In 2024, layer 2 on the Ethereum blockchain will experience meteoric growth. But behind this technological evolution, what are the real challenges for the projects embarking on this adventure? Find out how these new blockchains are transforming the ecosystem and what they hold for the future.

An anthology of layer 2 on the Ethereum blockchain

As the year 2024 has just ended, it will remain marked by a notable phenomenon: the strong growth of second-layer solutions on the Ethereum blockchain.

Also called layer 2 or L2, these solutions generally aim to offer higher scalability than that of Ethereum while maintaining the security of the parent blockchain.

Although this phenomenon is still at an early stage on blockchains like Bitcoin or Solana, Ethereum lists more than 120 layer 2s at the time of writing these lines according to L2BEAT data.

Many projects, for various motivations, have joined the race by launching their own layer 2. For example, during the year 2024, we can cite the launch of the Ape Chain, from Yuga Labs (the company behind the the essential collection of NFT BAYC) or more recently the Ink blockchain, from the centralized exchange Kraken.

What do all the companies below have in common?

OKX

Sony

Kraken

Uniswap

Coinbase

World Coin

Deutsche bank

Crypto dot comHint: It's on Ethereum

—Kyle Reidhead | Milk Road (@KyleReidhead) December 18, 2024

In 2025, other layer 2s will emerge such as Sony's Soneium or the Unichain of the famous decentralized exchange (DEX) Uniswap.

Don't miss the bullrun, join our experts on Cryptoast Academy

Advertisement

Why do layer 2s flourish so much?

As we mentioned above, most layer 2s aim to improve the scalability of the Ethereum blockchain, in particular by deporting a portion of transactions outside layer 1.

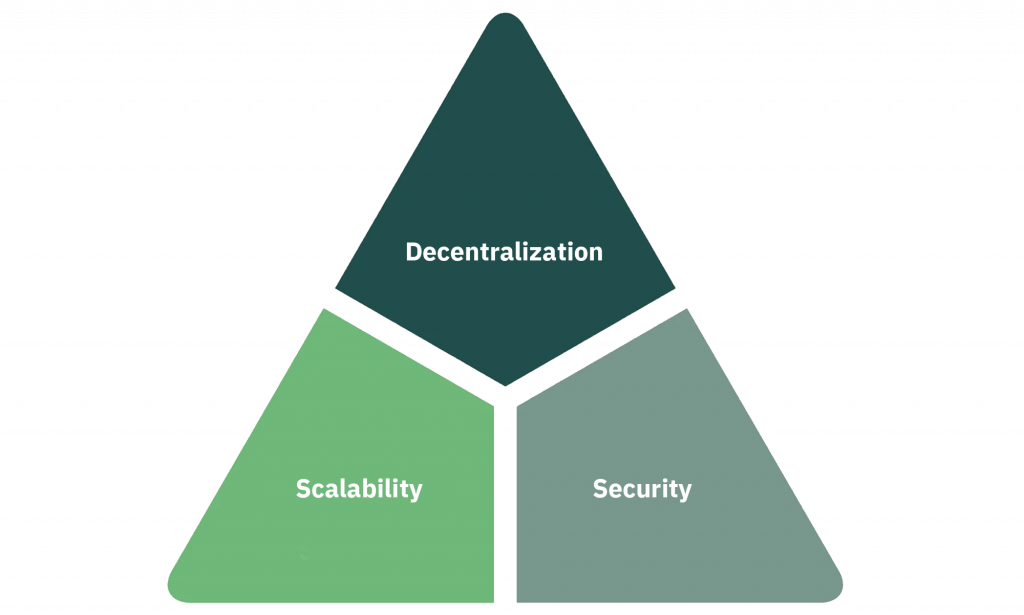

However, not all layer 2s launching necessarily plan to resolve the famous blockchain trilemma to attract new users.

Blockchain Trilemma

This problem, exposed by Vitalik Buterin himself, illustrates the impossibility for a blockchain to be efficient in these 3 areas: security, decentralization and scalability.

Second-layer solutions are therefore part of the answer to this problem. By benefiting from the security and decentralization of Ethereum, these blockchains acting on top of the latter can offer higher scalability.

In this context, some layer 2 projects go beyond simple scalability and focus on strategies to build user loyalty and engagement.

For example, Ape Chain stands out by offering decentralized applications (dApps) aligned with the values of its community. With a particular focus on “degen” dApps and careful visual design, Yuga Labs offers its community a blockchain specially designed to meet their needs.

The Base blockchain, launched by Coinbase, benefits from privileged access by directly capturing users of the platform. Thus, Coinbase users are naturally redirected to Base to benefit, among other things, from lower fees and a wider variety of cryptocurrencies, but also to take advantage of DeFi, which is not possible on a CEX.

Although activity on a centralized exchange cannot be quantified outside of trading volume, the data from the Base blockchain is eloquent to say the least. Indeed, just during the year 2024, blockchain generated more than $77 million revenue according to Artemis Terminal.

If the income generated by layer 2 is a strong argument for those hesitant to enter the race, they are not the only determining factor. Indeed, centralized projects must deal with a multitude of regulatory constraints, which evolve over time and vary according to jurisdiction.

So, complying with these requirements not only incurs significant financial costs, but also hinders innovation, thus providing a competitive advantage to decentralized projects.

If we had to summarize the advantages that projects have in launching their own blockchain in a few words:

- Revenue generated by transaction fees;

- User retention;

- Community loyalty;

- Competitive advantages for innovation over centralized projects.

However, launching your blockchain could have a double-edged effect, particularly for CEXs.

Coinbase: register on the most famous crypto exchange in the world

The other side of the coin for centralized exchanges

As we have seen previously, launching a layer 2 offers many advantages for CEXs, in particular by improving the user experience for more experienced profiles and promoting user retention. However, this initiative could also prove to be a double-edged sword.

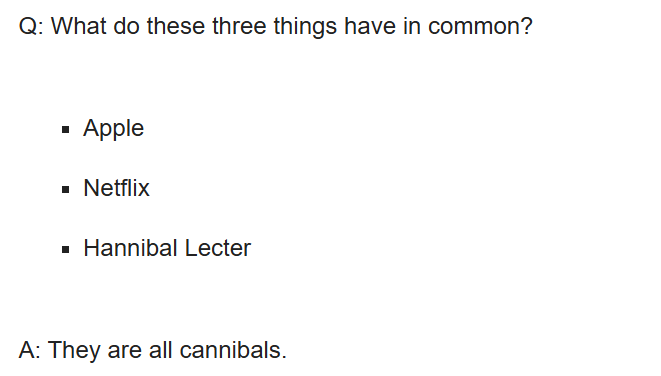

Indeed, as Milk Road points out through its newsletter, projects have already launched products in the past causing a premature drop in sales of their old products :

Milk Road Q&A

In its rhetorical question, Milk Road underlines the common point, in a humorous way, between the company Apple, Netflix and the fictional character Hannibal Lecter: “ they are all 3 cannibals “.

To support its comparison, Milk Road recalls that Netflix has “ cannibalized » its home delivery service for films by launching its streaming platform.

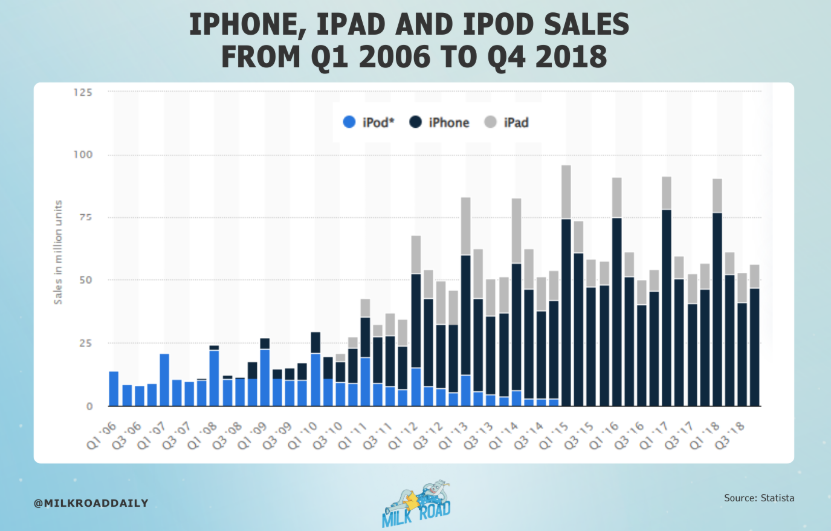

Apple would also “ cannibalized » its sale of iPod by launching the iPhone:

iPod, iPhone and iPad sales from the first quarter of 2006 to the last quarter of 2018

iPod, iPhone and iPad sales from the first quarter of 2006 to the last quarter of 2018

Thus, Milk Road opens a legitimate debate on the future of CEX in a crypto landscape increasingly adopting Ethereum layer 2. Indeed, as with the examples of Netflix and Apple, layer 2 could divert users from CEXs, who would have cannibalized themselves by launching their blockchain.

However, it is appropriate to bring moderation to these remarks. Although layer 2 offers significant advantages to experienced users in the cryptocurrency sector, CEXs will certainly always be the most obvious entry point for the most novice.

So let's not sell the bear too early and instead consider layer 2 as a complementary solution to CEX, and which is aimed at a more experienced audience.

Open an account on N26, the crypto-friendly bank

Layer 2 outlook for 2025

Although 2024 was a booming year for the layer 2 sector on the Ethereum blockchain, 2025 also looks promising: numerous projects with diverse ambitions will emerge, gain scale or affirm/refute their positions.

Projects such as Coinbase and its Base blockchain, however, will face major challenges: how to ensure the sustainability of a centralized exchange when its layer 2 offers significant advantages to its users?

In 2025, highly anticipated layer 2s like Unichain, coming from the most popular DEX in the crypto sphere, will see the light of day, but also more surprising projects like the arrival of Sony in this universe with its layer 2 Soneium.

In short, the year 2025 will prove to be decisive and exciting for the future of layer 2.

Ledger: the best solution to protect your cryptocurrencies

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission.

Investments in cryptocurrencies are risky. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital