The cryptocurrency market has stabilized for two weeks, limiting the breakage in the wake of the two stall sessions on November 7 and 8. The bankruptcy of FTX has certainly taken a few dominoes with it, but the dynamics of fund withdrawals from centralized platforms have calmed down, with a positive net deposit/withdrawal balance over the last 7 days. Technical analysis suggests that the market is in a long-term buy zone.

Bitcoin, the Stock to Flow indicates a zone of long-term interest for the buying camp

Ignoring the ongoing crisis of confidence in FTX’s post-bankruptcy cryptos, many technical indicators continue to suggest that the price of Bitcoin (BTC) is in a zone of buying interest. on the long term.

The current debate among Chartists is whether the surrender took placethat is to say if the 76% drop since the old all-time high ($70,000 in November 2021) is enough to have downsized the mammoth.

The battleground is between those who see a final dip to $10,000/$12,000 as the missing purge, versus those who have already entered a long-term bullish accumulation phase. You must keep in mind that these technical considerations only have value if the systemic risk is eliminated and at the current stage, its probability is still significant.

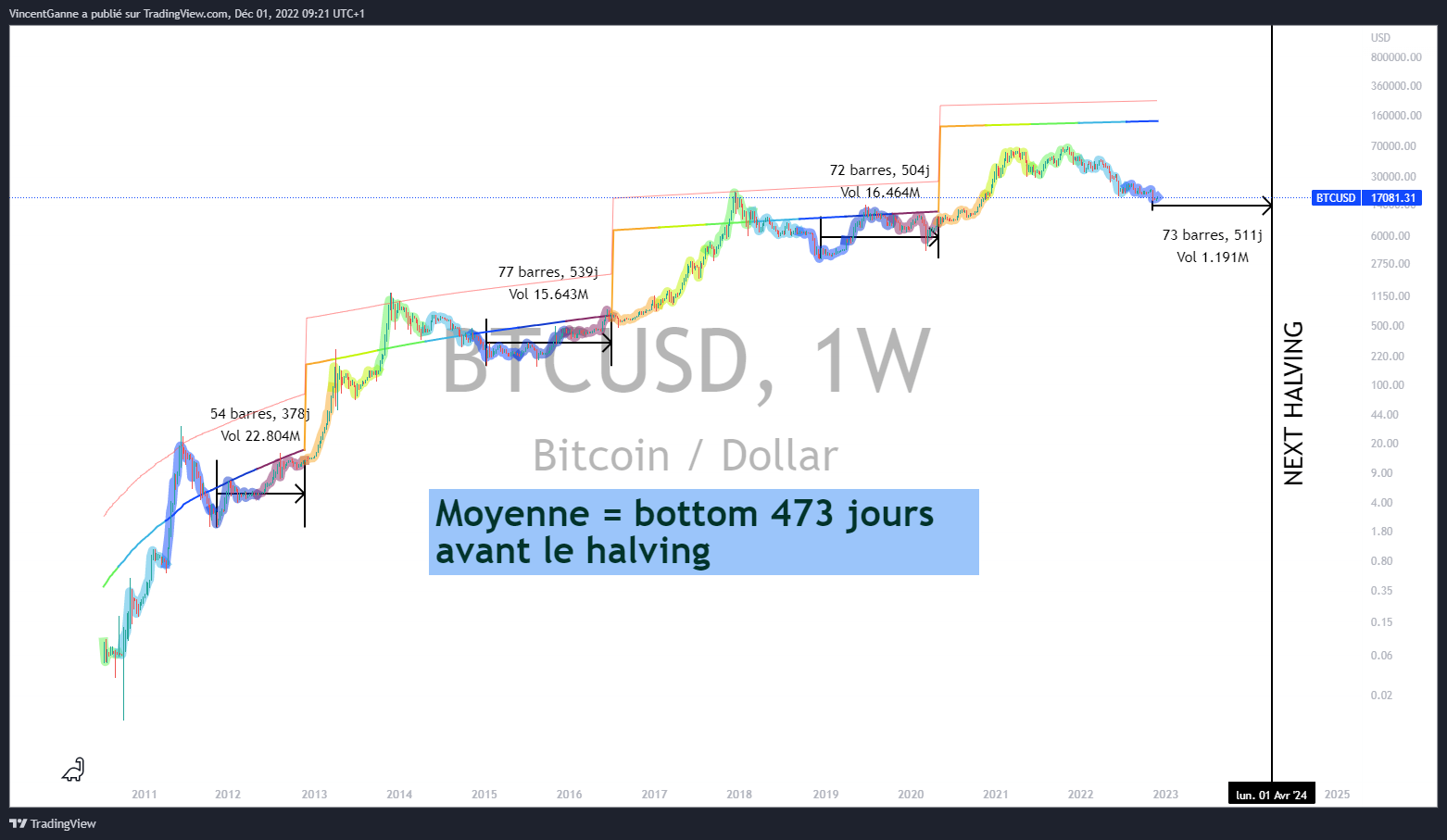

But let’s go to the end of the reflection with a model very popular with Bitcoin maximalists, the Stock to Flow model. This model is based on the relative scarcity of bitcoin, with a rate of production that decreases over time (via the halving process) relative to the use of the stock of BTC in circulation.

As I write these lines, the gap between the price of bitcoin and the line of the stock-to-flow is at an all-time lowclose to the gap level of 2011. The time aspect is also interesting with, on average, a bitcoin price ending its bear market 473 days before the next halving, we are currently 511 days away from the spring 2024 halving .

So you’re going to say, “He looked again and found a deviation from the mean argument in favor of rebounding.” Well yes, but only time will tell if this argument has any merit.

Figure 1: “Stock to Flow” model with indication of the time difference between the bottom of a bear market and the next Bitcoin halving

💡 Do you like Vincent Ganne’s technical analysis? Daily, he carries out exclusive analyzes on the Toaster, our group of experts to help you progress in the cryptocurrency market:

Vincent Ganne analyzes the crypto markets every day on our Premium group

On the technical level, a divergenceThe bullish e is forming on the weekly chart

The total crypto market capitalization and bitcoin price leveled off fairly quickly in the wake of FTX’s bankruptcy, however, no bullish reversal chart pattern has yet been validated.. It should be understood that as long as BTC remains below the major chart resistance of $20,000, it is the bear market that continues to have the upper hand and the target of $12,000 is engaged.

But on a personal level and àmha (for in my humble opinion; I like this acronym), this price zone is too consensual, everyone is waiting for it, even the “findumondistes”.

Be that as it may, it can be joined at the slightest fundamental bad news, that, I grant you. On the other hand, I continue to see bullish technical divergences since the last market drop, especially the one clearly visible on the RSI technical indicator in weekly data. In short, only the God of the stock market has the final answer.

Figure 2: Chart exposing weekly Japanese Bitcoin price candles

👉 Find our complete guide to buy Bitcoin (BTC)

The platform that simplifies trading

Buy crypto in minutes

Source: Figures 1 and 2 – TradingView

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.