The latest business cycle aggregates have signaled an increase in the likelihood of an economic recession in the West and therefore an equivalent increase in the likelihood of a Federal Reserve (FED) pivot this summer. What can be the impact of this fundamental combination on the crypto market as Ether (ETH) seems to want to outperform Bitcoin (BTC).

The probability of an economic recession in the United States is revised upwards

Stock markets are currently facing a tough dilemma, especially so-called “risky” financial assets such as the stock market and the crypto market. So what is it?

The latest economic data updates in the United States, including the Purchasing Managers’ Indices (PMI) from the Institute of Supply Management (ISM), have reinforced the probability of an economic recession on the horizon. 12 months for the world’s largest economy.

The manufacturing sector, subject to new bank and bond financing conditions (the powerful upward cycle in interest rates that has been developing for 15 months), seems set for a contraction in its activity and a reduction in its prospective profits.

Taken in isolation, this fundamental anticipation is a downward factor for risky assets on the stock market. But things are not so simple, because this increase in the probability of a decline in GDP in the United States (and in the West in general) increases another probability, that of seeing the Federal Reserve of the United States reverse monetary vapor and re-engage in a downward cycle of its interest rates to prevent the unemployment rate from soaringa systematic phenomenon in real economic recession.

Nevertheless, this potential downward monetary inflection is a bullish recovery factor for the equity market and the price of bitcoin. Ultimately, which of these two factors will prevail over the other? I can answer you as follows: whoever knows the certain answer to the above question will be able to predict the medium-term trend (these next few months) for the price of cryptos.

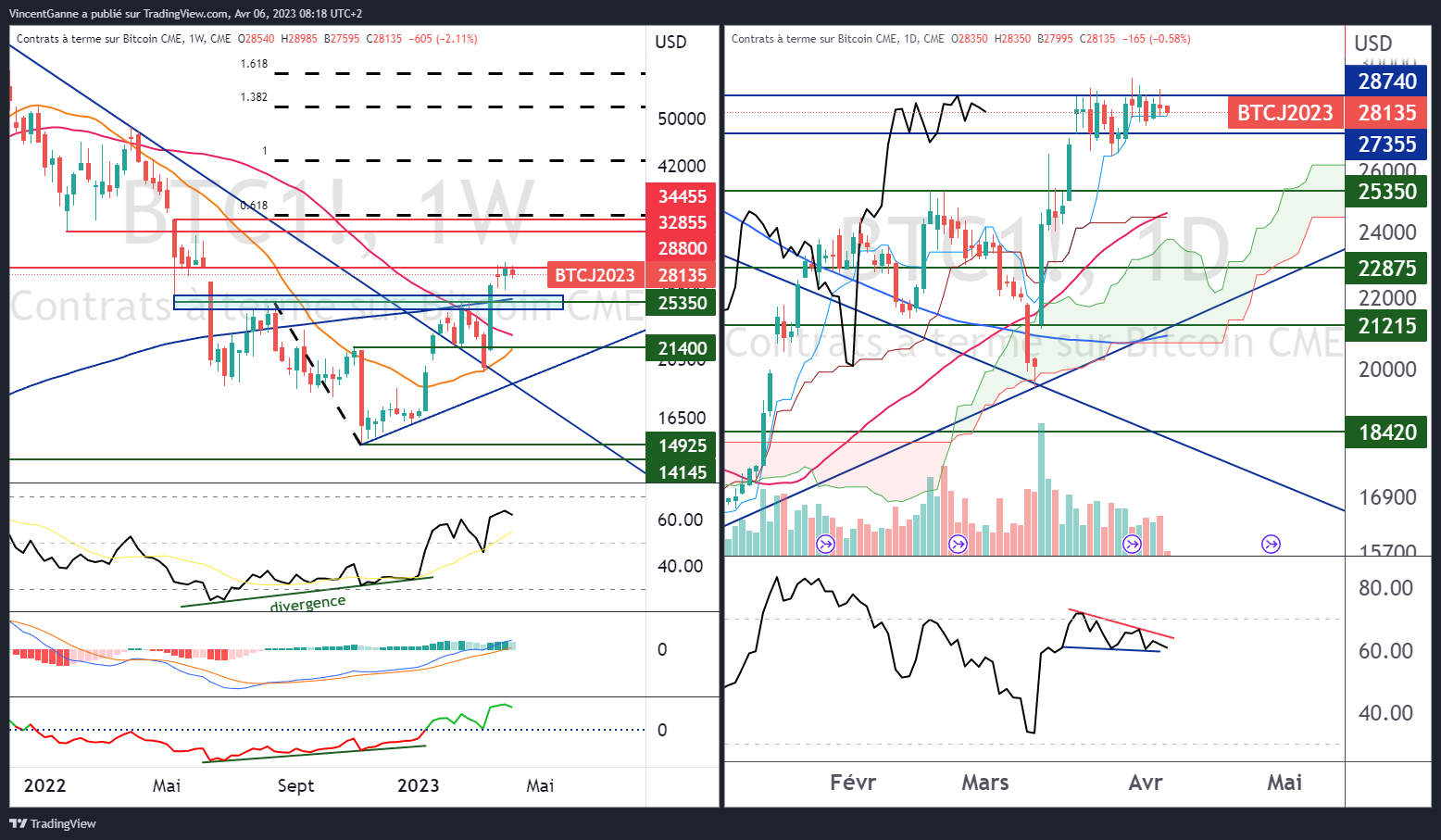

Meanwhile, Bitcoin (BTC) price still faces major technical resistance at $29,000, the latest strong chartist argument for permabears because if this resistance is overwhelmed, then the BTC will go to 35,000 dollars minimum.

On the other hand, it is quite possible that the market will enter a retracement to make a return movement (pull back) towards the new strong support at 25,300 dollars, before resuming the path of the rise.

In terms of the invalidation of the rise, it is the breakout of $25,000 that would spell the end of the annual rebound of the crypto market. The technical choice will be made on the basis of fundamental data, such as the publication of the US NFP report on Friday April 7 at 2:30 p.m.

Chart that juxtaposes weekly Japanese candles (left) of bitcoin price with daily Japanese candles (right)

Chart that juxtaposes weekly Japanese candles (left) of bitcoin price with daily Japanese candles (right)

👉 Buy crypto through ZenGo’s ultra-secure wallet

Discover ZenGo

$10 Bitcoin bonus from $200 deposit 🔥

Ether Could Start Outperforming Bitcoin As Shanghai Update Looms

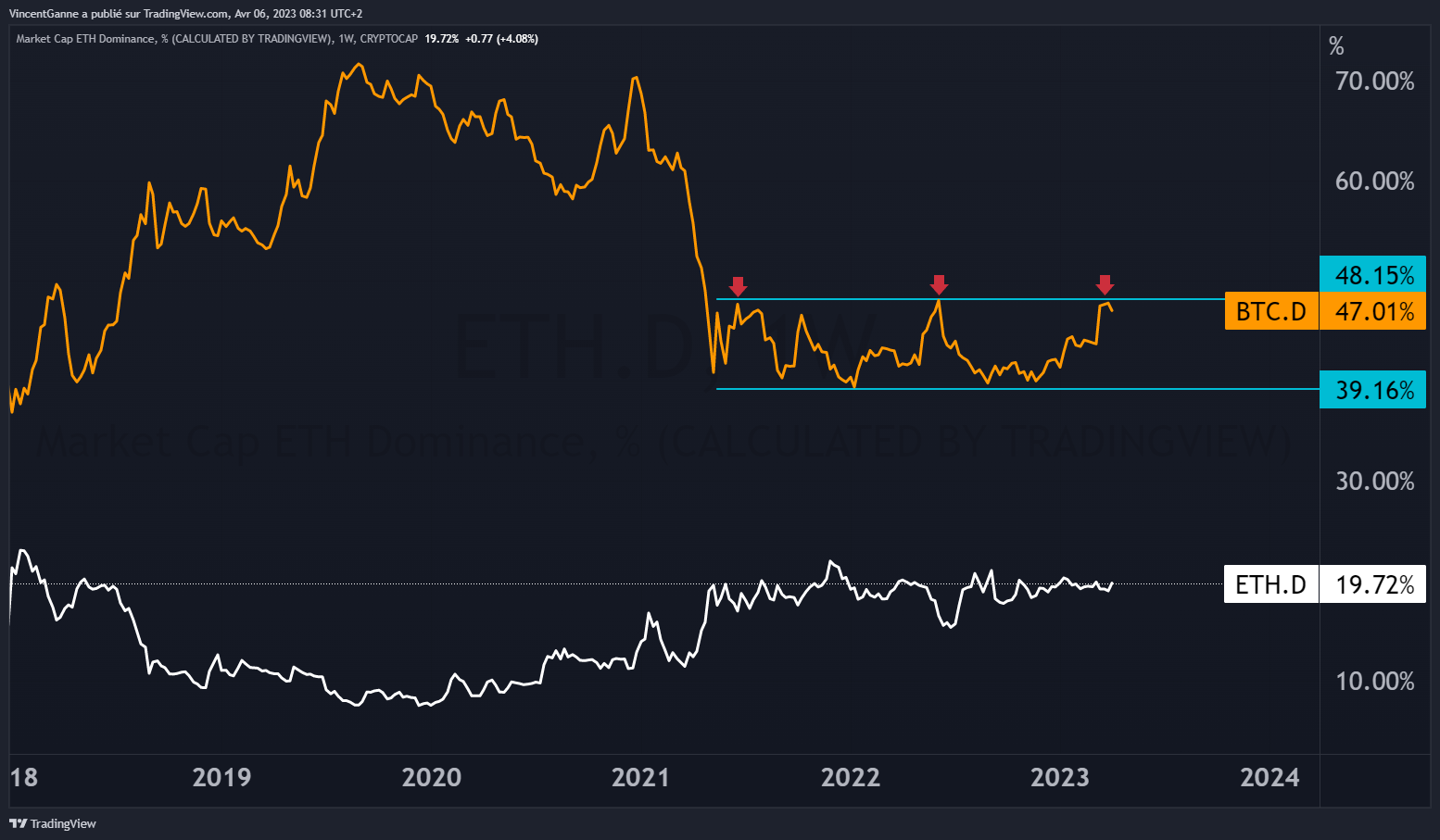

Ethereum’s Shanghai update is due on April 12 and it looks like the price of Ether is in the process of starting a phase of outperformance on the price of bitcoin. Technical analysis applied to dominance curves shows that bitcoin dominance is currently trading under resistance while ETH dominance seems to finally be waking up.

This better relative behavior of ETH on BTC could still last for the next few days.

Chart that compares Bitcoin dominance with Ehereum dominance

Chart that compares Bitcoin dominance with Ehereum dominance

👉 Find our explanatory guide to buy Ether

ETH crypto is available on Binance

-10% on your fees 🔥

Find exclusive analyzes by Vincent Ganne on Cryptoast Research, the ideal place to succeed in your cryptocurrency investments. You will learn how to position yourself on strategic price levels, identify investment opportunities and anticipate price movements. Join us now and take charge of your crypto investments.

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.