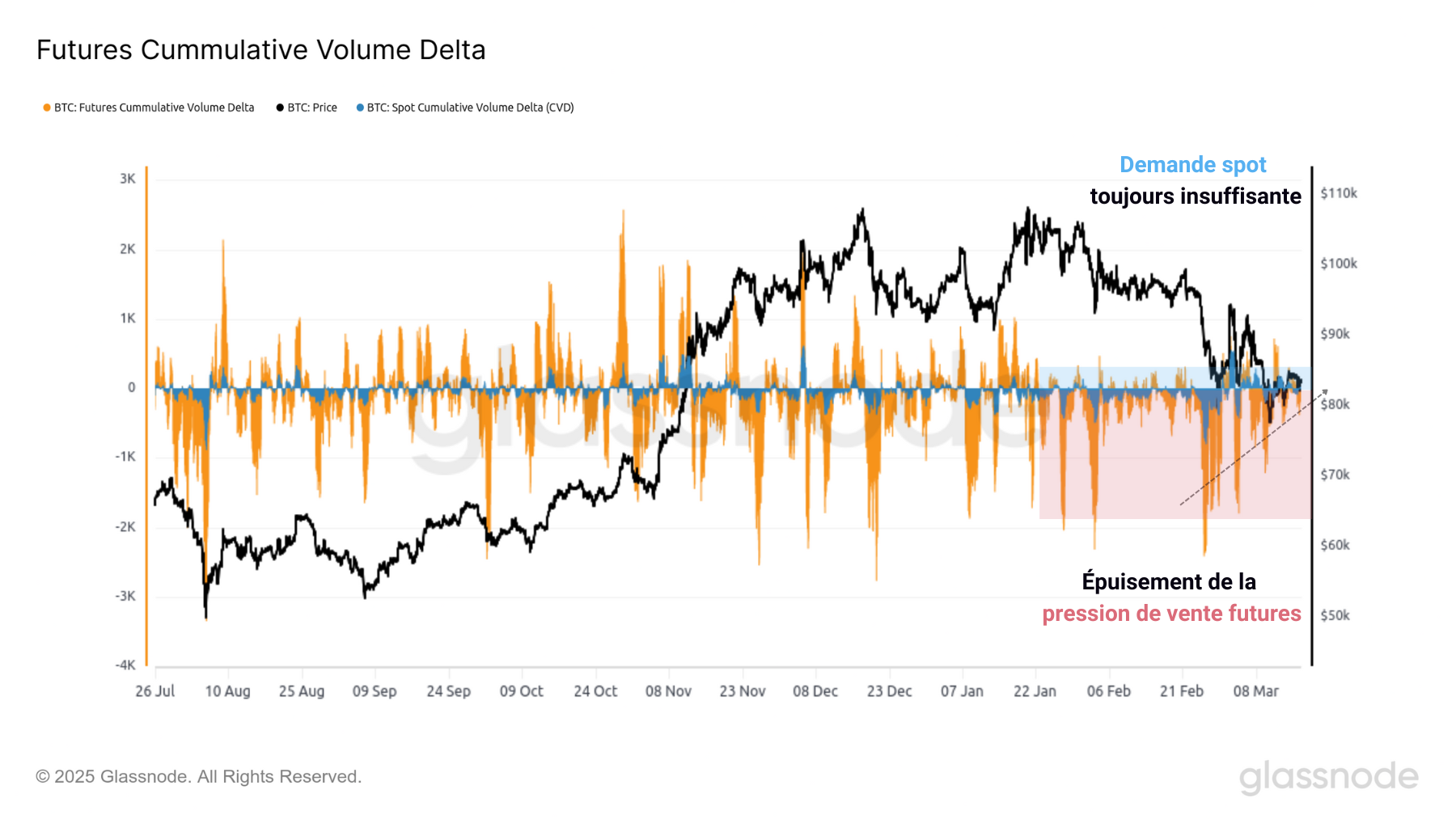

The influence of derived markets on the course of the BTC having had an unwanted impact, as illustrated by the purchase / sale volumes from these markets (in orange), which remain superior to the volumes of the Spot markets.

Note that The demand pressures, future or spot, are very low, even nonexistent since mid January 2025which allowed the market slowdown to turn into correction.

📈 Discover our selection of the best Perpetuals trading platforms

Currently, while the future sales pressure dominated, it seems to slow down, Augurant A depletion of sellers who paves the way towards an attempted bullish recovery.

The balance of forces has recently restoredin a position where buyers and sellers are both capable of imposing their wishes.

Figure 3: Net volumes of future markets and spot

Long or shorts over 100 cryptos with hyperliquid

Short -term uncertainty for BTC

From a cyclical point of view, the course of the BTC is close to an important point of tension. The Graphic below presents the evolution of the BTC price, accompanied by its weekly Bollinger (BB) bands (BB).

The BTC market is currently located near the lower Bollinger stripa tense context where the price can either make a rebound, or confirm the launch of a new downward / medium -term downward trend.

Figure 4: BTC course and weekly Bollinger strips

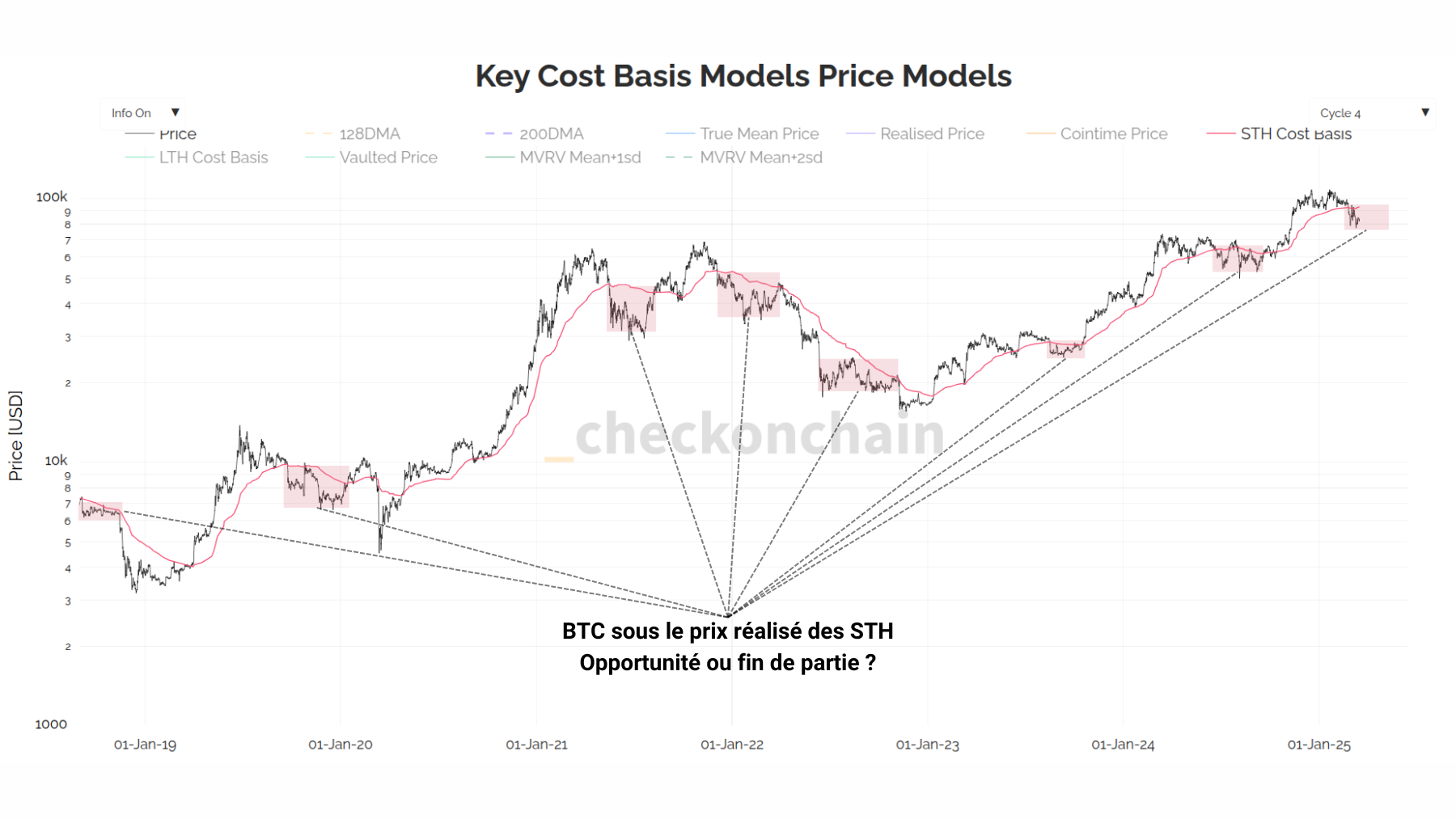

This observation is corroborated by the price made of short -term investors (STH), now higher than the Spot price.

Indeed, the moments when the BTC market ventures under this level are accompanied by a considerable tension and apprehension, bringing A first lowering signal not to ignore.

Buy crypto on binance, exchange n ° 1 in the world

Historically, bullish trends tend to maintain as long as the BTC price does not dive from STH for more than a few weeks.

In fact, It is still difficult to conclude whether the current correction represents an opportunity or a risk signal major.

Figure 5: price made of STH

Trade Republic: buy cryptos and actions in 5 minutes

Summary of this on-chain analysis on Bitcoin

Ultimately, recent data suggest that the open interest of future contracts has dropped considerably since December 2024, with more than 100,000 BTC having left future contracts, cleaning the excess leverage.

This purge of leverage is a positive consequence of current dynamics, allowing price action to express themselves in a more organic and natural way.

In addition, the BTC market is currently located near the lower Bollinger strip, a tense context where the price can either make a rebound, or confirm the launch of a new lower / medium -term downward trend.

Find exclusive analyzes of the teacher on Cryptoast academythe ideal place to succeed in your investments in cryptocurrencies. You will learn to position yourself on strategic price levels, to detect investment opportunities and to anticipate price movements. Join us now and take charge of your Cryptos investments.

Transform crypto crashes into opportunities 🚀 Receive 7 exclusive tips to succeed where 90% fail!

Sources – Figures 1 to 6: Glassnode

The crypto newsletter n ° 1 🍞

Receive a summary of crypto news every day by email 👌

Certain links present in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner gives us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital