The Central Bank of the Republic of Argentina has banned payment service providers from making or facilitating the purchase of cryptocurrencies for their customers. Is this an admission of weakness in the face of inflation that exceeds 100% in the country?

The Central Bank of Argentina is positioning itself against cryptocurrencies

This week, the Central Bank of the Republic of Argentina (BCRA) imposed a curious rollback on payment service providers offering payment accounts (PSPCP) vis-à-vis cryptocurrencies. Indeed, these PSPCPs simply no longer have the authorization conduct or facilitate transactions in digital assets not regulated by the BCRA.

Note that this new rule only applies to centralized players that are a priori non-crypto-native, which could force Argentine investors to turn to traditional crypto platforms or decentralized solutions.

Among the justifications for this measure, we find the usual remarks claiming a hypothetical risk to the financial system :

“Those interested should perform the operation by themselves. The measure ordered by the BCRA aims to mitigate the risks that operations with these assets could generate for users of financial services and the national payment system. »

👉 To go further — Find our guide to storing your cryptocurrencies outside of centralized platforms

The best way to secure your cryptocurrencies 🔒

🔥 Buy, trade, grow and manage over 5,500 cryptos

🎧 Listen to this article and all other crypto news on Spotify

A deeply devalued currency

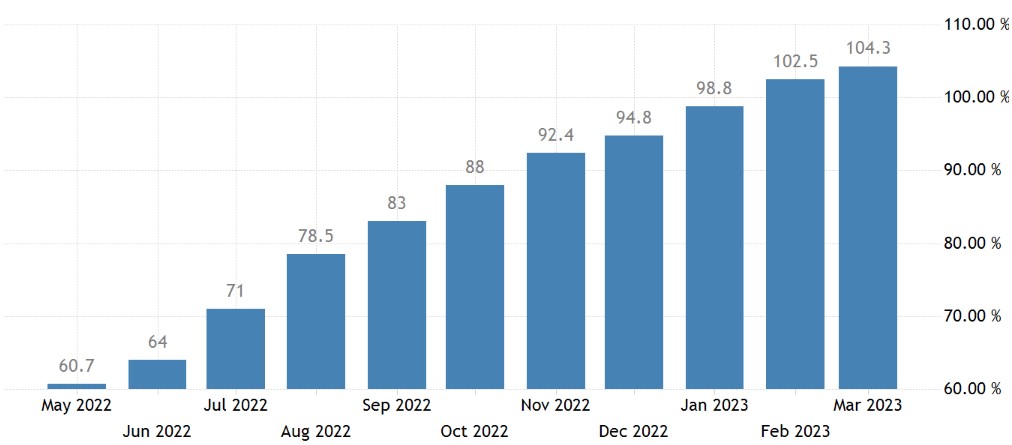

Given inflation that is totally out of control, cryptocurrencies are enjoying some popularity in Argentina. In effect, this inflation is now over 100%as shown by data from Trading Economics, which also anticipates a rate of 106.9% on May 12 for the month of April:

Figure 1 — Inflation in Argentina

Faced with this inflation, the BCRA was even forced to create a new note of 2,000 Argentine pesos (ARS) at the beginning of the year. Regarding this Argentinian peso, its rate against the dollar shows a continuous decline for several years now.

Moreover, the course of this currency is realizing its 40th consecutive month in the reddown more than 75% since January 2020:

Figure 2 — Rate of the Argentine peso against the dollar

Therefore, we can understand the attraction of Argentines for cryptocurrencies. The simple fact of converting their national currency against stablecoins in dollars would limit the damage of inflationwithout eliminating them.

While with our Western perspective, we mainly compare the price of Bitcoin (BTC) to the dollar, but a graph comparing it to the Argentinian peso allows us to radically change our perspective.

And for good reason, the BTC thus offers an increase of more than 54% since May 6, 2022trading at almost 6.6 million ARS according to the sources, and has almost regained its all-time high (ATH):

Figure 3 — Bitcoin price against the Argentinian peso

Faced with all these elements, the decision of the country’s central bank can therefore be seen as an admission of weakness, given its failure to maintain confidence in its currency.

For Argentines familiar with cryptocurrencies, this could thus encourage them to go through self-care solutionsallowing them to no longer depend on trusted third parties.

👉 Also in the news — Inflation: the ECB increases its 3 key rates by 25 basis points

Our service dedicated to cryptocurrency investors. Get real-time analytics and optimize your crypto portfolio.

Sources: BCRA, TradingView, CoinGecko, Trading Economics

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.