The dispute between Coinbase and the Securities and Exchange Commission (SEC) is seeing a new development as the regulator says the cryptocurrency exchange was fully aware of the laws governing its business. Coinbase, for its part, refutes these allegations by arguing that the regulators are not respecting their own declarations and obligations.

SEC responds to Coinbase

New twist in the standoff between Coinbase and the United States Securities and Exchange Commission (SEC): according to the financial regulator, the cryptocurrency exchange run by Brian Armstrong knew full well that the laws in force could always apply to its activities.

Thus, we can read in the document filed by the SEC on July 7:

“Since becoming a public company, Coinbase has repeatedly informed its shareholders of the risk that crypto-assets traded on its platform could be considered securities and therefore its conduct could violate federal securities laws. . »

The letter, filed with a judge in response to Coinbase’s latest request, also claims that the exchange is a ” multi-billion dollar entity advised by seasoned legal advisers who willfully ignore over 75 years of control law under Howey [voir : test de Howey, NDLR] », and who persists in thinking that she can determine what, according to her, is a security or not.

Paul Grewal, Chief Compliance Officer at Coinbase, Responds to Latest SEC Allegations in a series of tweets where he asserts that this document does not come to bring anything new, and that the regulators “ ignore their obligation to consider the public interest and the protection of investors when they allowed us to go public more than 2 years ago “. He adds :

“They are ignoring their own president’s statements 1 month later, made in congressional testimony, that there are no regulatory authorities for cryptocurrency exchanges like ours. »

👉 Train in disruptive blockchain technology with the Alyra school

Alyra, training to integrate the blockchain ecosystem

Coinbase under the weight of regulatory pressure

According to Patrick Moley, analyst at Piper Sendlerthe regulatory uncertainty that reigns in the United States – which has already almost got the better of Binance.US – would portend significant difficulties for Coinbase, at the forefront of American cryptocurrency exchanges in arms with the SEC.

So, Mr. Moley upgraded his Coinbase rating from “overweight” to “neutral”expecting the crypto exchange to see its transaction volumes and number of users drop to their lowest in 2 years.

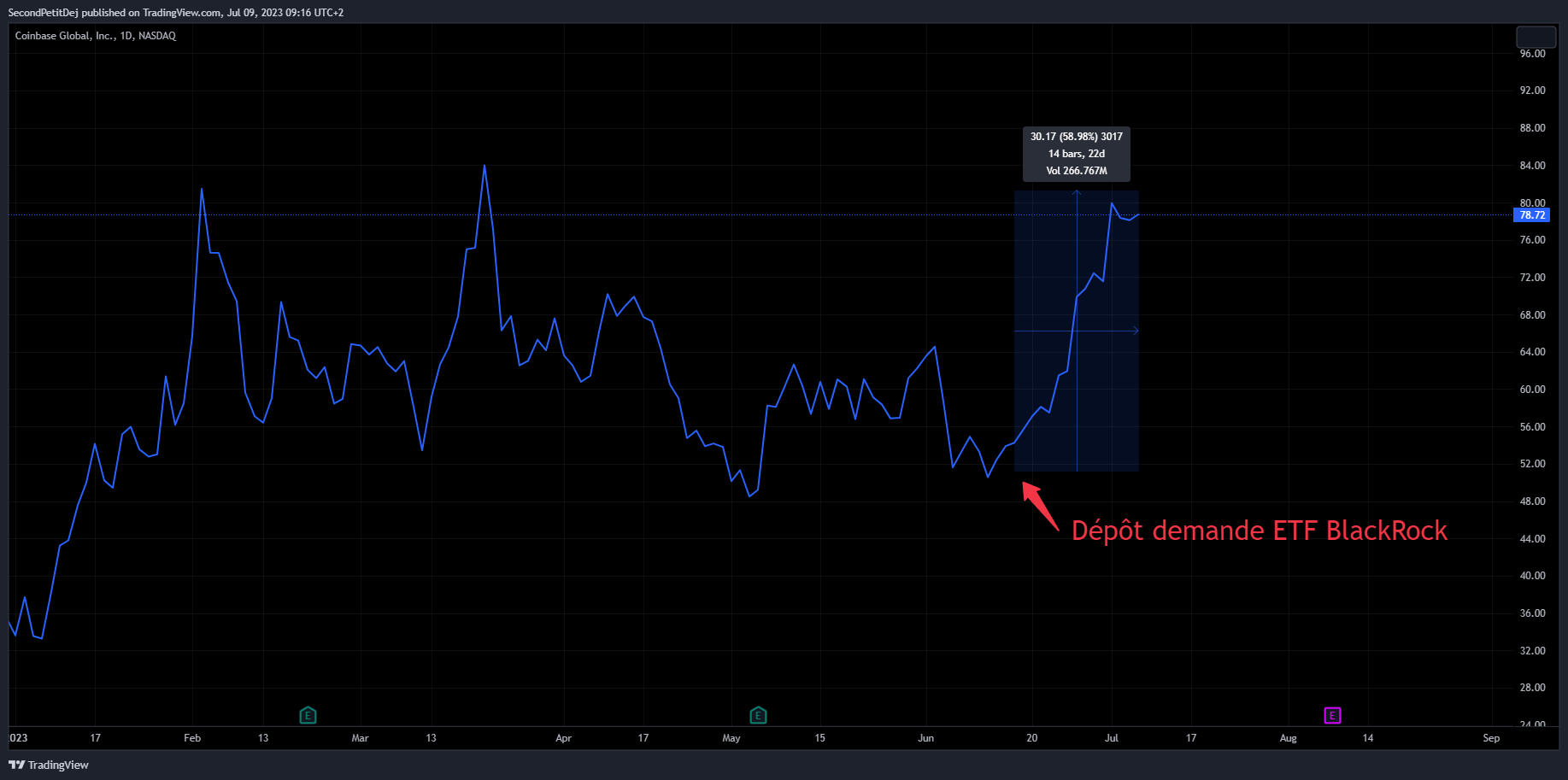

As we can see below, Coinbase (COIN) stock has reacted very positively to the request for a spot Bitcoin ETF filed by asset manager BlackRock, which has named the platform as a partner in the framework of its shared surveillance agreement.

Evolution of the COIN share of Coinbase (Nasdaq stock exchange)

However, according to the analyst, the combination of rising cryptocurrency prices and the announcement of Coinbase as a BlackRock partner will not have been enough to sufficiently recover transaction volumes on the exchange. So, ” more progress on the regulatory front and a convincing turnaround in underlying fundamentals would currently be necessary to hope for real progress from this point of view.

👉 Read also – Binance loses 3 senior executives, Changpeng Zhao assures it’s only FUD

Order our Book to understand everything about cryptos

Published by Editions Larousse

Source: Bloomberg, Twitter

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.