Following the massive withdrawals from centralized exchanges in recent days, investors are flocking to decentralized solutions like Uniswap (UNI). Thus, the protocol has passed Coinbase in terms of volumes traded in recent days, and already displays more than 52 billion dollars in volume traded over the past two weeks.

Uniswap takes advantage of recent events

Following the collapse of FTX, the event that has been in the news for a week now, users are withdrawing their funds en masse from centralized exchanges (CEX). Indeed, the sudden liquidity crisis of FTX, which remained Binance’s main competitor within the ecosystem, sent panic to the cryptocurrency market.

🔴 LIVE – Follow the FTX deal in real time

Consequently, the main centralized exchanges have been obliged to publish proof of their reserves as a guarantee of transparency vis-à-vis their customers.

Thus, at a time when the loss of investor confidence is reaching its climax, the latter are redirecting to decentralized solutions like Uniswap (UNI), a benchmark protocol recognized for its high liquidity on a large number of tokens. We invite you to read our page dedicated to Uniswap if you want to learn more about this pillar of decentralized finance (DeFi).

DEX starting to replace CEX?

Total ETH/USD (stable gold) volume:

Binance: ~$1.9b

Uniswap: ~$1.1b

Coinbase: ~$0.6b https://t.co/FQR2PcIQzX— hayden.eth 🦄 (@haydenzadams) November 14, 2022

As pointed out Hayden Adams, the creator of Uniswap, the decentralized protocol has overtaken the giant Coinbase in terms of volume traded over the past 24 hours. Since the screenshot above, the gap has narrowed slightly between Uniswap and Coinbase, but the unicorn-logoed platform remains ahead, across all asset classes.

👉 Discover dYdX, the leading decentralized trading platform

Trade on the leading DEX

⛓️ A platform at the heart of DeFi

Uniswap remains leader in DeFi

As shown in the graph below, Uniswap remains the leading decentralized protocol in terms of volume traded, ahead of PancakeSwap then Dodo and Curve. Moreover, while we are only halfway through November, the platform is already eclipsing the previous month: it currently displays 52 billion dollars traded over the last 15 days against 29 billion in October.

In comparison, PancakeSwap shows 7.55 billion dollars exchanged over the current month and Dodo 7 billion dollars.

Volumes traded on major DEXs over 12 months

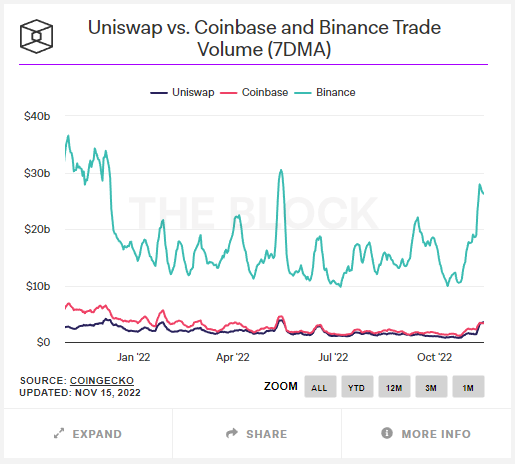

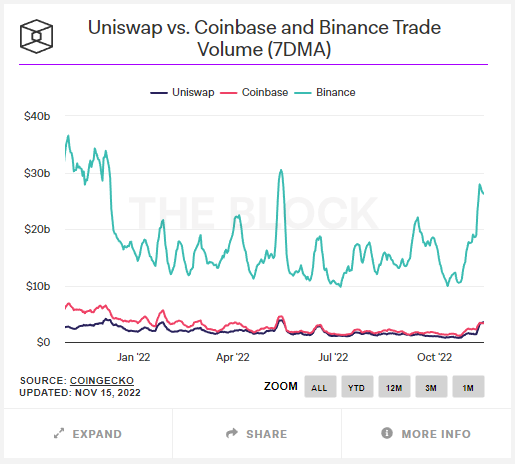

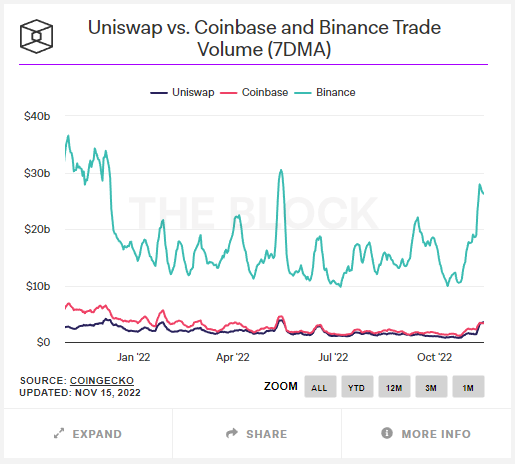

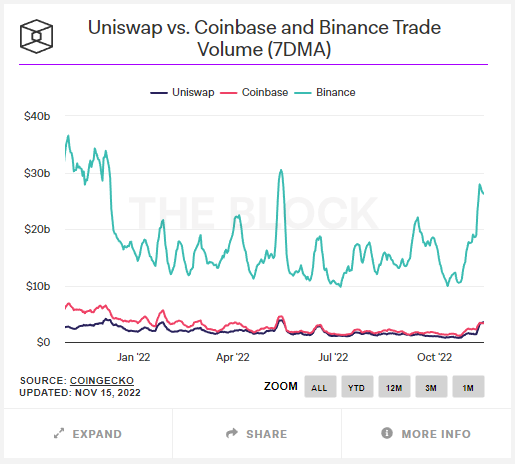

If we want to compare this data with centralized exchanges, we can see that the gap between Uniswap and Coinbase is now minimal since last Junewhere Coinbase previously maintained a certain lead.

Binance remains a big leader, however. of the ecosystem in terms of traded volume, and the trend should increase now that its main competitor FTX is out of the running.

Volumes traded for Uniswap (in blue), for Coinbase (in red) and for Binance (in green)

If the trend continues, Uniswap could well surpass its monthly volume peak of last May which had reached 61 billion dollars.

👉 In the news – The CEO of Crypto.com wants to be reassuring and denies the ambient rumors

The all-in-one crypto app

0 fees for your 1st crypto purchase 🔥 (up to $1000)

Source: The Block

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.