According to data compiled by Arkham Intelligence, the liquidators of Alameda Research, although supposed to gather the available funds, are being liquidated themselves within the decentralized finance (DeFi). In the night from Friday to Saturday alone, the latter would have lost more than a million dollars by having a sum of positions equivalent to 731 Ethers (ETH) liquidated.

Liquidators get liquidated

Alameda Research liquidators are, by definition, responsible for gathering the available funds of the company in the context of its bankruptcy in order, possibly, to reimburse its various creditors. Alameda Research, which is, let us recall, FTX’s sister company, itself bankrupt since the beginning of last November.

But Alameda Research, which is an investment company, still has open positions within decentralized finance (DeFi), for large amounts. Thus, the liquidators of Alameda Research wished to recover the funds deposited in various protocols, but it did not turn out how they probably would have liked.

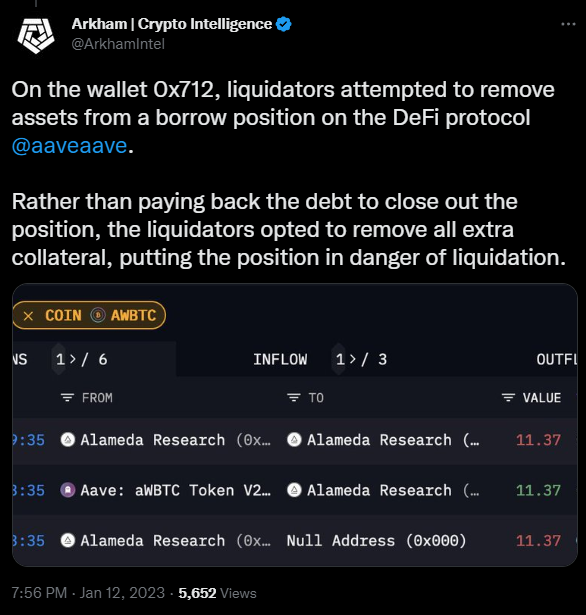

As Arkham Intelligence reported, the liquidators got their hands dirty, for example, trying to close a position on the Aave protocol. The latter withdrew all their collateral on a loan position, leading to the liquidation of 4 wrapped Bitcoin (wBTC), or more than $80,000 at the current price.

Arkham also explains that the liquidators tried to make large transactions on multiple occasions without success, including trying to withdraw $1.75 million in the form of LDO tokens, which were still in the vesting period. This led to a dozen unsuccessful transactions.

👉 Discover our guide to understand everything about decentralized finance (DeFI)

Trade on the leading DEX

⛓️ A platform at the heart of DeFi

More than a million dollars lost Friday night?

But according to exclusive information obtained by our colleagues from The Block, Alameda Research liquidators reportedly lost over $1 million in the only night from Friday to Saturday this weekend. The data was allegedly traced by Arkham Intelligence through an as yet undisclosed report.

The wallet here concerned held 9,000 Ether (ETH), or more than $13.7 million at the current price, supported by $20 million in the form of USDC as well as $4 million in DAI, both as that collateral.

But according to the on-chain data, the account concerned would have been “forced reduced”, which would have led to the liquidation of positions equivalent to 731 ETHor more than $1.1 million at current market price.

According to Arkham, the liquidations concerning this wallet could result from a voluntary operation:

“Surprisingly, out-of-portfolio trades were made before and during the liquidation, which indicates that the person controlling the portfolio was either unable to figure out how to liquidate the positions, or just didn’t want to. make. »

In addition, some Twitter observers did not fail to point out the few transactions carried out by the liquidators for only a few fractions of cryptocurrency.

the FTX estate bankruptcy is paying liquidators $1300 an hour to spend $2.99 on gas to move $0.02 worth of sushi tokens into a multisig pic.twitter.com/iQJfBFAKFf

— foobar (@0xfoobar) January 7, 2023

“FTX bankruptcy group pays liquidators $1,300 an hour to spend $2.99 in transaction fees to move $0.02 worth of SUSHI tokens into a multi-sig [portefeuille multi-signature, NDLR]. »

Although some individuals have noted that a few addresses that have recently moved funds may have belonged to Sam Bankman-Fried, the latter denied any involvement on his part.

👉In The News – FTX obtains approval to sell 4 of its most important subsidiaries

Protect your cryptocurrencies with NordVPN

Source: The Block

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.