The European Parliament has just approved the MiCA and TFR regulations, which bring particularly restrictive rules to the cryptocurrency ecosystem from 2024. And the European Union does not intend to stop there: it is the decentralized finance sector (DeFi) which now seems targeted. What could change?

The European Commission is turning to DeFi

DeFi is by definition decentralized: it does not rely on a central body and can in theory operate entirely separately from “traditional” finance. But not to the point of evading regulators? This is indeed the sector that now seems targeted by the European Commission, which has launched a call for projects.

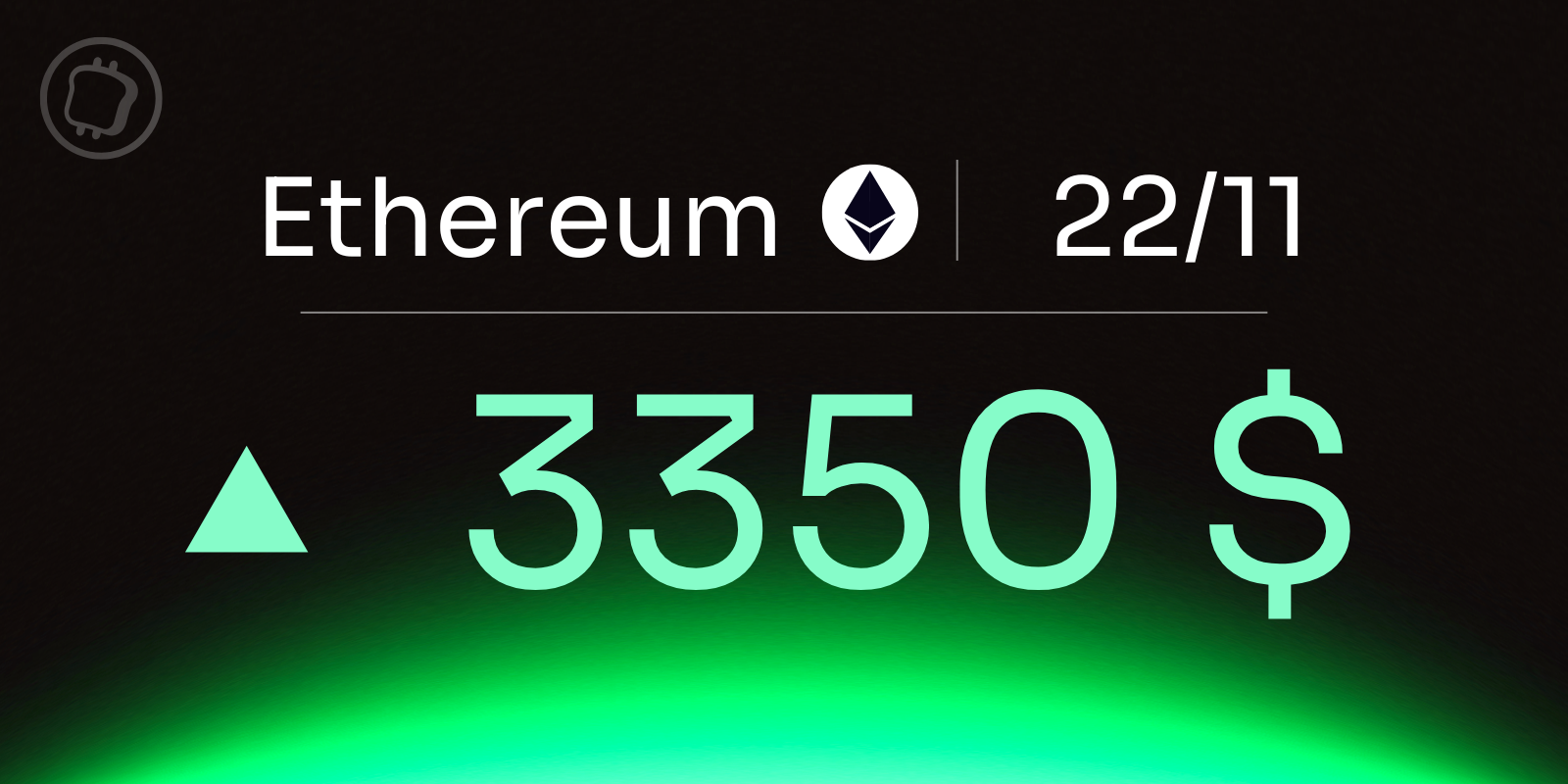

Published a few days ago, the proposal clearly sets out its objectives: develop and deploy a technological solution for the integrated supervision of decentralized finance (DeFi) activity”. The call for projects is based solely on Ethereum (ETH), the most widely used blockchain for this type of activity.

The publication speaks well of “integrated” supervision since it is a question of actively regulating Ethereum. That is to say, to collect data automatically in real time, in order to be able to monitor all transactions. The cost of the project? 250,000 euros.

👉 Read also – Will the European Union harmonize taxes on cryptocurrencies?

The No. 1 exchange in the world – Regulated in France

10% off your fees with code SVULQ98B 🔥

Europe ever stricter with cryptocurrencies?

MiCA and the Travel Rule are now a reality. From 2024, companies offering services related to cryptocurrencies (Crypto Asset Service Provider or CASP), will have to collect particularly in-depth information on the remittances of their users. A provision that goes against part of the philosophy developed within the ecosystem, but which does not affect transfers between self-hosted wallets.

👉 On the same subject – The Ministry of the Economy has requested access to the balance of all French bank accounts

This call for projects therefore takes the European Union’s field of investigation up a notch, as DeFi by definition does not rely on “classic” companies and service providers. If a regulation of cryptocurrencies is of course necessary at European level, one can wonder if the firmness of the Union couldn’t hold back innovation in a particularly dynamic sector at the moment.

👉 Follow all the latest regulatory news

Join Experts and a Premium Community

PRO

Invest in your crypto knowledge for the next bullrun

Source: Study on Embedded Supervision of Decentralized Finance via eTendering

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.