Ethereum Spot ETFs have taken a crucial step towards their introduction to the US markets, with the approval of 8 Forms 19b-4 by the SEC on May 23. What do the S-1 forms, the latest documents filed on Friday that must still receive approval from the SEC, tell us?

First information on Ethereum spot ETFs

On Friday, future issuers of the Ethereum spot ETFs approved last month updated their S-1 form, the last document necessary before the launch of these new investment vehicles on American stock exchanges.

Effectively, a total of 8 forms 19b-4 received the stamp of the Securities and Exchange Commission (SEC) on May 23, preliminary condition before placing on the market. However, the last points to be clarified before a real launch, particularly in terms of the fees that will accompany Ethereum ETFsare proposed to the regulator via the S-1 forms.

📖 To go further, find out how to invest in Ethereum spot ETFs

At the time of writing these lines, only Franklin Templeton and VanEck revealed the fees they wanted to offer, 0.19 and 0.20 percent, respectively. (their fees being 0.19 and 0.25% on their Bitcoin ETFs). Although the fees offered by issuers must be public before the launch of the ETFs, it is possible that the companies involved wait until the last moment to reveal their game.

Currently, Fidelity, Grayscale, Invesco Galaxy, Bitwise, 21Shares and BlackRock have therefore not yet specified what their fees would be. This emerging market still leaves plenty of room for competition, this could be a strategy on their part to adjust their costs according to the competition.

Buy Bitcoin ETNs and cryptocurrencies with XTB

Seed capital and prospects

According to the latest documents filed, Fidelity considers seed capital (seed investment) of 4.7 million dollars for its spot ETF based on Ether, at $38 per share. 21Shares revealed an investment of $340,739 in its ETH ETF, or 20,000 shares.

On their side, Franklin Templeton and Invesco Galaxy said they each received an initial investment of $100,000.

Initial investments in these Ethereum spot ETFs help launch the fund by providing the capital needed to cover start-up and management costs. Additionally, these investments provide some initial liquidity, making the fund more attractive and functional from its inception, which is essential to attract other investors and establish a solid base in the market.

Here too, the amount raised allows us to get an idea of who could become the leader of this new section of the market in the United States.

👉 Read on – Solana SOL token ETF: soon on the markets in Canada?

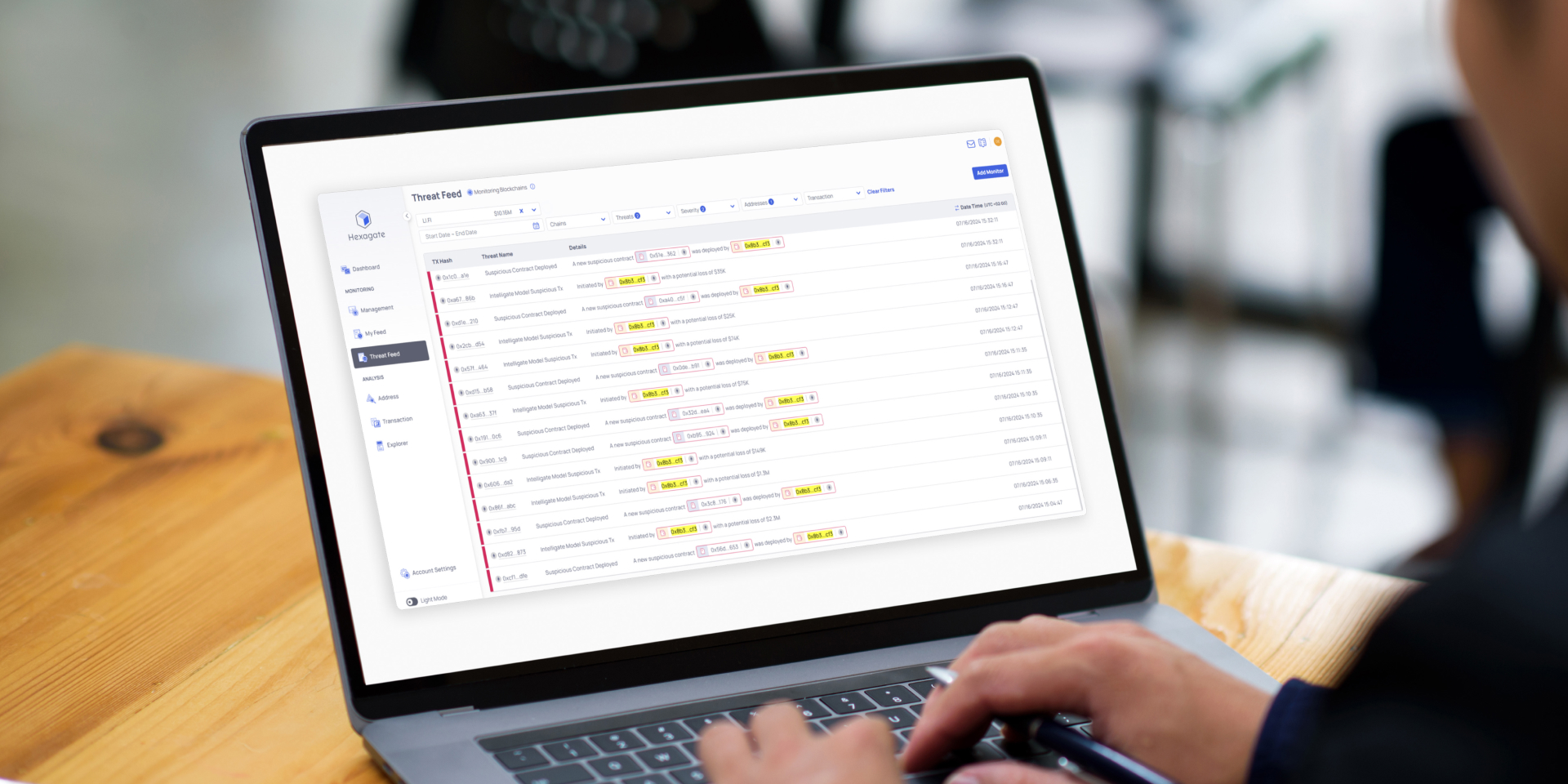

Other details were revealed in these famous S-1 forms, notably concerning the dangers for investors and other regulatory matters.

According to Eric Balchunas, ETF analyst at Bloomberg Intelligence, These Ether-based investment vehicles are expected to launch around July 2. According to him, these ETFs would be “lucky” if they managed to bring together 20% of assets under management dedicated to spot Bitcoin ETFs, or $55.55 billion at the time of writing these lines.

Cryptoast Research: Don't waste this bull run, surround yourself with experts

Sources: SEC filings

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.