Solana has been working in a range of values between $120 and $200 since March 2024. After bouncing several times on the lower limit of this range, the SOL seems well oriented to test the upper limit. Can Solana claim in the short term a reconquest of the zone beyond $200?

It is Thursday, July 25, 2024, and the Solana (SOL) price is around $170.

Solana's cryptocurrency has been performing well for many months, managing to attract attention and leading some market participants to make favorable arbitrages. Since late June, it has been accelerating its institutional adoption, as VanEck filed a Form S-1 with the SEC to launch a cash SOL trust.

SOL has established itself in 2024 in the top 5 of the largest capitalizations of the crypto ecosystem, a position that seemed unattainable 12 months ago. In the coming weeks, it could come to battle with BNB in order to conquer an additional step. Their capitalization is close and the momentum is in favor of the SOL token.

| Pairs with Solana | 24 hours | 7 days | 1 month |

| Solana/USDT | -1.90% | +7.10% | +25.60% |

| Solana / Bitcoin | +0.80% | +8.20% | +19.50% |

| Solana / Ethereum | +6.50% | +16.30% | +33.40% |

👉 How to easily buy Solana (SOL) in 2024?

The SOL price is still relatively far from its all-time high, which was recorded around $260. However, the progression since October 2023 has been exceptional, overcoming a retracement of more than 90% to now be only 30% from its ATH.

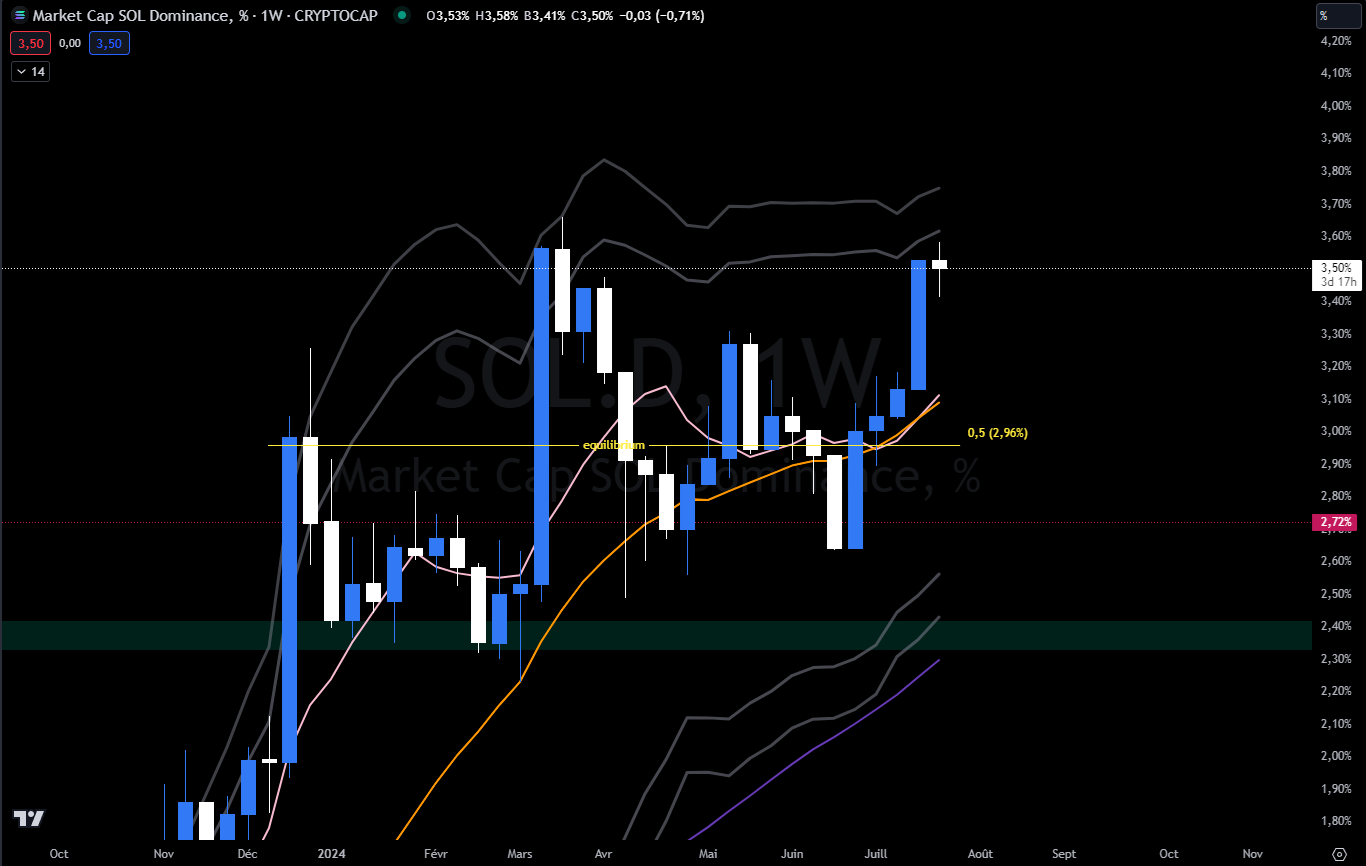

Paradoxically, the dominance of SOL within the ecosystem has been working on its peaks since December 2023. The cryptocurrency then recorded a new high point on December 25, which will not be surpassed until March 18, 2024. This dominance is once again close to its peaks, crossing 3.66% could once again favorably attract capital towards SOL.

The work zone suitable for preparing this crossing is located above the area drawn in purple. This is also the zone that would mark the short-term invalidation of the crossing scenario.

Graph of Solana's SOL dominance within the crypto ecosystem

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

SOL preparing for a bullish breakout?

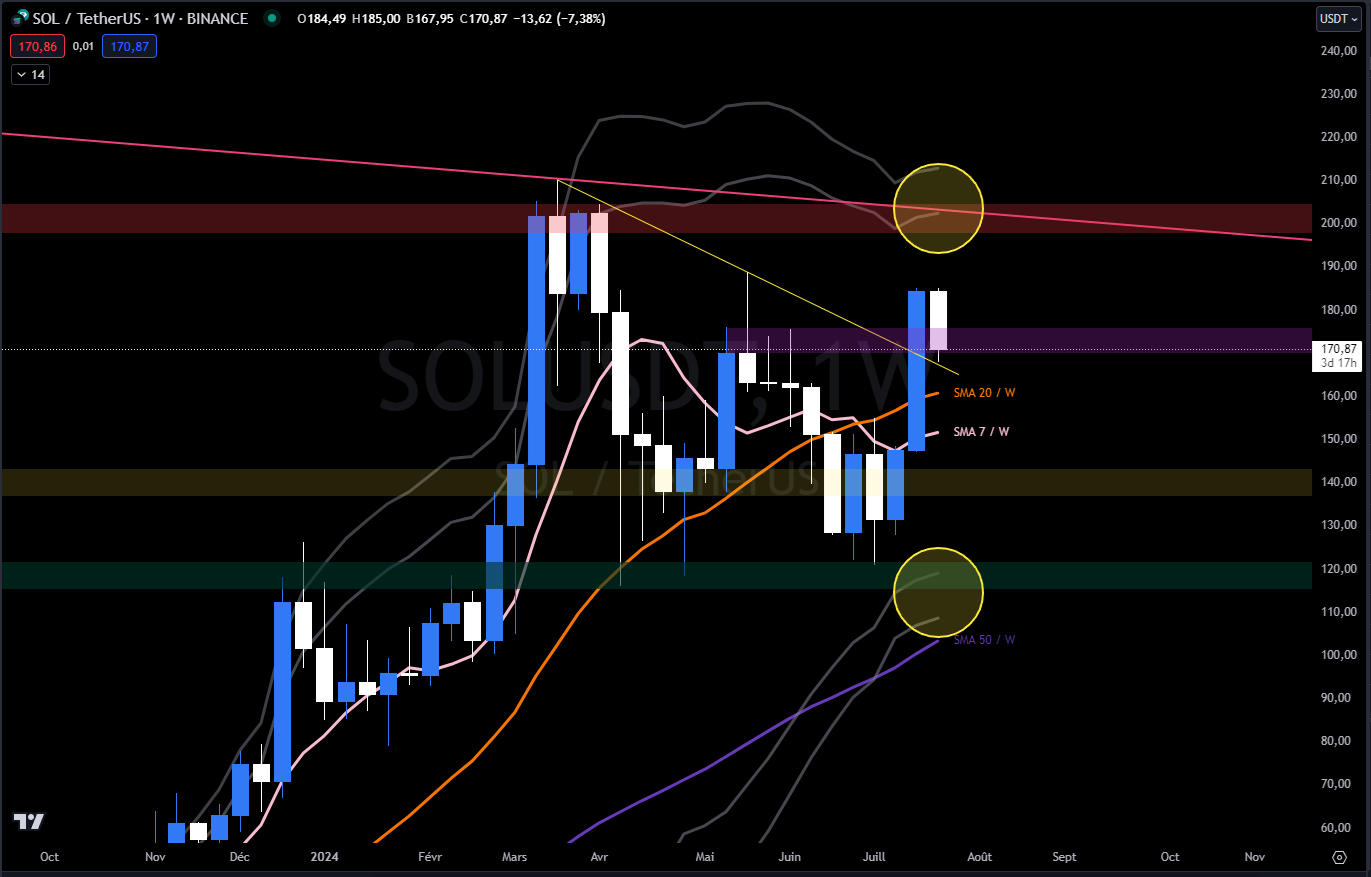

The weekly SOL pattern is still in its range between $120 and $200. Back in the upper part of it, Solana is moving in a positive polarity zone. As a result, the asset could soon attack the $200 level..

Last week's close marks the break of the oblique connecting the previous peaks of March and May, giving a particular meaning to this latest movement. An oblique that it has been retesting since the beginning of this week.

The latest close also manages to reclaim the $170-175 zone (drawn in purple) in which price action could take support before activating an upward continuation. This zone had been previously worked on last March, causing several rebounds towards $200.

The development of a bullish scenario therefore involves the consolidation of prices between:

- to the south: the purple zone and the 20-week moving average;

- to the north: the red zone in confluence with the upper Bollinger band and the oblique connecting the peaks of November 2021 and March 2024.

Breaking through the $200 zone sustainably will not be easy, it is a very high psychological and technical level. Keeping price action within the range remains the scenario offering the highest probabilities. However, if Solana manages to climb this last step, then there will no longer be any obstacle between prices and a new historical high.

Solana Weekly Price Chart

Buy crypto on eToro

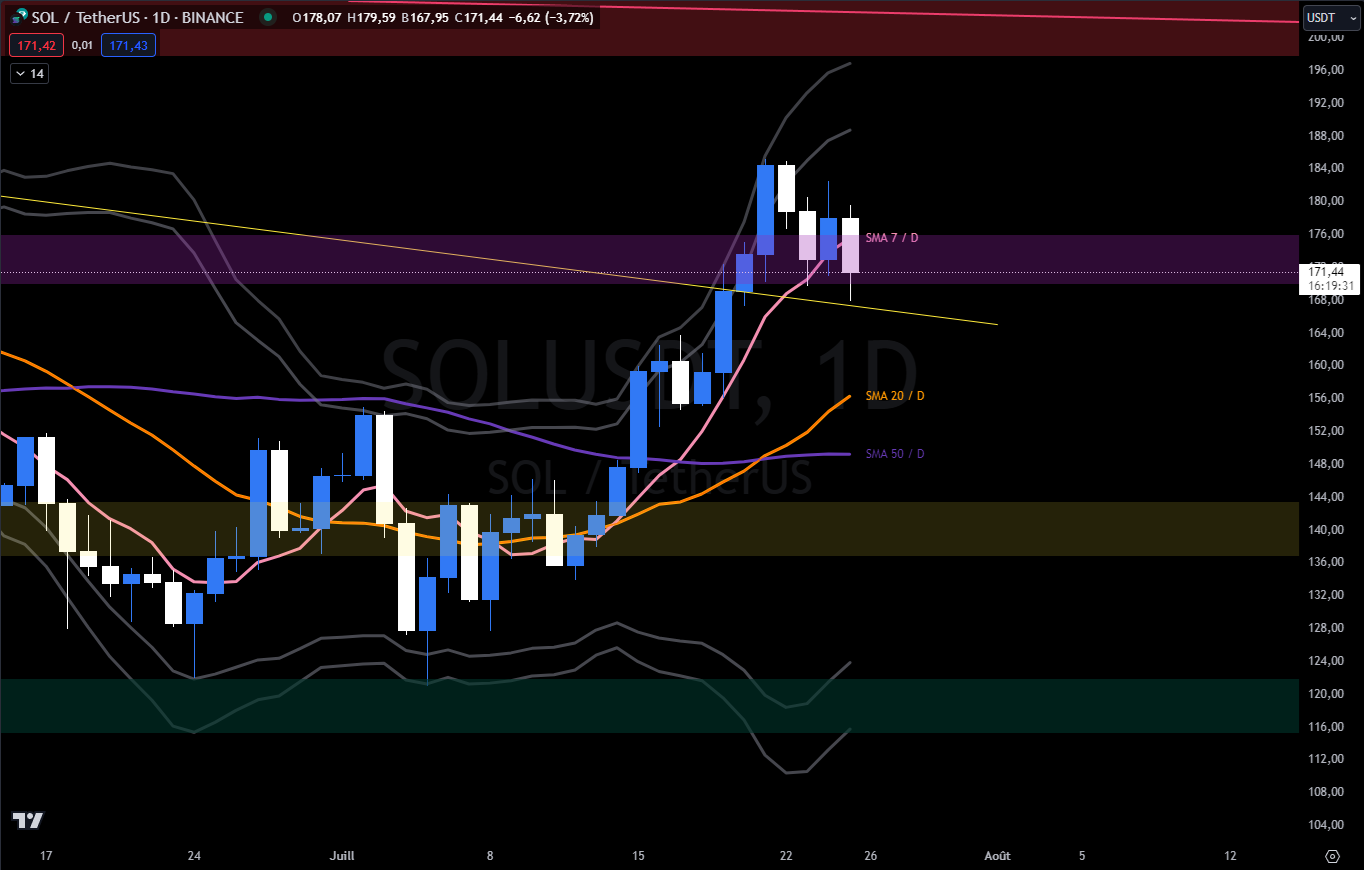

On a daily basis, The bullish flow is confirmed by the alignment of the 7, 20 and 50 daily moving averages and the ping-pong between the high BB and the 7-day moving average. The 50-day moving average nevertheless lacks the slope to provide significant inertia to the price action.

This morning, the 7-day moving average is under pressure. If it were to give way, in the second curtain and in the event of a deeper consolidation, the other 2 moving averages of this system are waiting for the SOL between 150 and 155 dollars. The 20-day moving average could nevertheless rise very quickly towards the purple zone if prices manage to maintain current levels.

In the event of a deeper correction, $150 represents the limit not to be crossed to maintain positive momentum on a daily basis. If prices were to settle back below, a first level could act as support between $137 and $143 before revisiting the lower limit of the range at $120.

Solana token price chart daily

Cryptoast Research: Don't Spoil This Bull Run, Surround Yourself With Experts

In summary, Solana is showing strength, but remains in its range between $120 and $200. However, the polarity is positive in the heart of the range and the price action shows a willingness to reach the top of the latter. The question of a crossing or a rejection towards the opposite limit ($120) could arise very soon. Crossing $200 is the last challenge before reaching the historical highs around $260.

So, do you think SOL can break out of its range? Please feel free to give us your opinion in the comments.

Have a great day and we'll see you next week for another technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a daily crypto news recap by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products, or services. Some links in this article may be affiliate links. This means that if you purchase a product or sign up for a site from this article, our partner pays us a commission. This allows us to continue to provide you with original and useful content. There is no impact on you and you can even get a bonus for using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers must do their own research before taking any action and only invest within the limits of their financial capacities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with a high return potential implies a high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of these savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.