On Thursday, the European Central Bank (ECB) continued its measures to try to bring inflation down to 2%, adding 25 basis points to its 3 interest rates. Earlier this week, the Fed made a similar decision.

The European Central Bank (ECB) raises interest rates

With soaring inflation in recent years, central banks around the world have been forced to review their monetary policies. It is therefore in this dynamic that the ECB announced on Thursday that it was raising its 3 key rates by 25 basis points.

In this way, the interest rate for the main refinancing operations goes to 3.75%, those of the marginal lending facility to 4%, and 3.25% for the deposit facility. These measures will take effect from May 10.

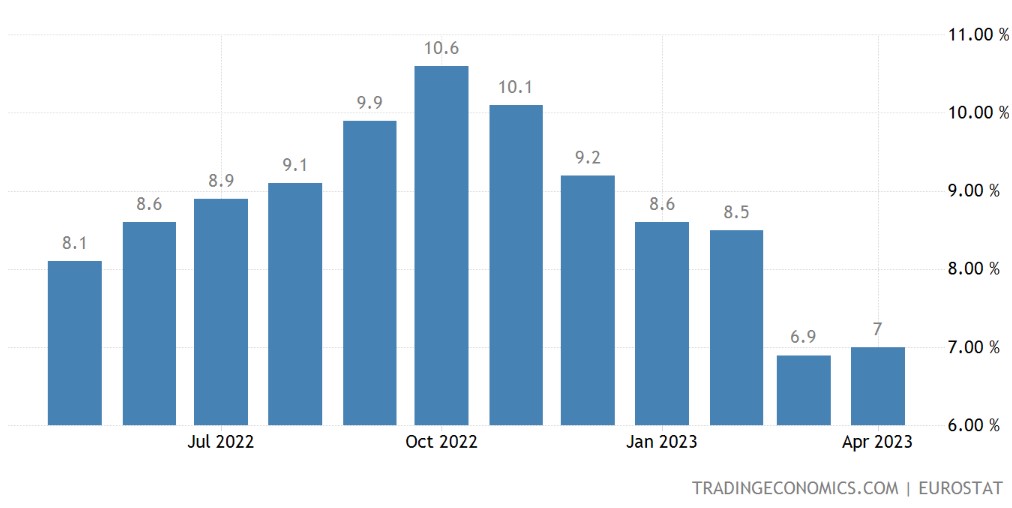

The purpose of these rate hikes is to bring inflation down to 2%while it was 7% in April in the euro zone:

Figure 1 — Consumer price inflation rate in the euro area

If the rate hikes have started to produce their effect, there is still a long way to go and the ECB indicates that these will be maintained as long as necessary :

“Future decisions by the Governing Council will ensure that policy rates are reduced to levels restrictive enough to allow inflation to return quickly to the medium-term objective of 2% and will be maintained at these levels for as long as necessary. »

In addition, Christine Lagarde, President of the ECB, specified in her speech informing about this rate hike that April food inflation was 13.6%. As for inflation excluding food and energy, it is 5.6%.

👉 To go further — Find our guide to buying Bitcoin (BTC)

Buy crypto on eToro in minutes

Similar choices in the United States

Before the ECB, the Federal Reserve of the United States (Fed) had also chosen a rate hike on Wednesday. There too, the “fed funds rates” have seen an addition of 25 basis pointsas the consensus expected, bringing these rates to 5.25%:

Figure 2 — Fed interest rate

As the chart above shows, a policy of continuous rate hikes has been in effect for a year now, and the next decision is due on June 14.

For its part, the price of Bitcoin was not particularly affected by these various macro-economic news, and continues to evolve in its range of 27,000/30,000 dollars, to just over 29,000 dollars during the writing these lines.

👉 Also in the news — Bitcoin (BTC), the FED could pivot this summer!

Our service dedicated to cryptocurrency investors. Get real-time analytics and optimize your crypto portfolio.

Sources: ECB, Trading Economics

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.