Non-fungible tokens (NFTs) are having a hard time, and the Bored Ape Yacht Club (BAYC), one of the most prestigious collections, is also feeling the pinch, as are the Azuki. While Bitcoin (BTC) has shown renewed momentum since the beginning of the year, NFTs continue to face challenges, raising concerns about the future of some flagship collections.

The floor price of the Bored Ape Yacht Club has fallen below 30 ETH

While the year 2021 will have been as complicated for cryptocurrencies as for non-fungible tokens (NFTs), this correlation has faded since the rise of Bitcoin (BTC). Indeed, while the latter is now sailing above $30,000 – and has posted an 87% gain since the start of the year -, NFTs failed to take advantage of the momentum in the crypto market. On the contrary.

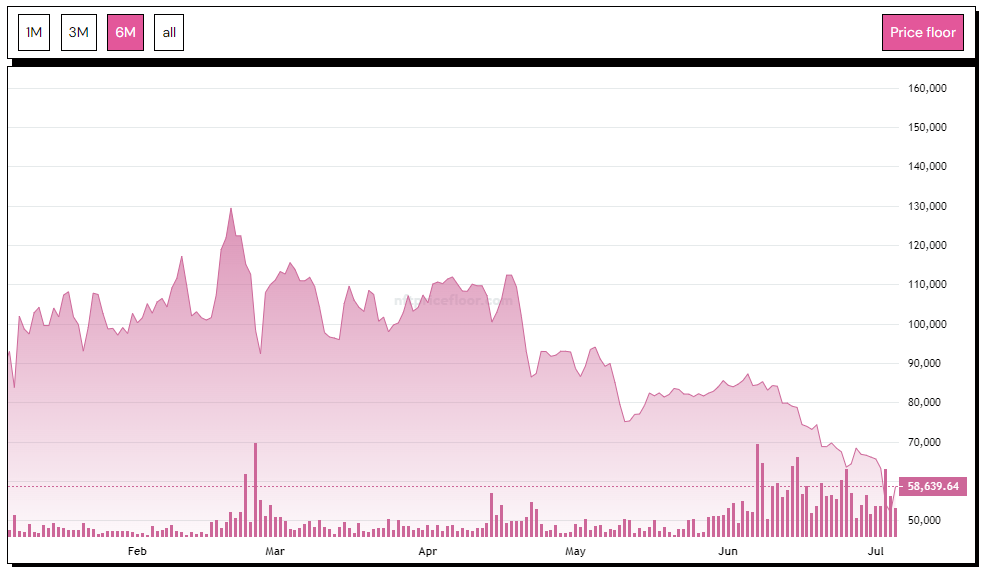

And this will not even have spared the flagship collections of the ecosystem of non-fungible tokens, generally called “blue chip” in this respect. The collection of the Bored Ape Yacht Club (BAYC), undoubtedly the most emblematic because of the sometimes staggering prices that some of its rarest pieces have been able to reach, saw its floor price fall below the symbolic threshold of 30 Ethers (ETH) this Sundayor about $58,700.

Evolution of the floor price of the NFT Bored Ape Yacht Club collection over 6 months

The floor price, or floor price, is the most commonly used metric to measure the value of a collection. It is calculated from the average of the minimum price desired by the sellers of the same collection in order to assess the trend of the latter.

For comparison, at the peak of their success in April 2022, Bored Ape Yacht Club NFTs were trading at a floor price of 152 ETH, or around $429,000. In other words, this constitutes a reduction of approximately 88% when you consider the price reached by the collection this Sunday.

Although NFTs are experiencing downward momentum in general, BAYCs have seen their price decline in part following a massive sell-off by collector Machi Big Brother, which sold around fifty of its NFTs in the space of a few days. Through the Blur platform, the interested party would have sold 19 BAYCs for 1.2 million dollars in a single transaction.

Some observers have also noted that rapper Eminem’s BAYC (#9055), which he acquired for $1.3 million in January 2022, now only worth $60,000.

👉 Find our guide to learn how to assess the potential of an NFT collection

Buy NFTs on Binance

Check out Binance’s NFT Marketplace?

Azuki and other NFT collections also affected

Azuki, one of the flagship collections of the NFT ecosystem, is not to be outdone; a group of some of its owners recently came together to demand a $40 million refund following the controversial drop of Azuki’s latest “Elementals” collection.

On average over the last 30 days, the Azuki collection saw its average price drop by more than 43%. This drop is even more edifying over the last 7 days, where the collection has lost 59% of its value, thus approaching the symbolic threshold of 10,000 dollars.

We just had a “Black Weekend” for NFTs.

Floor prices for BAYC, MAYC, Azuki, Memeland Captainz and other PFPs fell 30 – 60%, accelerating over the weekend.

What caused all of the panic selling?

It all started with the Azuki Elementals mint.

The Azuki community spent $38M to… pic.twitter.com/AQp1tslNFJ

— Teng Yan ⛩ (@0xPrismatic) July 3, 2023

“We just had a ‘black weekend’ for NFTs. Floor prices for BAYC, MAYC, Azuki, Memeland Captainz, and other PFPs fell 30-60%, and that drop accelerated over the weekend. […] This sparked a sudden mistrust that rippled through NFT communities: Are NFTs worthless/overrated as everyone in TC says [Crypto Twitter, NDLR] ? »

According to journalist Wu Blockchain, more than 1,200 NFTs have been liquidated in the last 3 days, which is a record in the history of non-fungible tokens. Of these 1,200, more than 630 are NFT Beanz, a parallel collection of Azuki.

👉 In NFT news – Lacoste reinvents its NFT experience with the UNDW3 Card – What does this dynamic NFT bring?

Confused and overwhelmed by cryptocurrencies? 🤔

Spot opportunities and make informed investment decisions 🔎

Source: NFT Price Floor

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page may feature investment-related assets, products or services. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.