In the competitive universe of decentralized finance (DeFi) and non-fungible tokens (NFT), a strategy has emerged: the vampire attack. They are driven by new protocols aimed at attracting users of another existing protocol, often by offering better incentives. How do vampire attacks work? What are the vampire attacks that marked the Web3 industry?

What is a vampire attack?

A ” vampire attack is a term used in the world of decentralized finance (DeFi) and non-fungible tokens (NFT) to describe a strategy where a new protocol incentivizes users of another existing protocol to migrate their funds to the new protocoloften by offering additional and/or better incentives.

If vampire attacks can be considered a wholly laudable form of competition, they are sometimes considered detrimental to the overall health of the Web3 ecosystem.

Thus, some platforms implement strategies to prevent or mitigate the impact of vampire attacks. For example, they can require liquidity providers to commit to a lock-in period or by limiting the number of LP tokens each user can withdraw during a given period.

Confused and overwhelmed by cryptocurrencies?

Spot opportunities and make informed investment decisions

How does a vampire attack unfold?

All vampire attacks are different, although the vast majority of them follow the same steps:

1 – Identify the target platform

Identify a platform that has a large user base and high liquidity. Ideally, it should be a project that charges high user fees, lacks innovation, and doesn’t offer new features or user incentives. These characteristics make it a prime target for a vampire attack.

2 – Offer bigger incentives

Create a new protocolusually a fork of the target platform, that offers better incentives or rewards to users. This can be done through methods such as token airdrops.

3 – Use aggressive marketing methods

Inform the target community of the existence of the new platform and its advantages. The ultimate goal is to convince users of the target platform to migrate to the new platform.

4 – Use the tokens of the new platform as rewards

Encourage users to transfer their cash (cryptocurrencies, NFT, etc.) to the new platform by rewarding them with new platform tokens.

5 – Increase liquidity on the new platform

As users migrate to the new platform, liquidity and trading volume on it are expected to increase. This can “drain resources” from the target platform, causing it to become disinterested with users.

If a platform manages to attract a large enough community following the realization of its vampire attack, it will therefore be operational and will no longer necessarily need to make efforts to ensure its operation.

Trade on the leading DEX

Some examples of famous vampire attacks

Cryptocurrency vampire attacks mainly target decentralized exchanges (DEXs) in the decentralized finance (DeFi) sector, but also non-fungible token (NFT) marketplaces.

For DEXs, this method is relatively common, because the code of Uniswap and other platforms being open source, it is relatively simple to copy the platform and make this copy operational under another name.

SushiSwap vs. Uniswap

SushiSwap’s vampire attack on Uniswap is an iconic examplee of a strategy employed in the decentralized finance (DeFi) sector to move liquidity from one platform to another.

SushiSwap then uses a vampire attack to trick Uniswap liquidity providers into staking their LP tokens on its platform. This was achieved by offering additional rewards paid in SUSHI tokens to liquidity providers. SushiSwap has launched an aggressive SUSHI token issuance program, distributing 1,000 SUSHI per block on the Ethereum blockchain to these liquidity providers.

SushiSwap’s vampire attack on Uniswap was successful. While it was originally a simple fork of Uniswap, the SushiSwap platform has managed to hold its own by gaining significant visibility and above all by bringing a breath of fresh air to the sector.

However, although this strategy was effective for SushiSwap in the short term, Uniswap has preserved its leading position in DEXs and maintains daily volumes consistently approaching $10 billion, while SushiSwap averages around $100 million in daily volume.

Figure 1 – Monthly volume (in dollars) of Uniswap and SushiSwap since May 2022

LooksRare against OpenSea

In February 2022, a new NFT marketplace appears: LooksRare. To make itself known, LooksRare uses drastic measures and tries to win over OpenSea users by means of a plethora of incentives around its own token, the LOOKS.

The principle is simple, but terribly effective. The LooksRare team identified OpenSea users who had traded at least 3 ETH for NFTs in the past 6 months. Each eligible user then had the opportunity to go to LooksRare to claim an airdrop of LOOKS tokens.

The only small subtlety, users had to list an NFT on the LooksRare markets to recover their tokens. This method proved to be very successful, as NFTs poured into the new markeplace significantly, allowing it to become viable in just a few days. Over this short period, the LOOKS token has risen significantly, going from $2 to $7.1 in 10 days, reaching more than $1 billion in capitalization.

So, with other incentives alongside this airdrop, LooksRare outperforms OpenSea in terms of volume for several weeks after launch. However, over time, incentives are running out of steam and users are migrating back to OpenSeawhich results in a loss of speed for LooksRare.

At the time of writing these lines (June 2023), LooksRare is still a fairly popular NFT marketplace, but it is losing ground against OpenSea and its other competitors, and really risks encountering significant difficulties. if it does not renew its user base.

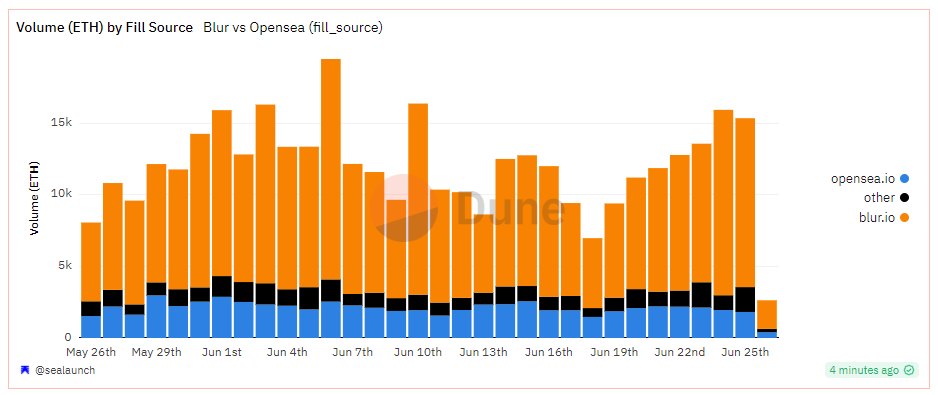

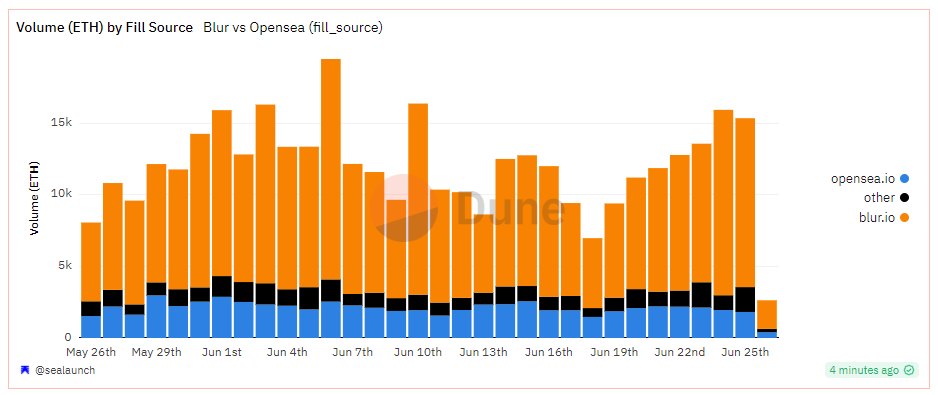

Blur vs. OpenSea

Blur’s vampire attack on OpenSea was particularly successful. Launched at the end of 2022 with the aim of offering a true trading experience to the world of NFTs, Blur is rapidly gaining momentum and dethroning OpenSea in many respects.

Thanks to a multitude of incentives around its BLUR token and low fees, Blur attracts NFT traders rather than collectors, which greatly boosts the activity of its platform. Perceived by many as the NFT marketplace that will manage to dethrone OpenSea, Blur easily obtains the fervor of a large part of the crypto-community.

At the time of writing (June 2023), Blur occupies 76% of the global NFT trading volume (in ETH), while OpenSea weighs only 16% of the global volume. OpenSea still has more users, but it has lost an entire section of its community, namely NFT traders.

Figure 2 – Blur significantly outperforms OpenSea in volume traded

Still not having its own token, OpenSea struggles to find a way to reward its community for its loyalty, where Blur rewards its most active users with BLURs. It is partly for this, but also for the platform’s low fees, that NFT traders are increasingly turning to Blur.

Confused and overwhelmed by cryptocurrencies?

Spot opportunities and make informed investment decisions

Graphic sources: Figure 1: Dune Analytics; Figure 2: Dune Analytics

Newsletter

Receive a summary of crypto news every Monday by email

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.