The SUI token is well on its way to being one of the best performers in the current bull cycle. In a context where the market is progressing in disjointed order, could the SUI attract more capital and continue to progress in the price discovery zone?

After the impulse, the lateralization phase on the SUI token

It is Wednesday, November 20, 2024 and the price of the SUI token is around $3.75.

Sui is a layer 1 blockchain that is based on the foundations of technologies developed by Meta/Facebook. It uses the Move language for the development of its smart contracts and has a parallelized architecture, offering exceptional scalability potential.

Since our previous analysis, the SUI has progressed significantly. It has now been lateralizing for several days, digesting 80% of an increase which developed very quickly.

Now in 17th position in the ranking of cryptocurrencies, with $10.65 billion in market capitalization for only 28% of its supply in circulationthe SUI project still seems to attract the attention of investors. SO, where are we technically on the SUI token?

Cryptoast Academy: don’t miss the bullrun, join our experts

| Pairs with SUI | 24 hours | 7 days | 1 month |

| SUI/USDT | +1.1% | +23.80% | +80.00% |

| SUI/BTC | -0.20% | +16.30% | +32.10% |

| SUI/ ETH | +1.20% | +23.70% | +56.80% |

👉 Find our selection of the best platforms for buying cryptocurrencies

The current range is the key to the next moves!

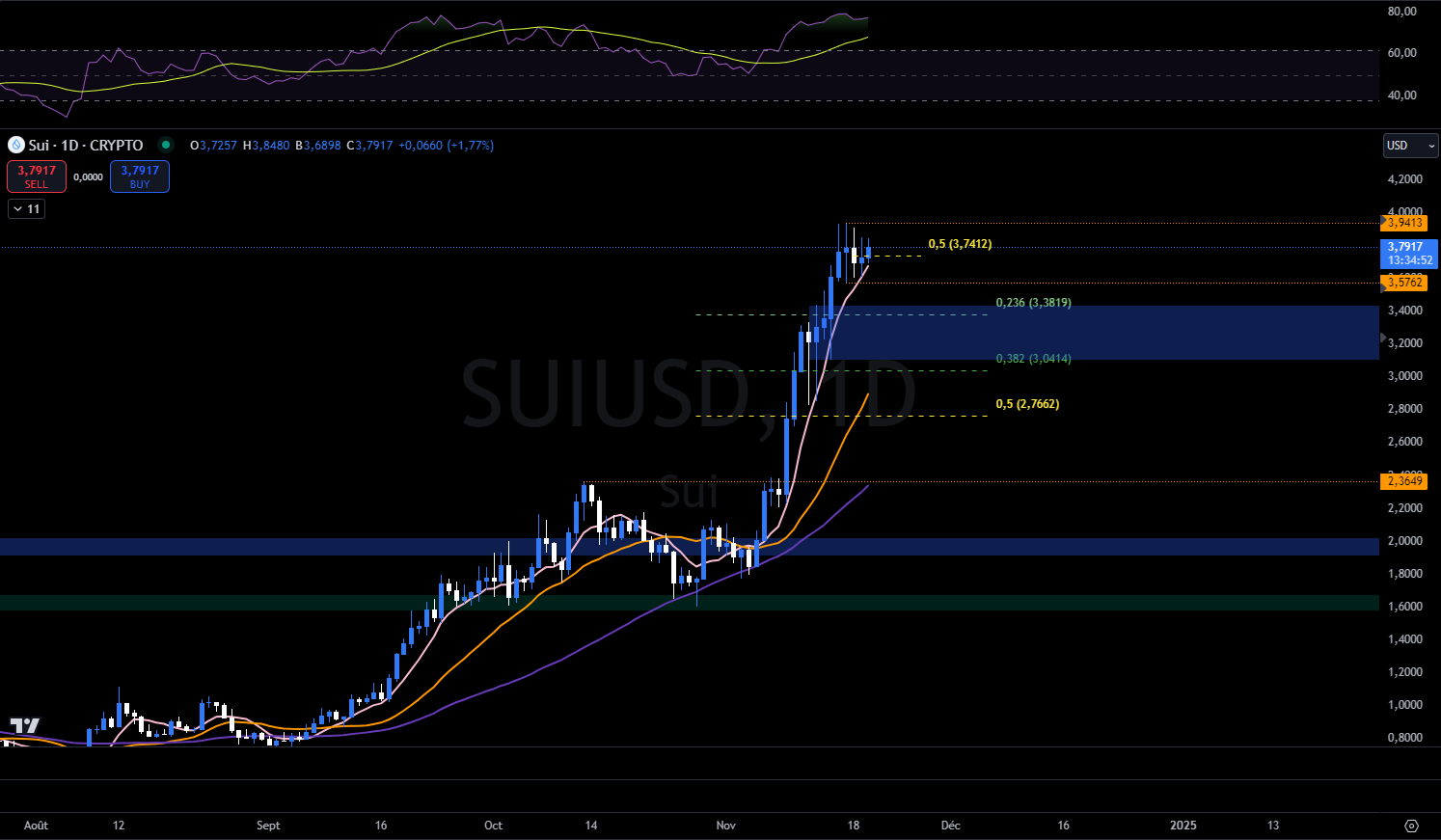

The last bullish leg on SUI developed in just 10 days for a performance close to 100%. This movement is being digested by the token, which is pausing in a tight range between $3.50 and $3.95. This range could be the key to the next move.

The previous trend being bullish, the probability of exiting this consolidation at the top is to be favored. In this lateralization zone, we can consider the median at $3.75 as a polarity factor. This level is also in confluence with the moving average 20 in H4 whose configuration with the Bollinger bands perfectly marks the range.

Thus, crossing one of the limits could relaunch the SUI in a new explosive phase with Bollinger bands which could open and moving averages which realign into support or resistance.

Be careful though, range exits are not always trivial. In addition, one should be wary of false exits whose re-entry generally leads to a breakout in the opposite direction.

Open an account on N26, the crypto-friendly bank

On a daily basis, we can clearly observe the gap created by the price action since the beginning of November, with a strong uptrend configuration. The chart has a very large corrective margin without calling into question the trend.

Furthermore, given the strength of the movement, a short correction between $3 and $3.4 could be relevant. If this move is brief and followed by significant buying, then we could experience a re-entry scenario from the H4 range that we presented above. This scenario is favorable for a continuation of the upward trend towards 5 dollars.

On the other hand, if prices were to settle below $3.57 at the daily close, the correction could require more time in order to rebuild a structure and consider a continuation of the rise. Let us add that to maintain good upward momentum on SUI, it is advisable not to close below $2.76.

SUI token price graph on a daily basis

Buy cryptos on eToro

In summary, the SUI token is engaged in a powerful uptrend. The probabilities are favorable to a continuation in the direction of the trend, but a correction could be necessary before managing to extract itself from the top of the range under construction in a small unit of time.

So, do you think SUI can continue to outperform the crypto market? Don't hesitate to give us your opinion in the comments.

Have a nice day and we’ll see you next week for a new technical analysis of altcoins.

Sources: TradingView, Coinglass, Glassnode

The #1 Crypto Newsletter 🍞

Receive a summary of crypto news every day by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to cryptoassets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.