Safety breaches and hacks typically spotlight the dangers of storing Bitcoin (BTC) on centralized exchanges. One analyst even claims that protecting your BTC on exchanges can also be an element for worth dips.

Rufas Kamau, analysis and markets analyst at Scope Markets Kenya, defined his ideas on how protecting BTC on an alternate lowers coin worth. Kamau believes that shopping for BTC on exchanges solely quantities to purchasing an “I Owe You” (IOU) which he describes as “paper Bitcoin.”

If you happen to purchase Bitcoin on the alternate, you might be shopping for paper Bitcoin, an IOU from your alternate that’s settled the second you determine to switch your Bitcoin exterior the alternate.

That explains the excessive withdrawal charges.

2/n

— Rufas Kamau ⚡ (@RufasKe) May 8, 2022

The analyst additionally proceeds to level out that exchanges create some ways to discourage withdrawing BTC equivalent to excessive withdrawal charges. Then again, exchanges encourage protecting BTC inside the exchanges by offering staking companies.

In line with Kamau, that is finished as a result of the exchanges are capable of sell Bitcoin that is saved inside the exchanges to different patrons, whereas the proprietor of the Bitcoin IOU stays completely happy incomes an annual share yield on their BTC.

Due to this course of, Kamau claims that traders who purchase BTC and maintain it inside exchanges undergo a deficit as the method allows exchanges to “print” Bitcoin and because the provide goes up, the value goes down. He additionally urged customers to maintain their holdings off the exchanges is the “logical factor to do if you wish to change the world with Bitcoin.”

Whereas many favored and retweeted Kamau’s thread on Twitter, not everybody agreed along with his remarks. Twitter person Koning_Marc responded to Kamau saying that his thread is “wild hypothesis at greatest.” Moreover, Twitter person Felipe Encinas additionally replied that if this was the case, exchanges are capable of brief BTC with out having it. Encinas stated that this “cannot occur.”

Associated: Understanding staking swimming pools: The professionals and cons of staking cryptocurrency

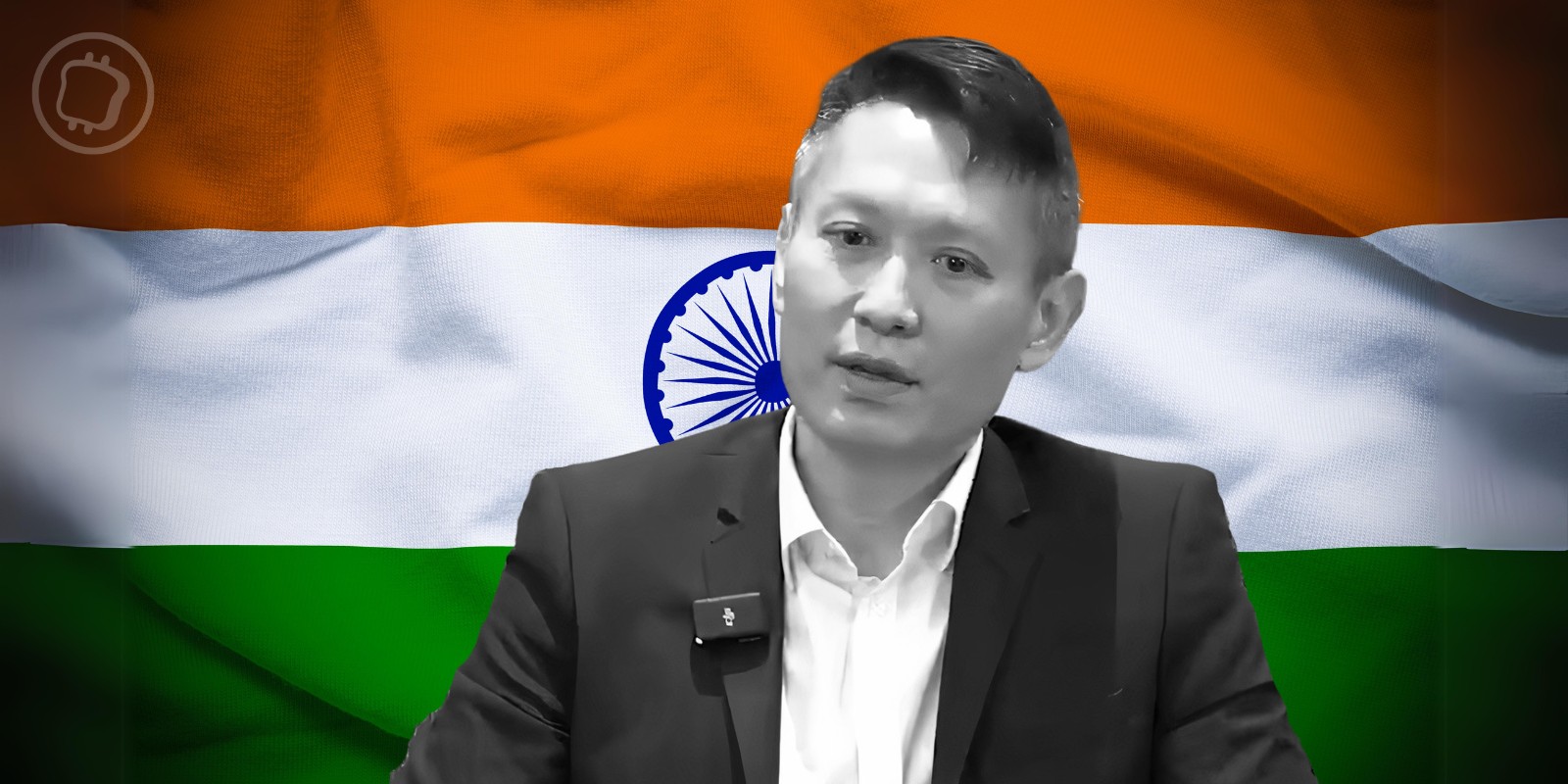

Crypto exchanges didn’t deny that this can be taking place with some exchanges. Nonetheless, LBank Chairman Eric He informed Cointelegraph that these exchanges that do that apply can be taught a lesson. He defined that:

“The market will train exchanges that sell customers’ Bitcoin a lesson as a result of they will be unable to purchase again the Bitcoin they bought. Exchanges like this may certainly fail.”

He additional defined that digital asset exchanges that are thriving and increasing in the mean time are “agency crypto believers.” They’re these that imagine that BTC can hit the $100,000 mark and due to this fact have been shopping for BTC as an alternative of doing shady issues like promoting different folks’s Bitcoin.

Binance weighed in on the difficulty. In an announcement, a Binance spokesperson informed Cointelegraph that exchanges usually are not licensed to maneuver their customers’ funds with out consent. Inside their firm, they stated that they don’t take positions and that “customers’ crypto belongings are safely saved and custodied in offline, chilly storage services that are maintained inside the alternate.”