The synthetic opioid crisis, which has a growing crypto nexus, is contributing to tens of thousands of deaths annually in the U.S. Fentanyl has been at the epicenter of the public health crisis, which has been a policy priority for the current U.S. administration and its predecessor. Transnational drug trafficking organizations (DTOs), including those in Mexico, have historically focused on other illegal drugs, such as cocaine, however they are now intimately involved in the transnational illicit fentanyl trade. On top of cartel activity, online vendors and darknet marketplaces (DNMs) also play a role in the fentanyl trade, and engage with different types of entities in the ecosystem – all while leveraging crypto. Below, we’ll take a look at this ecosystem, its geographic centers of gravity, two recent use cases, and practical lessons to combat this persistent threat.

On-chain nexus to fentanyl ecosystem is more substantial and broader than commonly understood

Cryptocurrency is increasingly interwoven into the illicit drug trade, allowing DTOs to bypass the traditional international financial system. The on-chain fentanyl trade includes a broad array of players, each of which provides complementary services:

- Precursor manufacturers are the start of the fentanyl supply chain. Leveraged by amateur drug vendors and DTOs alike, these suppliers openly advertise on the open web, and conduct sales over instant messaging apps and emails. They ship worldwide, and commonly accept payment in bitcoin (BTC) and stablecoins.

- Darknet Markets (DNMs) are the original crypto-drug marketplace, and provide the platform on which vendors of illicit material and buyers can trade. Many DNMs ban fentanyl in their terms of service. However, some vendors will still sell substances laced with fentanyl (e.g. commonly counterfeited prescription drugs), as well as fentanyl derivatives like China White heroin, and nitazenes, which are dangerous synthetic opioids with a similar potency to fentanyl. Western darknet markets commonly accept Monero (XMR) and BTC.

- Drug forums serve as a watering hole for vendors and buyers. Some are geared towards DNM activity, while others are geared toward drug synthesis and chemical manufacturing, with representatives from Chinese chemical companies engaging with amateur online drug vendors who are synthesizing their own substances. Subscribers may pay for access and/or can make donations in cryptocurrency, and users do not always take measures to obfuscate their transactions.

- Postage services sell bulk postage in exchange for cryptocurrency. They are often used in direct ‘vendor to consumer’ shipments due to crypto’s perceived anonymity. Popular in the U.S. and Mexico, these services are not illegal, however their counterparties can be useful in generating leads to individuals who may incorrectly believe they are operating in secrecy.

- Research chemical vendors sell analogues of controlled substances as a means to bypass regulation; these drugs are consumed in the same manner and have similar effects as the illegal substances that have inspired their creation. For example, while alprazolam, or Xanax, is a federally controlled substance, flubromazolam is not, and selling it in bulk to wholesale buyers has proven to be a lucrative business. The initial powders are often purchased in bulk from China-based vendors, and are then resold online and/or pressed into counterfeit pills. Some of these vendors also sell nitazenes. One result of the research chemical trade is that street-level buyers are unwittingly taking substances that are altered or counterfeited, and that could potentially have nitazenes or fentanyl laced in.

- Pill Press Manufacturers, also commonly China-based, sell pill presses, industrial mixers, and pill molds, which are used for drug counterfeiting. There is heavy on-chain association between these manufacturers and DNM vendors who are pressing their own pills.

- Independent drug vendors have either diversified their streams of income by operating their own shops on top of their DNM profiles, or have divorced themselves entirely from the centralized DNM scene. Some of these actors maintain Telegram bot shops, while others may have clearnet or TOR-based websites. These vendors, if they are producing their own drug material, will likely be sourcing their precursors from China.

While fentanyl trafficking is a prominent example of this dynamic, this typology applies broadly to vendors involved in other synthetic drugs as well. China, in particular, is a significant source country not only for fentanyl precursors, but also for a wide range of synthetic drug material.

Backbone of international fentanyl market spans China, Mexico, and U.S.

Crypto not only enables the purchase of chemical precursors without physical interactions, but also forms part of a broader underground banking and financial facilitation scheme spanning Mexico, the U.S., and China. Chinese money laundering networks, including Chinese nationals based in the U.S., are increasingly working closely with drug trafficking networks, most notably the Mexican DTOs, to launder their ill-gotten proceeds, often using cryptocurrency. Since Chinese nationals are prohibited from buying more than $50,000 in foreign currency, using underground banking networks tied to the fentanyl trade provides one way to evade the country’s capital controls.

In spite of its ongoing cryptocurrency ban, China continues to be the main source of the world’s fentanyl precursors, shipping services, and other offerings, such as TDP die kits, which are used to press counterfeit pills. For example, as we have flagged previously, from 2018-2023, one group of suspected China-based chemical traders received more than $37.8 million worth of cryptocurrency. Major Mexico-based DTOs, such as the Sinaloa Cartel and the Cartel Jalisco Nueva Generación, purchase these precursors to manufacture synthetic opioids, including fentanyl, which they then traffic and distribute in the U.S.

Despite their centrality in the fentanyl trade, Mexico and China are far from the only important on-chain players:

- Earlier this month, Iranian national and Nemesis DNM administrator Behrouz Parsarad was designated by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) for facilitating the sale of fentanyl and other drugs worldwide, including to the U.S.

- In October 2023, OFAC designated Canada-based Valerian Labs, along with its Canadian owner Bahman Djebelibak (aka Bobby Shah). Valerian was a major facilitator of Jinhu Menshing, a China-based entity that advertises punches and dies for tablet presses with pharmaceutical imprints on e-commerce platforms and has provided pill dies for counterfeit oxycodone. These entities were part of a larger designation targeting the supply chain for purchasing and facilitating the distribution of chemical precursors to produce illicit narcotics, including fentanyl.

- In 2022, OFAC designated Dutch nationals Alex Adrianus Martinus Peijnenburg and Martinus Pterus Henri De Koning for supplying illicit fentanyl, synthetic stimulants, cannabinoids, and opioids to U.S. markets through internet sales and a host of shell companies.

Two recent, but starkly different, cases exemplify how blockchain analytics shine a light on networks that would otherwise be inaccessible and provide actionable inroads.

Civil forfeiture case: straightforward, but effective, laundering for the cartels

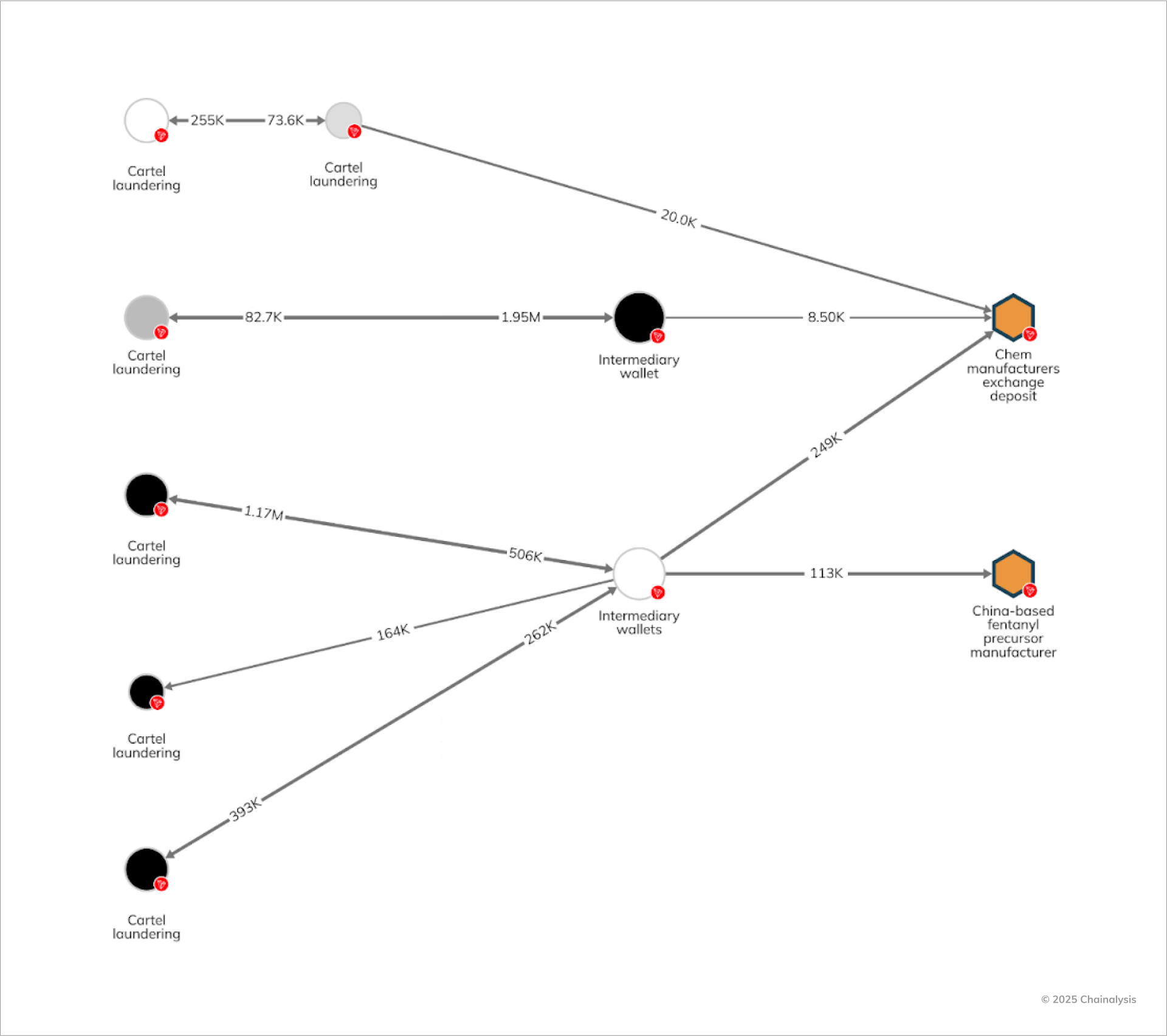

As we discussed recently in the Organized Crime section of our 2025 Crypto Crime Report, a recent civil forfeiture case in the Eastern District of Wisconsin highlighted crypto’s growing role in the financial ties between Mexican cartels and Chinese chemical suppliers. The case resulted in the seizure of over $5.5 million in cryptocurrency and illustrates how Chainalysis can reveal hidden financial flows within organized crime.

The investigation began with a money laundering probe targeting a Mexican cartel-affiliated network operating in the U.S. Authorities identified centralized exchange accounts and crypto addresses used to move illicit drug proceeds, primarily linked to the sale of fentanyl and methamphetamine. Chainalysis traced significant transfers from these addresses to wallets previously identified as belonging to Chinese companies supplying fentanyl precursors.

The on-chain link confirmed a direct financial relationship between cartel-linked money launderers and suppliers overseas, including in China, as seen in the below Reactor graph.

What stands out about this laundering operation is its unsophisticated yet large-scale nature — a frequent pattern in other forms of organized crime onboarding to crypto. Unlike cybercriminal syndicates such as North Korean state-backed actors who use advanced on-chain obfuscation techniques to great effect, cartel-affiliated launderers have operated more openly, moving funds swiftly through centralized accounts and unhosted wallets.

While the cartel may have benefitted from speed, low transaction fees, and cross-border efficiency, their reliance on the blockchain has allowed investigators to trace these transactions more easily than would have been possible with traditional cash-based money laundering. Furthermore, it allows even greater disruptive potential, because issuers and centralized services typically have the ability to freeze assets when necessary.

MonPham case: ecosystem now extends to small-town fentanyl vendors

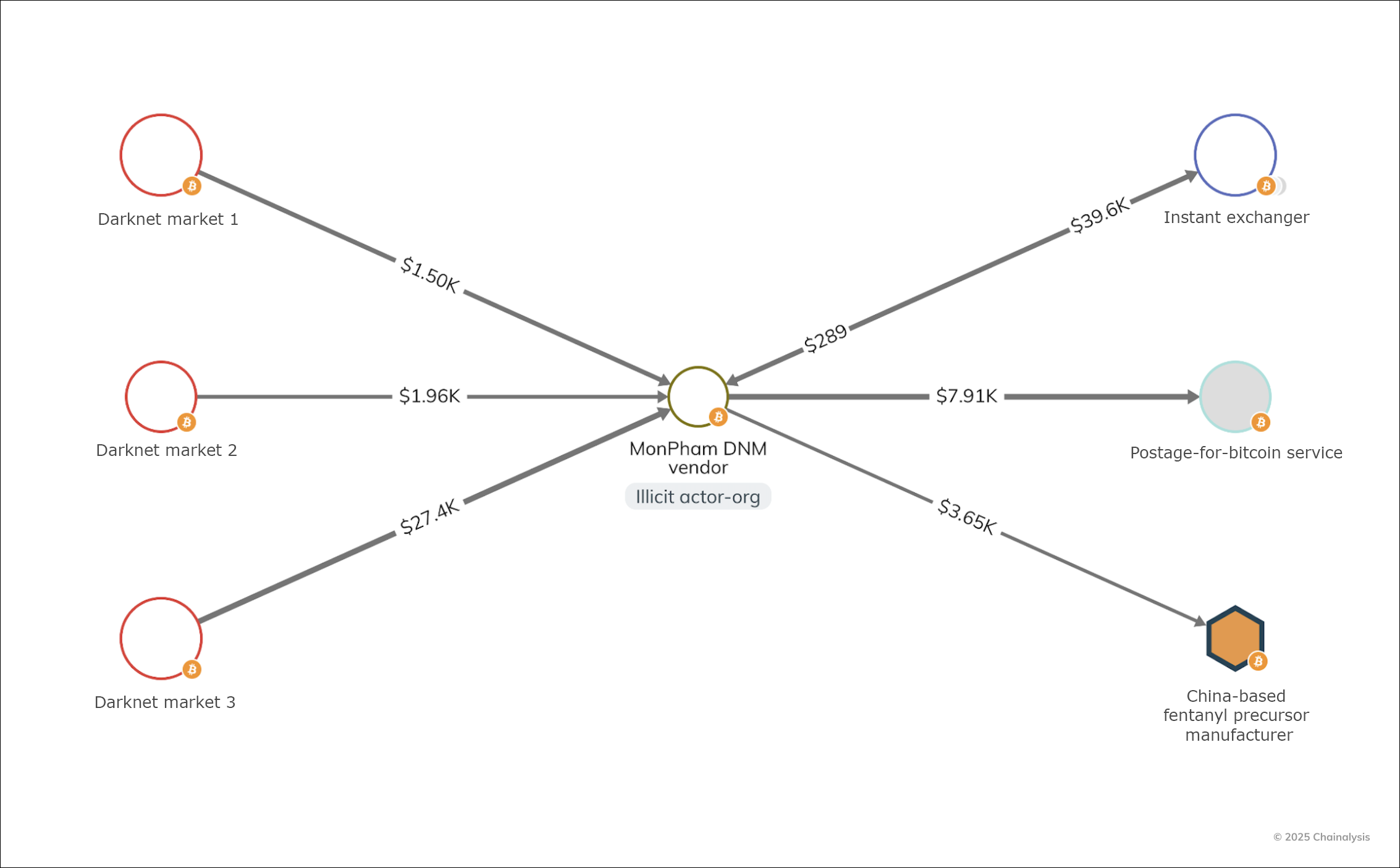

Another recent case in the U.S. shows how fentanyl manufacturing and distribution extends beyond complex, transnational networks, such as the Mexican cartels. In 2024, a family in rural Pennsylvania pleaded guilty to conspiring to distribute fentanyl. According to court documents, the family manufactured counterfeit oxycodone and Xanax in a laboratory in their residence. They sold tens of thousands of counterfeit narcotics pills, some of which contained fentanyl, and operated on several DNMs using the moniker ‘MonPham.’

The mother of the family claimed she was not part of a drug conspiracy, but rather conducting research for a relevant screenplay, according to court documents. However, as we can see in the Reactor graph above, MonPham received funds from three DNMs. MonPham made purchases from a service that sells postage for BTC, and a China-based fentanyl precursor manufacturer. MonPham then sent funds through an instant exchanger, probably to launder funds. Upon execution of its search warrant of the family’s residence, law enforcement discovered the family’s drug lab, pills, binding agents, drug ledgers, and numerous electronic devices containing hundreds of text messages among the family detailing the conspiracy’s day-to-day operation.

Chainalysis is powering the disruption of the fentanyl ecosystem

The fentanyl trade is multifaceted, transnational, and fatal. Chainalysis data is instrumental in helping disrupt this deeply insidious activity while empowering the authorities in several ways:

- Proactively generating actionable threat intelligence, not only by following the flow of funds between attributed entities, but also by conducting comparative analysis that looks for similar behavioral patterns across our data to identify new leads.

- Promoting education for, and collaboration among, law enforcement and other authorities focused on fentanyl and drug trafficking more broadly. As with terrorism, ransomware, and many other issues, the transnational fentanyl trade is a global scourge that requires global solutions and robust international collaboration, powered by Chainalysis data.

Building bespoke workflows that integrate real-time monitoring and alerting of crypto activity that allow for quick disruption at choke points, such as compliant services.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.