Zoom on yuzu, a platform allowing you to generate attractive returns with your euros or your cryptocurrencies while actively supporting eco-responsible projects. This completely free application offers flexible, transparent and simplified savings through the use of stablecoins and decentralized finance (DeFi).

Learn about simplified savings with yuzu

Simplified savings, accessible at all times and actively working for the environment: this is what yuzu, a French startup, sums up which offers an innovative investment booklet.

yuzu was shaped by Clément Coeurdeuil and Stanislas de Quénetain2 entrepreneurs who benefit from a strong experience in finance and innovative technologies.

Clément Coeurdeuil led the fintech Budget Insight for about ten years before becoming president of Mango 3D, a benchmark 3D printing company. On his side, Stanislas de Quétenain spent 13 years in leading financial institutions such as Goldman Sachs, Crédit Agricole or JP Morgan, of which he was vice-president in charge of legal matters.

Drawing on their respective past experiences, they came up with the idea of creating a one-of-a-kind savings account: profitable, durable, liquid and secure. at yuzu, your funds work for you. yuzu proposes a target of 6% interest (held from February to November 2022), and funds available at any time. However, this return target is not guaranteed.

What further differentiates yuzu from the classic Livret A, is that your interest is paid to you from the first day and from the first euro depositedwith no payment cap.

In addition, your funds can be withdrawn at any time, the time of a transfer. And to reassure its customers, yuzu has set up a solvency ratio of 8% to guarantee client funds in the event of any losses, as stated in the general conditions of use. On the other hand, yuzu is registered as a digital asset service provider (PSAN) with the Autorité des marchés financiers (AMF).

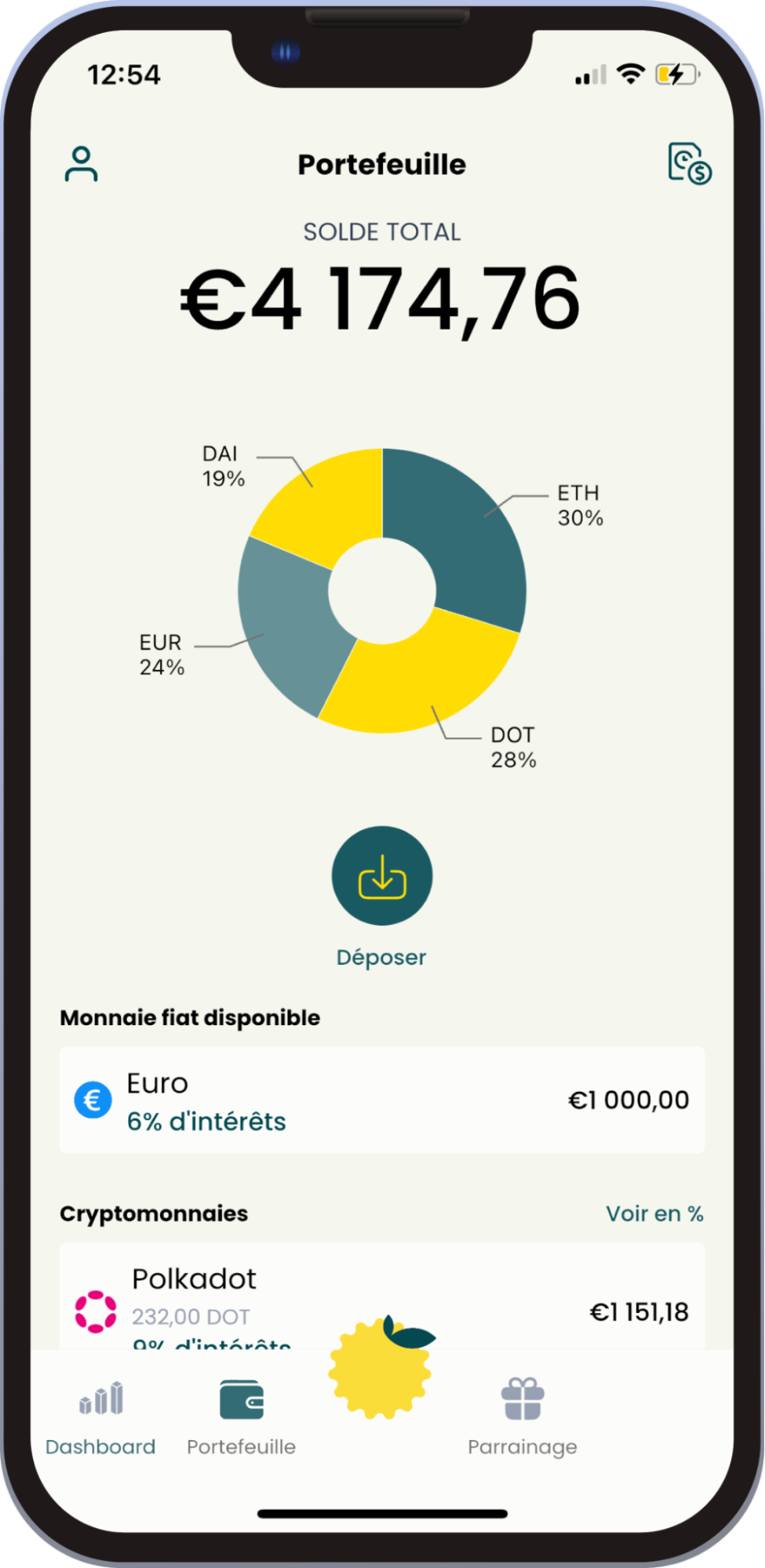

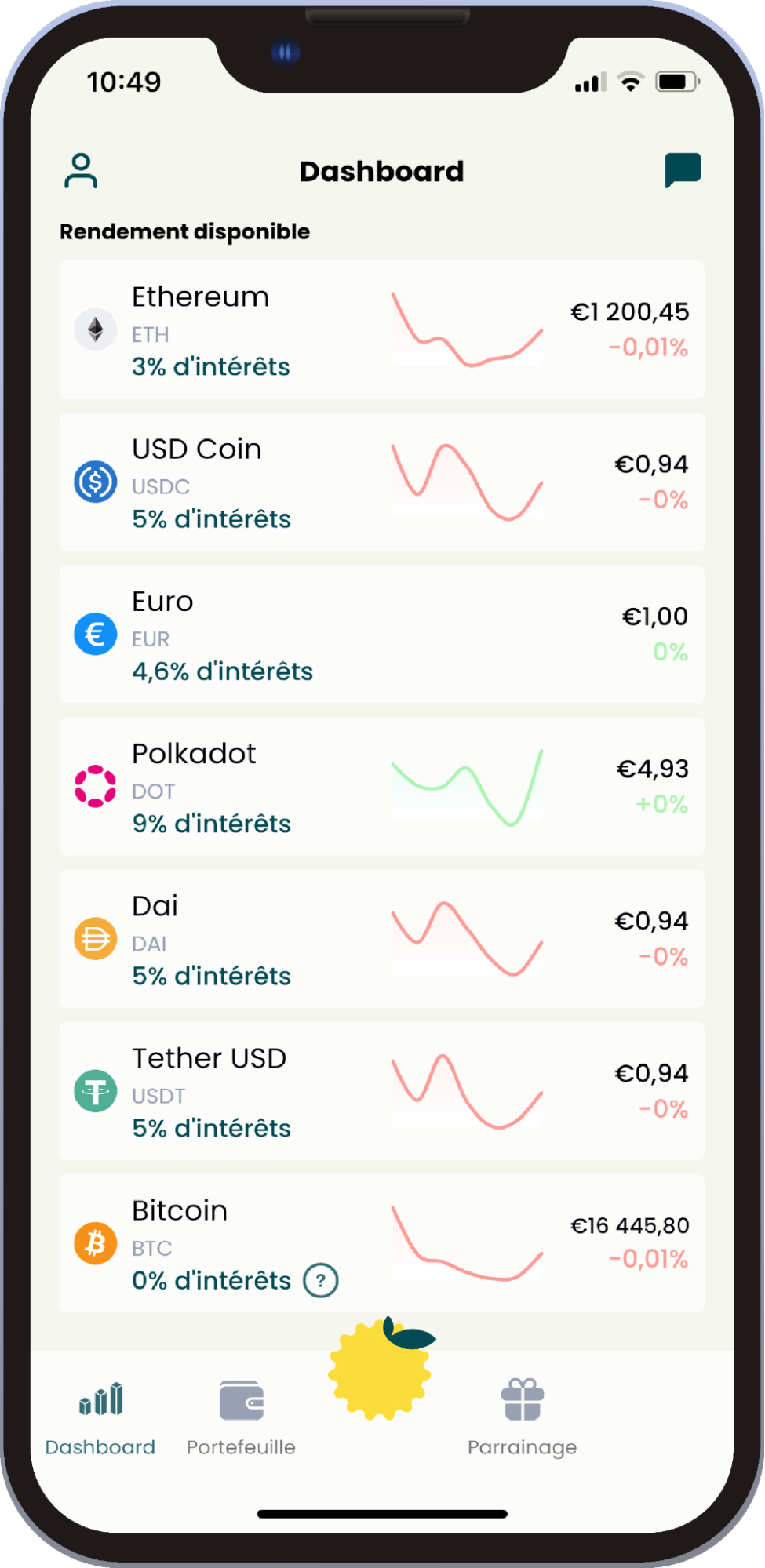

yuzu works through a mobile application, which has the merit of being very fluid and really easy to use.

Overview of yuzu mobile app interface

Only crypto company signatory to the UN Global Compact, yuzu is actively invested in the ecological transition, and has implemented a methodology for measuring, avoiding and offsetting its emissions. It is therefore carbon neutral insofar as it fully offsets its emissions. In addition, yuzu offers its customers the opportunity to use their yields themselves to offset their own carbon footprint.

In order to choose and monitor these ecological projects, yuzu surrounded himself with Stock CO2, a French startup that helps companies offset their carbon footprint. The projects financed (reforestation, methanization) are all located in France, and labeled low-carbon by the Ministry of Ecological Transition.

Do you want to buy Bitcoin (BTC), but are you worried about the pollution caused by mining? According to calculations, yuzu estimates that 1 BTC emits between 1.5 and 3 tons of CO2 per year. Placing 1 BTC at yuzu means 8 to 12 tons of CO2 are captured each year! Because yes, you can deposit euros with yuzu, but also certain cryptocurrencies such as Ether (ETH), BTC or even DOT from Polkadot.

👉 Download the yuzu app from Google Play or App Store

First of all, it should be noted that yuzu offers compound interest on its passbook. That is to say, the earnings you generate (on a daily basis, again) are continually added to the amount initially invested.

More simply, if you decide to invest 100 € in yuzu, you will receive 6.18 € per year, and not only 6 €: after the second day of your first deposit, the 6% investment of yuzu will consider on the one hand your initial investment, but also the gain of the day before. In other words, with yuzu, you can claim 6.18% APY (for Annual Percentage Yield) and 6% APR (Annual Percentage Rate). And for the sake of transparency, the company communicates on all of its past daily returns, which may go up or down depending on the market. In 2022, the rate of return is 6.48%.

To meet its goal of 6% returns, yuzu turns the funds you deposit into stablecoins to make them work for you. The use of stablecoins has 2 advantages here: on the one hand, this type of cryptocurrency is much less volatile than the others, since it is by definition assumed to remain stable following the price of a real asset. And since most stablecoins are in dollars, yuzu handles the EUR/USD hedging for you.

These stablecoins are mainly invested in liquidity pools. Simply put, a liquidity pool, in DeFi, is made up of 2 separate cryptocurrencies serving as an exchange reserve for users wishing to switch from one to the other. If we transpose this to a fiat currency model, you could for example immobilize 100 euros and 100 dollars on a EUR/USD liquidity pool, which will serve as an exchange reserve for users wishing to exchange dollars against euros and Conversely.

The decentralized platforms in question, such as Uniswap (UNI) or Compound (COMP), reward users depositing funds into these liquidity pools. It is on this model, among others, that yuzu makes it possible to generate returns.

Overview of the different yields offered by yuzu at the time of this writing

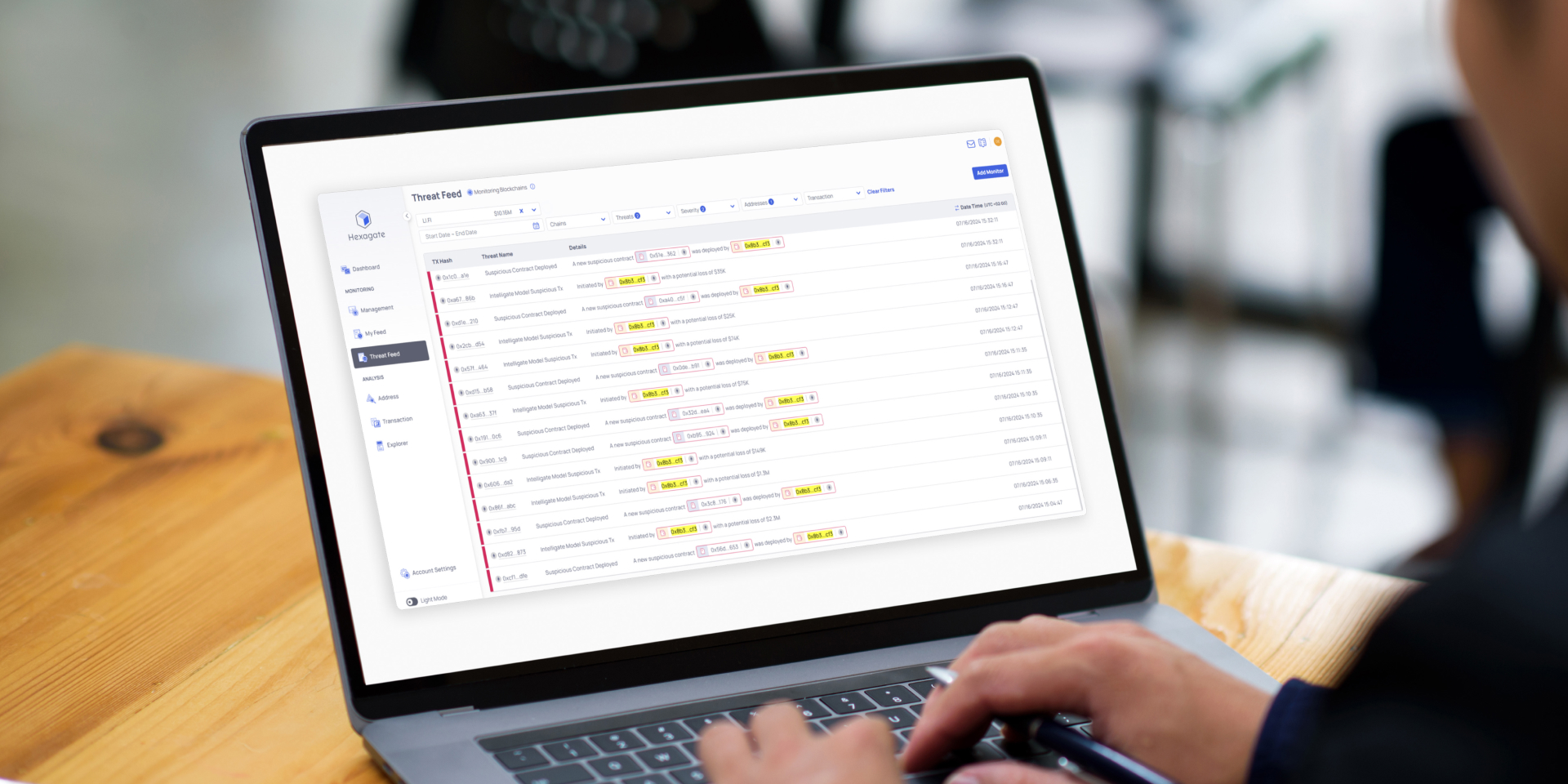

As you know, decentralized finance (DeFi) is not risk-free due to its intrinsic functioning. It is precisely for this reason that yuzu invests in several different protocols and above all, with several stablecoins, in order to limit its exposure.

Also, yuzu investments are continuously monitored to prevent any risk induced by the cryptocurrency market: if a stablecoin loses its parity or the total locked value (TVL) of a pool drops to a level deemed dangerous, yuzu will immediately come out of its exhibition to the relevant stablecoin or pool.

The potential loss related to these emergencies is supported by yuzu’s own funds, as they did during the fall of the UST or during the crisis of FTX.

Our conclusion on yuzu green saving

” Combine business with pleasure as the saying goes. With yuzu, it is now possible to generate attractive and secure returns while working effectively for the environment. Thanks to its collaboration with Stock CO2, yuzu makes it possible to invest in a carbon-neutral booklet, but also allows everyone to finance eco-responsible and sustainable projects thanks to its returns.

Its various liquid staking-based investments help ensure continuous liquidity for users, allowing them to withdraw their funds whenever they want. This already significant flexibility is supported by the compound interest mechanism of the bookletwhich generate returns from the first day of investment, from the first euro.

In addition, using yuzu is totally free : the company does not charge any deposit fees, management fees or custodial fees on the returns displayed. yuzu aims to generate a performance of 9% and give a return of 6% to its customers.

If you still have questions about yuzu, we invite you to read their page dedicated to frequently asked questions.

👉 Stay up to date with the latest yuzu news by following them on Twitter

This is a sponsored and paid article. Cryptoast has done prior research on the products or services presented on this page but cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.