We learn following the publication of a legal document filed on January 20 with a New York court, that US federal authorities have seized $700 million in assets belonging to Sam Bankman-Fried. These funds include 56 million Robinhood shares, cash and accounts held at Binance.

SBF sees its assets seized by American justice

According to information revealed by our colleagues at CNBC, US federal prosecutors reportedly seized approximately $700 million in assets belonging to Sam Bankman-Friedthe former CEO of bankrupt exchange FTX.

According to documents filed with the court for the Southern District of New York, publicly available, the majority of the funds involved here would be in the form of Robinhood shares. The latter are at the heart of a conflict between SBF and the cryptocurrency lender BlockFi as well as the new management of FTX.

The latter all claim ownership of these approximately 56 million shares which were previously stored with the broker ED&F Capital Markets. At the current HOOD stock price, the total value of the loot amassed by federal prosecutors for this purpose is approximately $533 million.

🎙️ Listen to this article and all the crypto news on Spotify

The American justice supported the seizure of the assets by alleging that these actions had been obtained thanks to the funds stolen from the customers of the exchange. Sam Bankman-Fried, who pleaded not guilty to the 8 charges against him, denies using client funds for illegal purposes.

👉 Must Read – Cryptoast’s 1st NFT collection is out

Cryptoast launches its 1st collection of NFTs

NFTs associated with a collector paper journal 🔥

Other assets seized here and there

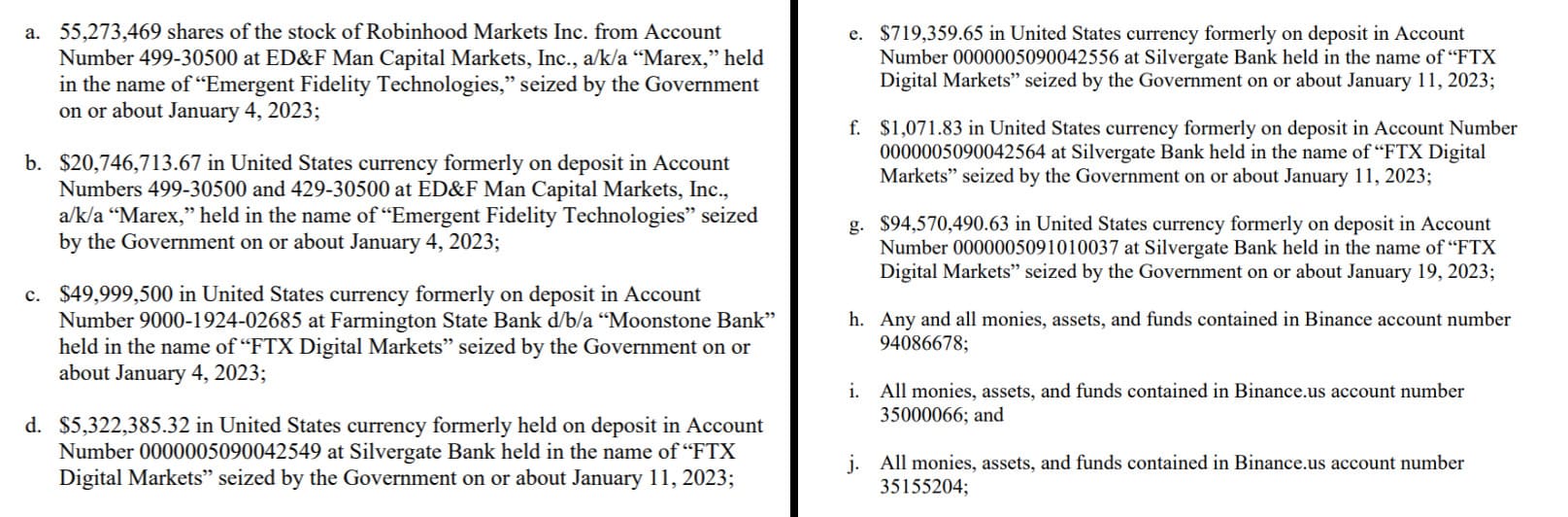

According to the document filed on January 20, a certain amount of other assets may have been seized. The nearly $700 million seized here is scattered around in the form of cryptocurrencies, cash and stocks.

As we can see in paragraph b, more than 20 million dollars were seized within the broker ED&F Capital Markets as Emergent Fidelity Technologiesan Antiguan company majority-owned by SBF, which also owned the previously listed Robinhood shares.

$50 million were seized from an account denominated in the name of FTX Digital Markets, a Bahamian subsidiary of FTX, within Moonstone Bank.

The latter may have had a close relationship with the empire built by Sam Bankman-Fried, since she had received approximately $11.5 million from Alameda Research in January 2022. However, the latter very recently issued a statement indicating that it was abandoning the crypto space following the collapse of FTX.

Preview of the court document regarding the seizure of the assets of Sam Bankman-Fried

Moreover, approximately $100 million was seized on different accounts belonging to FTX Digital Markets in the vaults of the Silvergate Bank. This crypto-bank was also very affected by the collapse of FTX, since it recently revealed a net loss of 1 billion dollars for the last quarter of 2022.

3 accounts hosted on the Binance cryptocurrency exchange platform were also seized by the courts, but the amounts held there were not disclosed in the document.

👉 Related – FTX CEO Talks Possibility of Relaunching Exchange – FTT Climbs 40% on Statement

An intuitive platform to start crypto

€10 offered by depositing €50 or more on Young Platform 🔥

Source: CNBC

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.