Sample letter for free download: property tax assessments are often full of errors – so file an objection

Anyone who receives the property tax assessment from the tax office should check it carefully. If there are errors in the notification, you must file an objection as soon as possible, as you have little time to do so. The easiest way to do this is with a sample letter.

Anyone who has submitted the property tax return will eventually receive a letter from the responsible tax office. There are usually two notices in the envelope, which you should examine carefully. In this article, we explain exactly what the notifications mean and what you need to pay attention to.

As stated in the instructions on legal remedies on the notifications, you have only one month to appeal. So if you find one or more errors, you should take action. It’s easy to do with a sample letter.

This is how it works with the property tax return

With the WISO tax program, the property tax declaration can now be made in no time at all. About FOCUS online you get the tax software for exclusive special price of only 26.99 euros. Normal price is 29.99 euros.

Objection due to error in property tax assessment

There are enough sources of error. For example, you might have made a typing error when filling out the form or the tax office made a calculation error. In any case, you can calculate everything with a real estate tax calculator.

As a rule, you will appeal against the real estate tax assessment. An informal letter to the responsible tax office is sufficient for this. In addition to the name and address, the file number is always important so that everything can be assigned correctly.

It is good if you also give a reason for the objection. However, if this does not work in the short time, you can also simply state that you will submit the reason later. With a sample letter, the objection works very easily.

Property Tax – The Big Guide – PDF

The reform for the new property tax is complex – and this year it will require owners. You have to submit some data to the tax office. You have to be very precise and observe special deadlines. In our large guide you will find all the information you need to know in a compact form.

Property tax assessment: file an objection by Elster

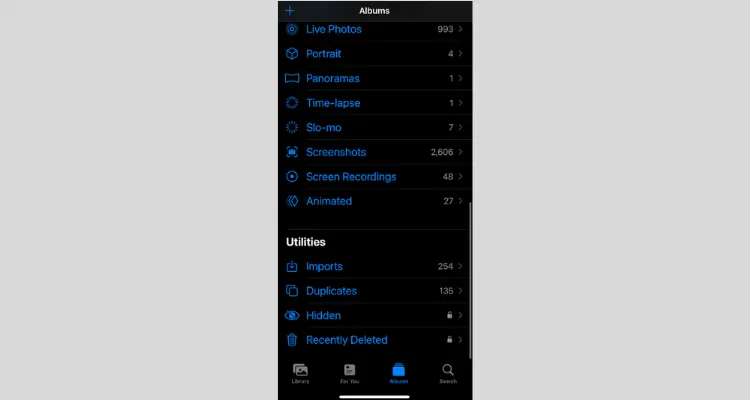

The tax office prefers to receive your data via Elster, i.e. digitally. This makes further processing easier, but the authorities then reply by printed letter.

However, you can also use Elster for the objection instead of writing a letter. To do this, log in to Mein Elster and control the area All forms at. Right at the top below Requests, Objections and Notices call objection and click through the wizard.

At Item 3 administrative act Please make a choiche Valuation – real estate tax valuation of real estate out, put as Deadline 01/01/2022 enter and submit Date of the administrative act the date stated on your notification. If you want to report a bug, choose No request for suspension of execution out of.

Contact the tax office

Since money is involved, many people are wary of the tax office. But don’t worry, normal people work there and you can simply get in touch if you have any questions. Find out which tax office is responsible for your property tax.

You can use the tax office search to find out the necessary contact details and opening hours, so that you can simply ring the bell. In this way, misunderstandings should also be able to be clarified over short official channels.

34,000 percent! The background to Germany’s most glaring property tax increase

Property tax shock: Where it will be more expensive in 2023 – and who will be spared

2560610/CHIP

;Resize=(1200,627)&impolicy=perceptual&quality=medium&hash=6836f1957a094cda0c615268a5c0c8a0663ecb4a3eb7813873be111dd654c885)