Since the new ATH reached by the price of Bitcoin at $73,000, investors are asking the following question: what are the means at my disposal to detect market peaks? This question is central, because those who have the most tools could obtain the best performance on the market. Using the data available on the blockchain, let's take a look at the 6 indicators that constitute the method of identifying tops in a bull market.

How to identify the top of a bull market?

During a bull market, crossing ATHs often marks the beginning of the feeling of euphoria among investors. This phenomenon is characterized by high transaction volumes and aggressive buying.

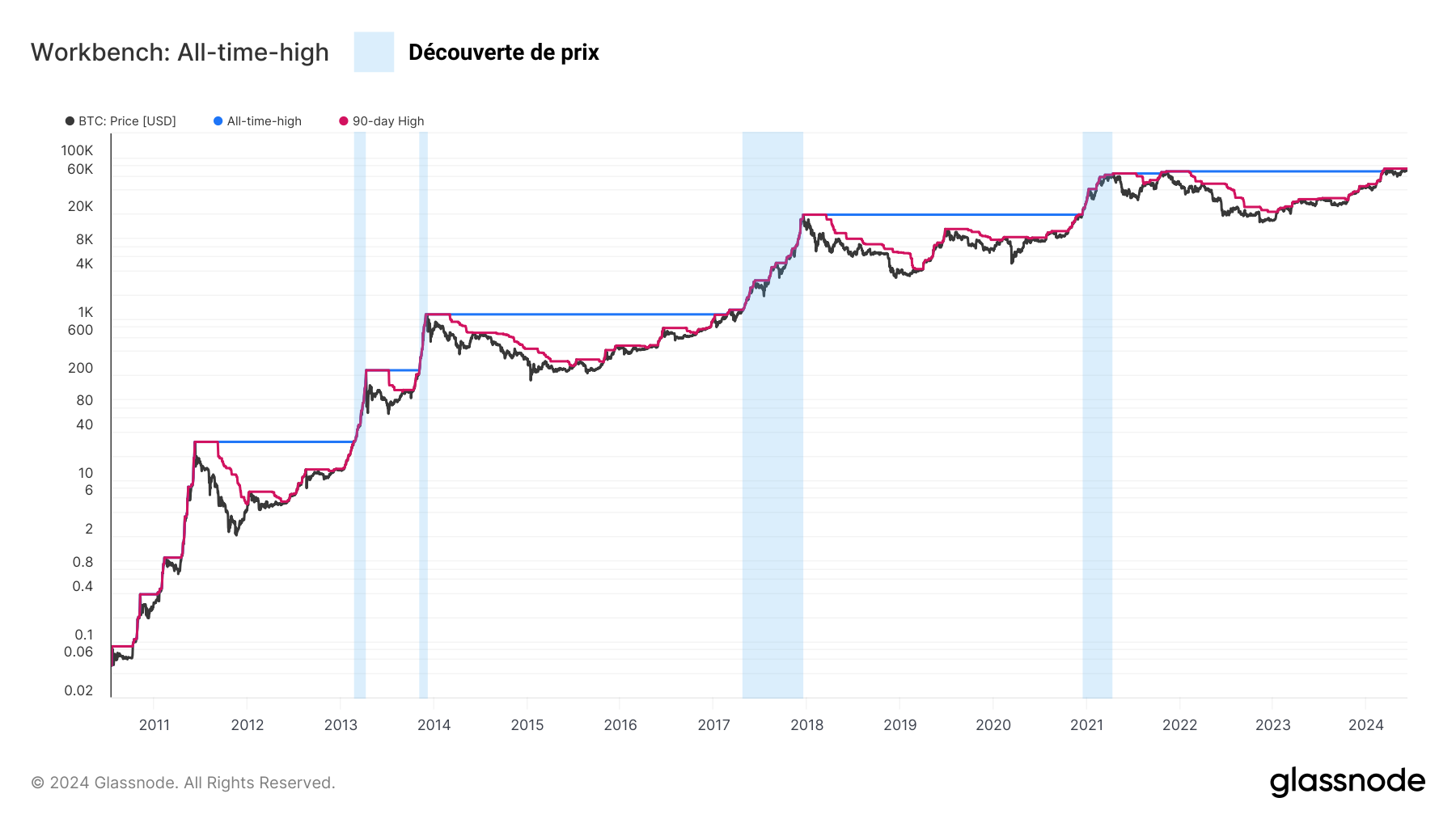

This period when ATHs tirelessly multiply is called “price discovery”: it precisely illustrates the market booms. Note that a cycle on the cryptocurrency market (4 years) has never experienced more than 2 phases of price discovery on the price of Bitcoin. These are unlikely to be important in identifying the top of the market:

Price discovery on the price of Bitcoin (BTC) from 2011 to 2024 – Glassnode

Historically, these periods of euphoria are very short and extend over a few weeks, or even several months for the longest of them. In addition, their amplitude decreases over the cycles, with Bitcoin becoming less and less volatile.

👉 Can Bitcoin (BTC) climb further? Here is the best free tool for investing well

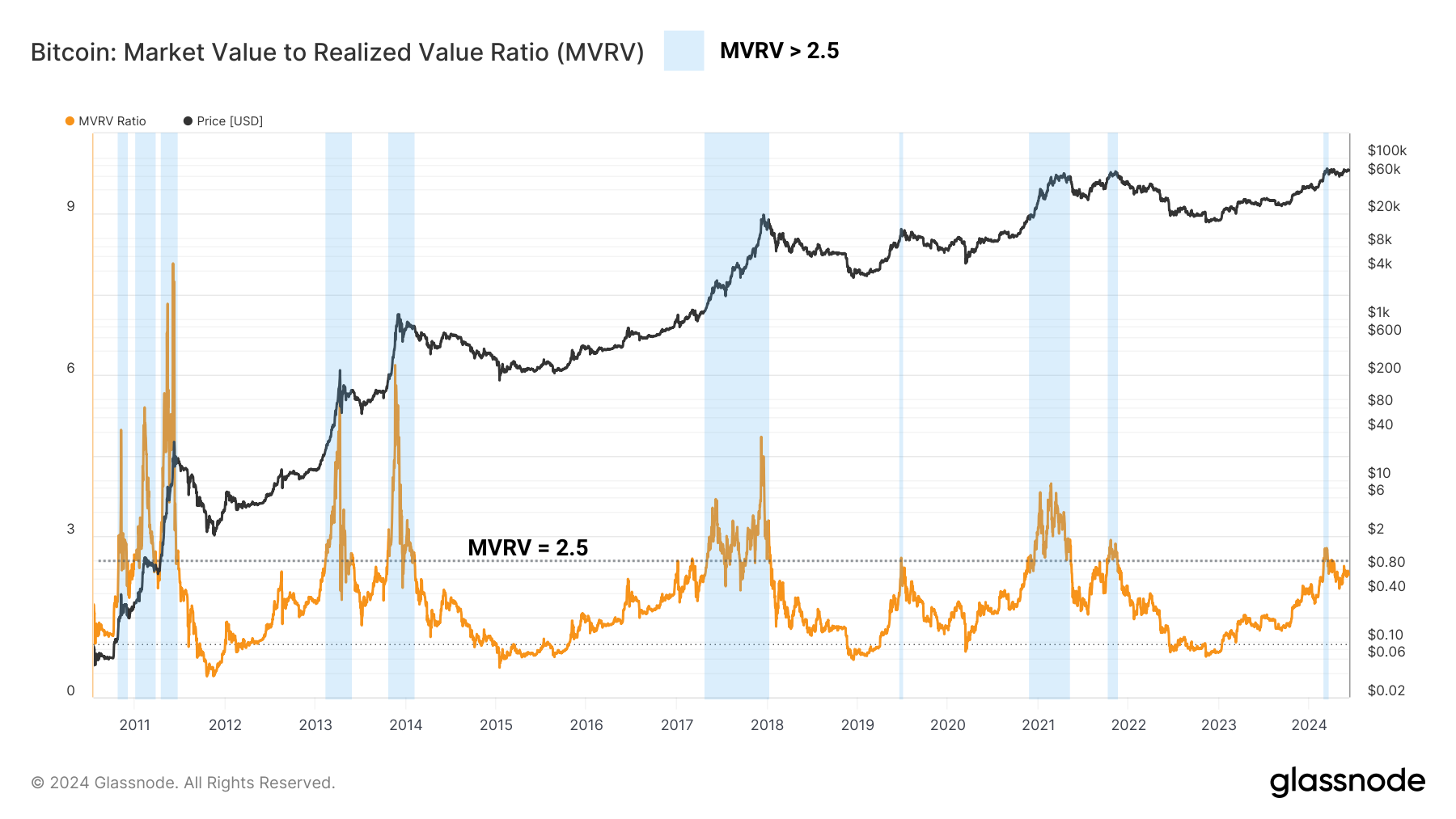

This tool comes with the MVRV indicator. English acronym for “Market Value to Realized Value Ratio”, the MVRV calculates the difference between market value and performance achieved (unsold positions) of investors.

During a bull market, a high MVRV ratio indicates that the majority of the market holds large profits latent. Depending on each person's risk threshold, it is possible to use different fixed thresholds (MVRV > 2.5 or MVRV > 4) to identify market peaks:

MVRV on the price of Bitcoin (BTC) between 2011 and 2024 – Glassnode

In addition, this indicator is very relevant for discovering sales opportunities thanks to the precision of its data. It can also be used in times of bearish market, because an MVRV between 0.8 and 1.2 constitutes an interesting signal for those wishing to expose themselves to the market with the best prices.

💡 Bitcoin Momentum Oscillator: discover this new indicator in 3 minutes

The third indicator on our list is the Long Term Investor Distribution (LTH). To detect the peak of the bull market, you have to ask yourself the following question: Are long-term investors (LTH)… [85% de l’article restants]