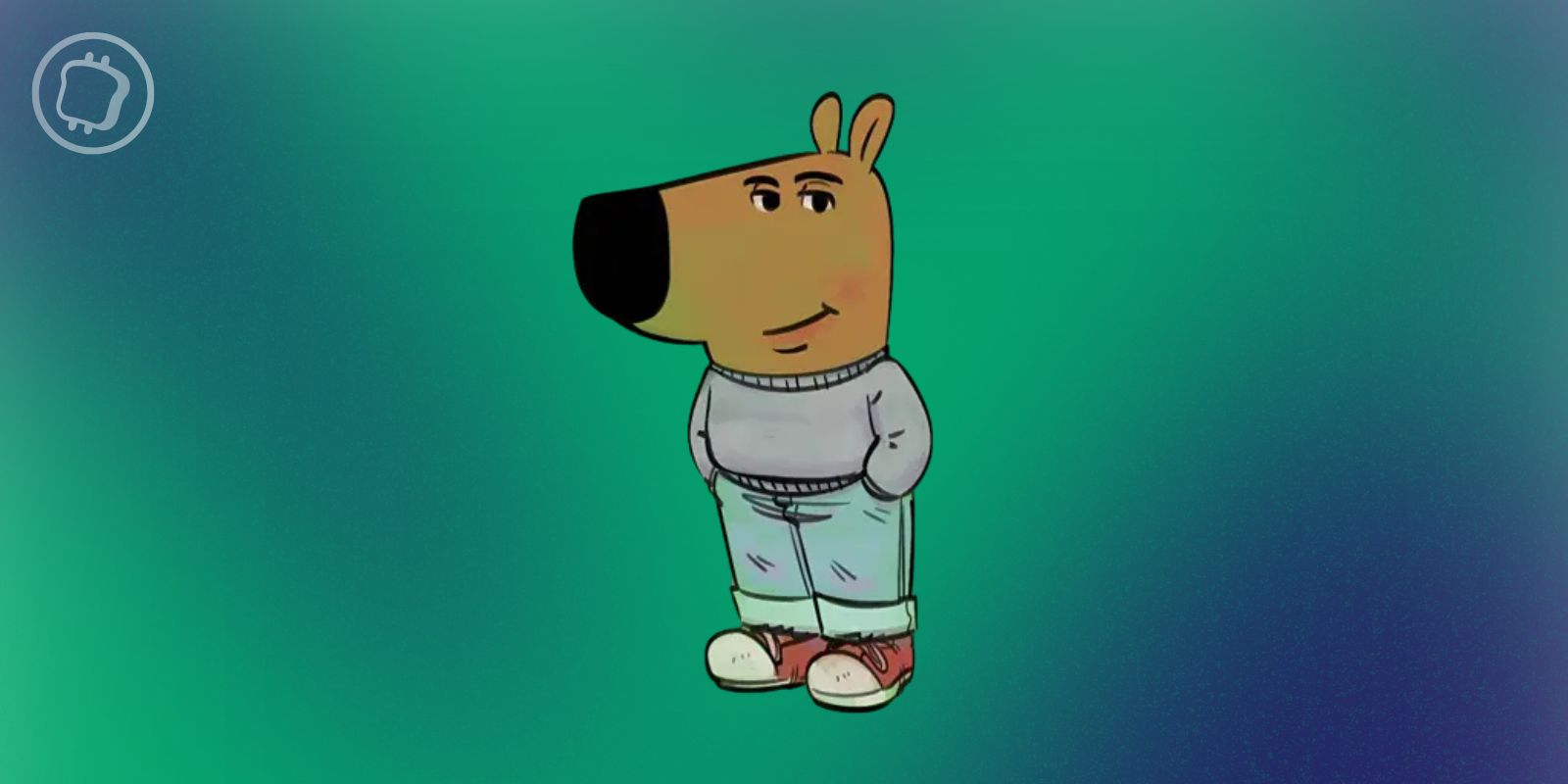

In the past 24 hours, the Lido protocol has emerged as the top protocol in the decentralized finance (DeFi) ecosystem by total value locked (TVL) after beating out MakerDAO (MKR). Thus, almost 6 billion dollars of Ethers (ETH) are currently staked on the liquid staking platform.

Lido, now the first DeFi protocol

The Decentralized Finance Protocol (DeFi) Lido just overtook MakerDAO (MKR) in terms of total value locked (TVL), effectively becoming the first DeFi protocol in the ecosystem on this metric. Thus, Lido now has more than 15% of all total value locked within the DeFi ecosystem.

Top 5 DeFi protocols across all blockchains

Lido is what is known as a liquid staking protocol, a method that allows users to deposit and immobilize a cryptocurrency in exchange for its equivalent to be able to take advantage of DeFi. For example, Lido is commonly used for deposit ether (ETH) in exchange for stETH (for Lido Staked ETH).

🎙️ Listen to this article and all the crypto news on Spotify

This is a relatively democratized technique within decentralized finance which makes it possible to maximize the speculative aspect of its assets, and which allows de facto to vary their exposures.

So, according to Dune Analytics, Lido is by far the leading Ether staking protocolin front of the main exchanges such as Coinbase, Kraken or Binance:

Depositarys on the Beacon Chain from 2020 to present

Although Lido supports different networks, including Solana (SOL), Polygon (MATIC), Polkadot (DOT) or Kusama (KSM), this protocol is very mainly used for Ethereum staking, a feature that has been particularly popular since the transition from blockchain in Proof-of-Stake (PoS). Proof of this success, at the time of writing these lines, around $5.9 billion worth of ETH is staking on Lido.

Following this progression, the price of the Lido utility token, the LDO, increased by 15.7% over 24 hours. The latter is currently trading at $1.16, still much lower than when it reached its highest price (ATH) of $7.30 in August 2021.

👉 Read our guide to understand all about the importance of TVL in DeFi

The reference platform to buy and trade more than 600 cryptos

10% off your fees with code SVULQ98B 🔥

Sources: DefiLlama, Dune

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.