This week reminds us that the crypto market is always and first and foremost facing its own demons, the issues of regulation of crypto platforms which are still in the process of being put in place. For the annualized uptrend in the price of bitcoin, it is the resurgence of an endogenous challenge just days before the FED and as the market tests a pivotal chart zone.

Regulation, the issue of the long-term upward trend

The Coinbase/Binance affairs are a reminder of how important it is for High Finance to see the cryptocurrency market acquire regulation close to the standards of traditional finance. The American financial markets regulator, the SEC, has decided to go the second step to force the two giants of the so-called centralized crypto sector to respect the rules of the game in order to secure their long-term maintenance on the United States market.

In my opinion, this is a new resurgence of a fundamental debate that does not question the annual upward trend in the price of Bitcoin (BTC), on the contrary it comes to give it structural body if a framework of transparent and efficient regulation was to be put in place in the coming months.

The crypto market is currently experiencing the same legal scheme as the foreign exchange market (FOREX) had experienced in the early 2010s. Regulators then tackled a new market accessible to all traders and only players who had agreed to play regulatory framework had been able to benefit from strong sustainable growth over the long term.

Clearly, the giants of the category (Binance and Coinbase) have every interest in being proactive, voluntarily complying with all the requirements of the regulators, this will be for them the first root of the expansion of their activity in the long term. Indeed, the flows of high finance require this new regulatory framework to which they are accustomed on the other classes of assets on the stock market.

The year 2023 represents a good timing to make deep progress on the regulation of cryptos and thus benefit in 2024 from a healthy infrastructure for the next bull run which will not fail to happen as the date of the next halving approaches.

Note that in terms of stock market barometers, the BNB/USD token is testing a technical pivot zone at $250 in the short term, the price reaction will tell whether the storm triggered by the SEC is behind us or not.

Chart made with the TradingView site and which shows the Japanese BNB/USD candles in daily data

Chart made with the TradingView site and which shows the Japanese BNB/USD candles in daily data

👉 Discover our complete guide to investing in Bitcoin (BTC)

Discover ZenGo

$10 Bitcoin bonus from $200 deposit 🔥

All eyes are on the FED next Wednesday

For the crypto market, this Binance and Coinbase business week is a technical breakthrough week and it is a breakthrough week ahead of time. Indeed, the market’s attention is primarily focused on the next monetary policy decision of the Federal Reserve (FED) which will be unveiled on Wednesday, June 14 with a market consensus in favor of a pause in monetary tightening.

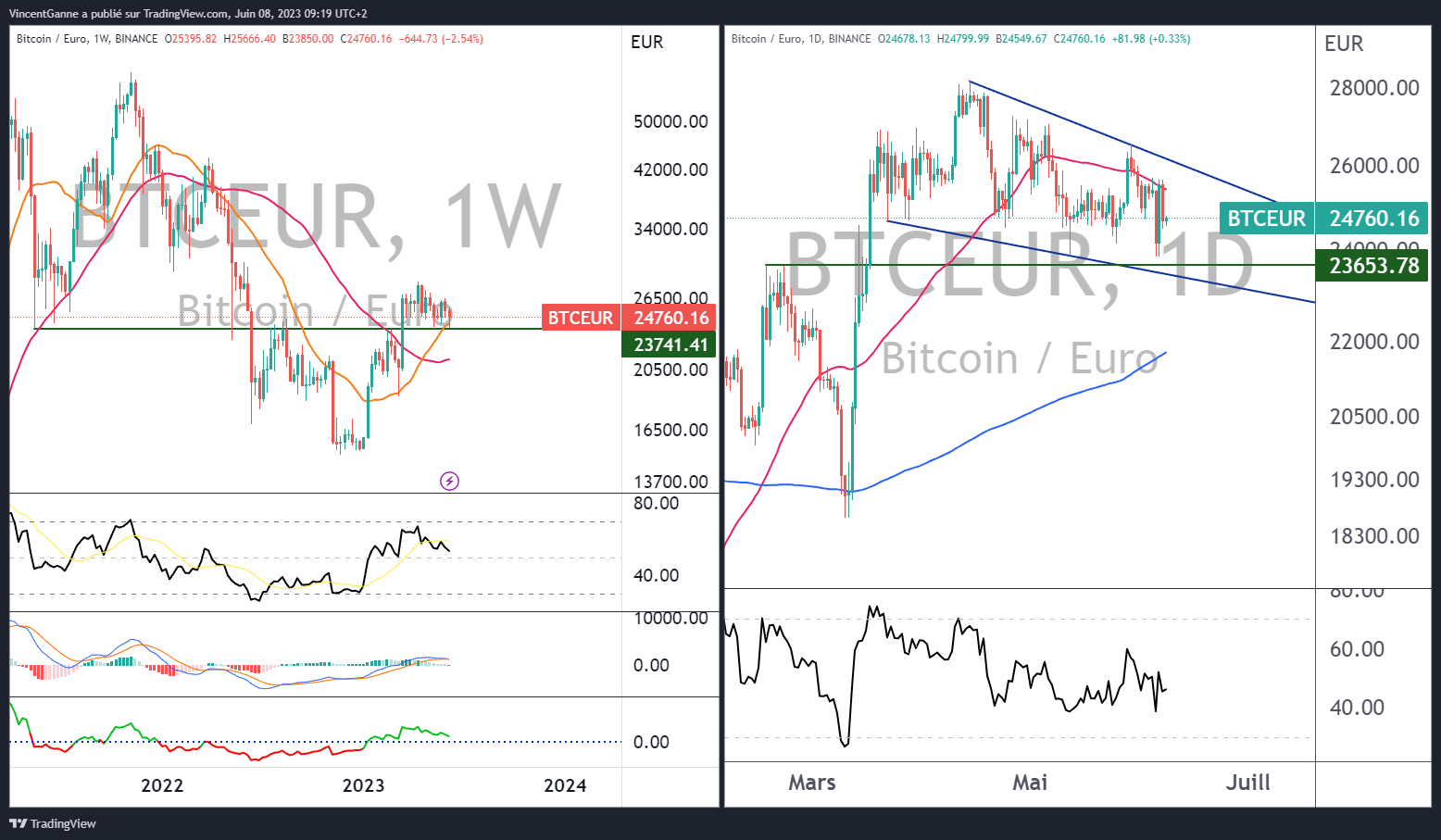

Technically, it is possible that the price of bitcoin will not be patient until this date to make its chartist choice. because it is already and since Monday, testing the pivot chart zone, the last one that ensures the bullish trend in place since the beginning of the year : the 23,000 and 24,000 on the bitcoin/euro pair.

Chart made with the TradingView site and which juxtaposes the weekly and daily Japanese candles of the price of BTC / EUR

Chart made with the TradingView site and which juxtaposes the weekly and daily Japanese candles of the price of BTC / EUR

👉 Do you want to trade? Find our dYdX tutorial, the most complete DEX for trading cryptos

Trade on the leading DEX

⛓️ A platform at the heart of DeFi

Find exclusive analyzes by Vincent Ganne on Cryptoast Research, the ideal place to succeed in your cryptocurrency investments. You will learn how to position yourself on strategic price levels, identify investment opportunities and anticipate price movements. Join us now and take charge of your crypto investments.

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.