While Bitcoin and high finance are awaiting US PCE inflation figures and the results of the legislative elections in France, we are now 67 days after the 4th BTC halving and the market remains in sideways transition between 56,000 and $73,000. What is missing to finally consider exiting from the top of this range and entering into price discovery?

Patience, the Bitcoin purge will soon be over

The intransigence of the American Federal Reserve (FED) regarding the prospects of its monetary policy, combined with the uncertainty regarding a possible resurgence of the sovereign debt crisis in Europe after the French legislative elections are 2 factors which combine and maintain BTC in the lateral phase that it has been developing since its historic record of last Wednesday, March 13.

In the meantime, the 4th BTC halving has taken place and we are now 67 days after this crucial “monetary” event for the underlying trend of Bitcoin.

67 days and still nothing, not the slightest trace of the bull run, nothing seems in sight even with a powerful telescope. Many investors express their disappointment. However, they are wrong.

👉 Bitpanda: the most complete cryptocurrency platform for investing?

The coming bull run that will span 2024 and 2025 will be triggered by elements of traditional finance that I describe in the second paragraph of this article.

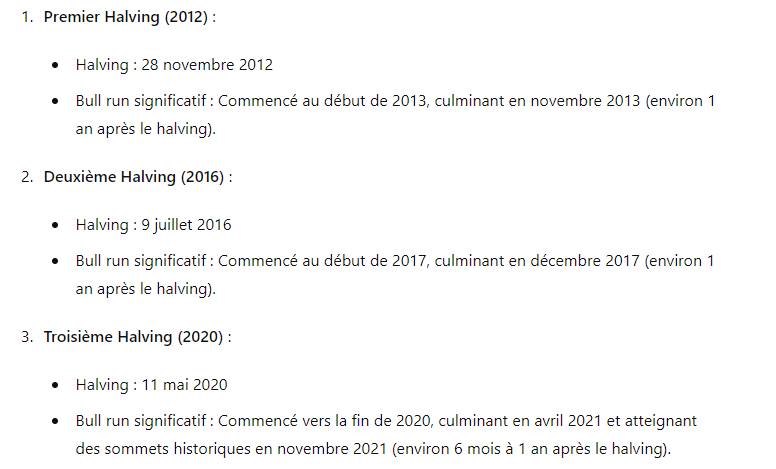

But when it comes to the BTC monetary cycle, particularly its post halving cycle, there is nothing surprising in not having a bull run just 2 months after this quadrennial event.

I resumed price action in the 100 days following the halvings of 2012, 2016 and 2020 and it was a volatile period each time, with market drops. So be patient again, the next bull run will start later in the year.

In my “worst case scenario”, the BTC/USD pair will make a final purge below its 200-day moving average (see the scenario with the halving of 2016) and then the bull run will arrive a few weeks later. BTC/USD is currently testing its 200-day EMA just above $60,000.

Chart of BTCUSD just after the second halving in July 2016 (purge below the 200-day exponential moving average before starting again)

Chart of BTCUSD just after the second halving in July 2016 (purge below the 200-day exponential moving average before starting again)

👉 Also find Vincent Ganne in video on the Cryptoast Research YouTube channel.

Receive your €50 bonus with Bitpanda!

The 4 conditions necessary to enable BTC price discovery this summer

Here are, in my opinion, the 4 conditions necessary for the Bitcoin price to evolve this summer:

- Condition 1 : FED pivot confirmed for Wednesday, September 18 and bearish technical breaks on US bond rates on the market, notably 2-year and 10-year rates;

- Condition 2 : bearish reversal of the US dollar trend (DXY) on the foreign exchange market (rebound of the EUR/USD rate);

- Condition 3 : a favorable post-halving seasonality (around 100 days after the halving);

- Condition 4 : the massive presence of institutions (this condition is now already met).

📈 You want to have Vincent Ganne's trading opinion on Bitcoin every morning as well as his best configurations on altcoins, then join the professional Cryptoast Research service! Satisfied or refunded for 15 days so don't hesitate any longer!

It has always taken several weeks to months after the halving to trigger the bull run.

To learn more about my technical analyses, find me on the Cryptoast Research YouTube channel!

Find technical analyses by Vincent Ganne on Cryptoast Researchthe ideal place to succeed in your cryptocurrency investments. You will learn how to position yourself on strategic price levels, identify investment opportunities and anticipate price movements. Join us now and take charge of your crypto investments.

Get your €50 bonus with Bitpanda!

Newsletter 🍞

Receive a crypto news recap every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.