The cryptocurrency market generally benefited from the momentum generated by Ripple’s lawsuit against the Securities and Exchange Commission (SEC), but that was short-lived. Indeed, the decline of Bitcoin (BTC), XRP and more generally all altcoins will have been just as rapid, with more than 180 million dollars liquidated over the last 24 hours.

Crypto Market Shaken by Announcements

The recent victory of Ripple (XRP) in its – long – lawsuit against the Securities and Exchange Commission (SEC) of the United States will have briefly boosted the market. Indeed, while the heart of the trial is essentially to determine whether XRP is a security or not, the judge declared this Thursday that no, XRP should not be considered as such on the secondary market.

Quickly, the market got carried away, and the Kraken and Coinbase platforms have even decided to re-list Ripple’s XRP in order to make it available for trading. So during the day Bitcoin (BTC) went for 30,800 dollars and XRP briefly rose above $0.93, a point it had not touched since December 2021.

For its part, the price of Ether (ETH) exceeded the resistance of 2,000 dollars, which had not happened to it since last May.

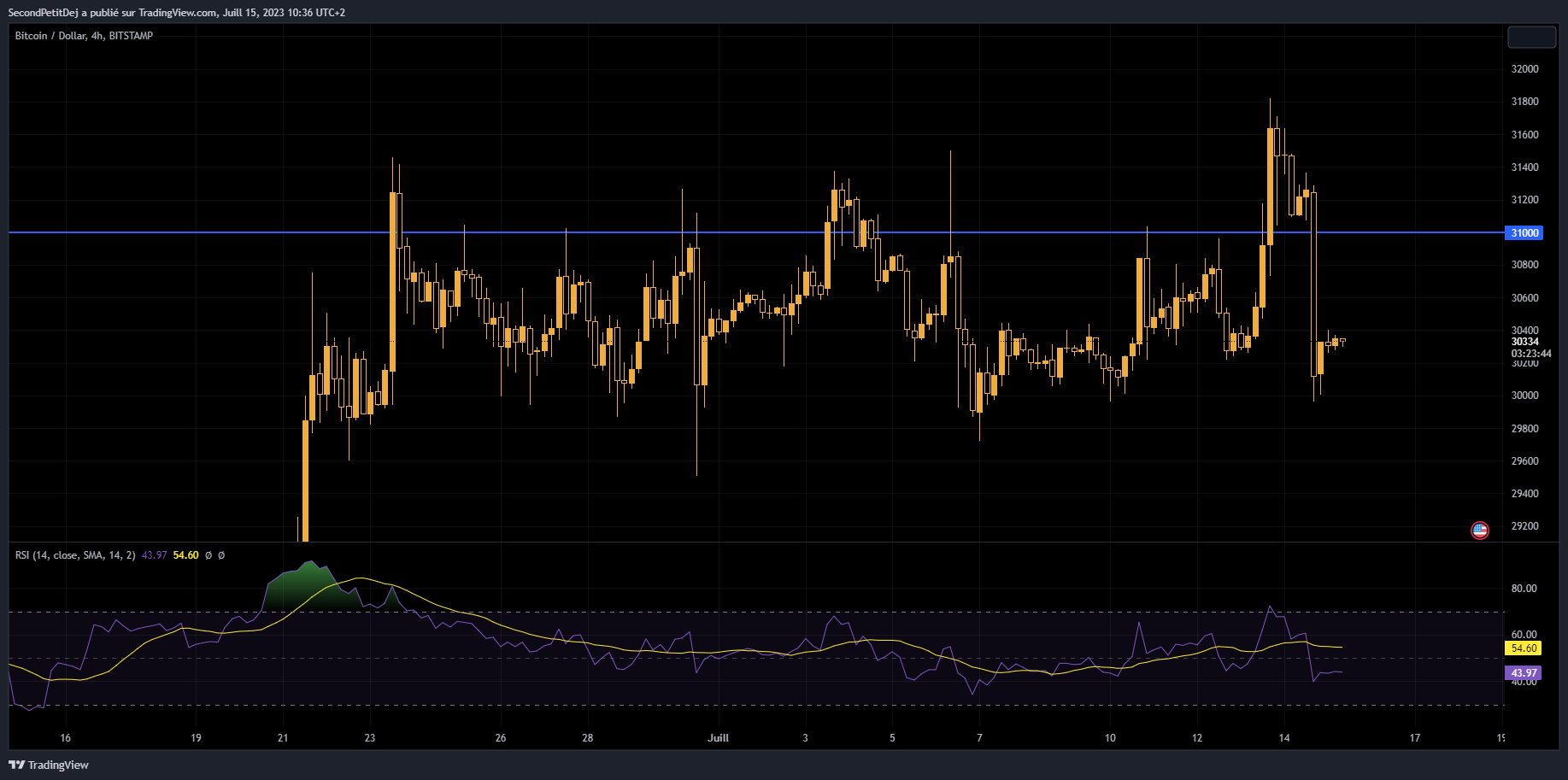

However, the rise was only temporary and the market quickly corrected: the BTC fell back below 30,000 dollars yesterday Friday July 14, and the price of XRP lost 30% at the same time, falling below the bar of 0.67 dollars.

👉 Ripple (XRP) against the SEC: how did the conflict start?

Figure 1 – BTC price evolution in h4

Consequences of sudden market movements, the rise of XRP had caused an impulse of liquidations on the short positions of the market on July 13. Following yesterday’s fix, we can observe that more than 180 million dollars have been liquidated in the last 24 hoursmainly on long positions.

Figure 2 – Liquidations observed on the crypto market over 48 hours

The market capitalization of XRP naturally inflated following the announcement, to the point of pushing Ripple’s cryptocurrency ahead of Binance’s BNB in the top 10 of the most capitalized cryptos. However, the trend reversed again yesterday, although the 2 assets are still neck and neck.

Moreover, the dominance of Bitcoin has fallen below the symbolic threshold of 50%while the king of cryptocurrencies had exceeded this milestone on June 20 in a sustainable way.

Ultimately, the cryptocurrency market seems to be struggling to maintain a sustainable rise as positive announcements have been rolling in for some time now, from spot Bitcoin ETFs to recent statements from BlackRock CEO Larry Fink, news surrounding Ripple and broader institutional adoption .

👉 Join our private Discord group to benefit from market analyzes carried out by our experts

Confused and overwhelmed by cryptocurrencies? 🤔

Spot opportunities and make informed investment decisions 🔎

Sources: TradingView, Coinglass

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.